I am reading that most major banks in US, Asia and Japan have become very interested in Blockchain technology to save billion in settlement services and clearing houses. The latest news is that UBS, Deutsche Bank and BNY Mellon are looking for approval for a "utility settlement coin". Goldman, Citi and JP Morgan have already patented their own proprietary settlement coins.

The banks consultant Oliver Wyman, which specializes in analyzing banks, say that the total savings for the finance industry could be between $65 billion and $ 80 billion.

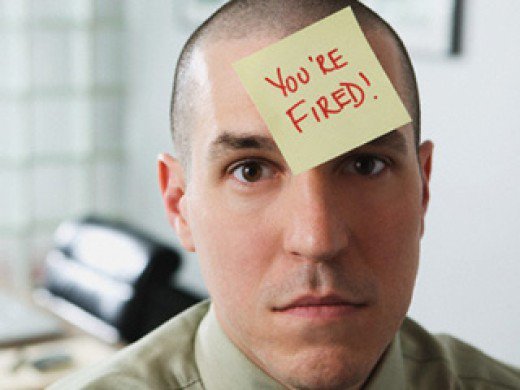

Perhaps these numbers are inflated, but it is certain that banks are aiming at speeding up money and securities transactions with block chain technology while saving cost by laying off thousands of people.

Financial regulators in Wall Street are falling over themselves to approve such innovation.

Many block chain experts will enrich themselves in the financial sector, but thousand of back office and middle office workers will lose their jobs and their families will lack support from their income.

What could an employee in the middle office of a large financial institution in their 50s or 60s retrain for?