Cryptocurrencies in their current state are not able to reach their fullest potential, for

reasons to do with limitations that are inherent to currencies in general, as well as of the

underlying blockchain technology that supports each cryptocurrency. A “service layer”

solution is proposed that will unify these blockchains and ultimately enable them to

operate more efficiently both in and of themselves, and between one another.

Cryptocurrencies have attracted tremendous amounts of investment and interest from

the public, as well as the finance world. In spite of the fact that they (and their

underlying blockchain technologies) are in many ways superior to fiat currencies and

their banking systems, they are restrained from realizing large-scale success. Three key

reasons for this are as follows;

Blockchains are not easily interoperable (e.g. Bitcoin cannot easily be traded with

Ethereum, except through a third-party exchange)

Transactions are not instant (they can take as long as several minutes or even

hours)

Incomplete anonymity (the movement of coins can be highly traceable)

As individual cryptocurrencies grow, they meet the virtually universal fate that it is

impossible for any currency to be the world’s “primary” currency. As there are 180

currencies worldwide (recognized by the United Nations), it is clear that this fate is

shared with fiat currencies as well. Just as standardized banking systems such as

SWIFT were able to bridge the gaps between different banking systems, a similar

solution can do the same with blockchains, creating harmony across multiple

cryptocurrencies. The proposed solution will also optimize transaction speeds and

improve anonymity. Further, it will capitalize on this harmony to create a decentralized

exchange for cryptocurrencies (alleviating the inefficiencies of centralized exchanges).

In addition, it will introduce a derivative of the Casper protocol before Ethereum

introduces it - which makes blockchains safer, more scalable, and more energyefficient.

Limitations of Current Blockchain Solutions

Traditional blockchain technologies face several practical issues, which are hindering

the adaptation of these technologies into mainstream use. We will be focusing on the

blockchain technology implemented in Bitcoin as the central case study to demonstrate

its limitations. We believe that the blockchain mechanisms used in Bitcoin are wellestablished,

and have the largest base of installations as of this writing. Further, most

other cryptocurrencies use similar concepts in their blockchains. Hence, we believe the

limitations that Bitcoin faces are representative of those that are faced by other

cryptocurrencies as well.

The Bitcoin network faces the following challenges as of today;

3.1 Lack of Scalability

As per the Bitcoin Wiki, the maximum transaction rate of the current Bitcoin blockchain

implementation is limited to a maximum of ten transactions per second.

This is far behind the current capacity of payment networks such as Visa, which are

capable of processing several thousand transactions per second. A comparative

analysis "Bitcoin and Ethereum vs Visa and PayPal – Transactions per second", gives

insight into this competitive discrepancy.

Incomplete Privacy

Anyone can track transactions, using open blockchain explorers. As such, essentially

any person could discover private information such as wallet balances, recurring

payments, and recipient names. The pseudonym privacy offered by the blockchain is

only secure as long as the pseudonym is not tied to an individual. A considerable

amount of research (Bitcoin Transactions Aren’t as Anonymous as Everyone Hoped)

has gone into proving the weakness of the anonymity provided by most blockchain

implementations. The Bitcoin Wiki article "Anonymity" provides an overview of the

anonymity issues that Laser will seek to address.Incomplete Fungibility

Fungibility is the property that detaches individual units of a currency from its past

owners. Hence, a US dollar coming from any source has an equivalent value to any

other US dollar. For instance, dollars sent by Alice will have the same market value as

those coming from Bob, even if Alice may have a bad market reputation. This

characteristic makes US dollars fungible. However, since Bitcoin transactions are

traceable in the current blockchain implementation, individual coins can have their value

tainted if it is known that they once belonged to an undesirable party. As such, the

fungibility of Bitcoin units cannot be guaranteed.Lack of Interoperability

When it comes to making transactions with other blockchains, the Bitcoin network does

not support such transactions. In the fast-growing virtual economy, a lack of

interoperability between different cryptocurrencies will become a major problem. The

need of the hour is to have a network on which different currencies can be exchanged

between blockchains in a trusted environment with minimal fees. Most current

implementations of blockchain lack this feature, forcing each of them to operate in

isolation from other blockchains.No Incentive for Full Node Setups

Full nodes are the backbone of the Bitcoin ecosystem, and for almost all of the different

blockchain implementations. Specifically in the case of the Bitcoin network, there is a

general misconception that the network is controlled by miners. While there is some

truth to this, it is not completely true. The Bitcoin Wiki article "Bitcoin is not ruled by

miners" goes into greater detail about this. A further explanation regarding how full

nodes enforce the consensus rules can be found here by Danny Hamilton.

A textbook incident of miners not following the consensus rules was witnessed in July

of 2015 on the Bitcoin network (Some Miners Generating Invalid Blocks). It was found

that many of the miners were not verifying the transactions at all before including them

in the blocks. The outcome of this was a six-block fork of the Bitcoin network, which

resulted in a loss of around USD $50,000 worth of Bitcoin, as well as some doublespends.Overall, a blockchain having more full nodes results in a faster, more stable, and more

decentralized network. Although proponents of Bitcoin advocate that users are

incentivized by the heightened overall network security that comes from running a full

node, it is our opinion that a user should be fully confident of the security, whether they

run a lightweight node or full node. This is why our solution incentivizes full nodes;

compensating those who choose to operate them, and not causing those who don’t to

feel under-secured in any way.

Existing Work

Unlike other solutions such as Dash[28], which are specific implementations of

blockchain, Laser is geared to work with any blockchain, without any need for changes

in the underlying protocol. Additionally, the functionality enhancement to utilize the

added services of Laser is limited to the full nodes or the validator nodes – not the other

parts of the network. This allows multiple blockchains to interoperate parallel to one

another while retaining each blockchain’s built-in security properties.

Most of the current solutions for interoperability across blockchains are either limited to

inter-chain transactions of native currency across the participating blockchains (such as

Metronome[26]), or they are limited by compliance requirements of the participating

blockchain. For instance, AION[27] needs a participating blockchain to implement the

‘locktime’ feature, which is not present in IOTA. Such compliance requirements limit the

applicability of the solution – and in turn, the adoptability of the solution in the market.

With our current approach, the only compliance requirement for the participating

blockchains is to have the multi-signature capability, which is present in almost all

blockchains. This easy-to-meet compliance requirement will allow for very easy

adoption of our solution.

Proposed Solution for Better Privacy, Faster

Transactions, and Better Interoperability

In this paper, we propose a solution to address the issues of privacy, near-instant

transactions, and inter-chain operability. We introduce a service layer that is made up of

full nodes.

This layer, termed the servicenode layer, will help in achieving a more secure and robust

blockchain network.

The design of Laser provides for incentivization of the nodes which form the

servicenode layer for providing its services. This will cultivate strong user interest in

operating such nodes – to the benefit of both the servicenode layer, and every

blockchain on which it operates.

Overview

The central idea of Laser revolves around operating the servicenode layer on top of an

existing blockchain as shown in Figure 1. It runs in parallel to the existing blockchain,

sharing computing resources between both blockchains to perform functions as

needed.

For a full node on a given blockchain to be escalated to a servicenode, all of the

following conditions must be met:

- Collateral: The requirement of collateral creates a high entry barrier to dishonest

players, making it an expensive and risky endeavor to deploy multiple rogue

nodes on the servicenode layer, as it will require a substantial commitment of

capital to attempt this. Further, with the possibility that the collateral will be

confiscated from nodes that exhibit dishonest behaviour, it disincentivizes such

conduct – as the collateral can be confiscated upon discovery of this behaviour.

The value of the collateral can be decided based on the market value of the

cryptocurrency of the underlying blockchain. - SLA (Service Level Agreement): Servicenode operators will be required to

commit to guaranteeing network service with at least 99% uptime. This assures

users of constant and steady service. - Dedicated IP Address: This acts as an identifier for the servicenode.

- Node is not a Miner/Validator: In the case of blockchains that support miners

and validators, a full node that is seeking to become a servicenode cannot be

performing these functions. This is because the underlying blockchain network is

responsible for confirming the transactions.

Laser Blockchain

We propose the launch of a blockchain called Laser by hard-forking the Ethereum

blockchain. We will also introduce a new cryptocurrency called Photon as part of the

Laser blockchain.

All holders of Ethereum (ETH) and Ethereum Classic (ETC) before the hard fork will

receive an equal number of Photons on upgrading their software.

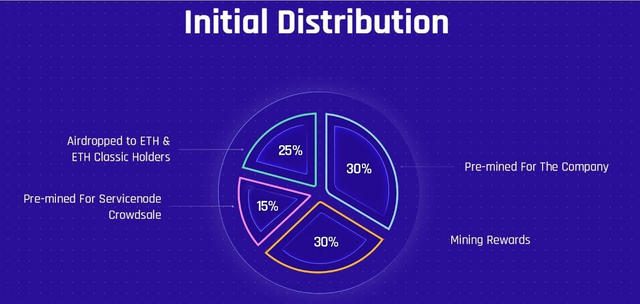

Initial Distribution of Photons

The total supply of Photons will be capped at 42 million units.

All ETH and ETC holders will be entitled to Photons under the proposed distribution

plan, as below.

30% (12.6 million Photons) will be pre-mined for the company.

15% (6.3 million Photons) will be pre-mined for the servicenode crowdsale.

30% (12.6 million Photons) will be generated by the miners. Note that eventually the

mining will be replaced with PoS by Q4 2018.

25% (10.5 million Photons) will be airdropped to Ethereum and Ethereum classic

holders. The Photons allotted to the Ethereum and Ethereum Classic holders will be 5%

of their current holdings.

Current holders of Ethereum and Ethereum Classic will be incentivized to begin staking

on the Laser network through a targeted airdrop. Currently it is estimated that they will

be rewarded with a yearly payout of 36% in Photons.

for mor info contact:

website: https://laser.xyz/

bitcoin talk: https://bitcointalk.org/index.php?topic=3466533.0

telegram:https://t.me/laserxyz

twitter:https://twitter.com/laserprotocol

medium: https://medium.com/laserprotocol

reddit: https://www.reddit.com/r/LaserProtocol/

bitcointalk username: Jeffter

bitcointalk profile link : https://bitcointalk.org/index.php?action=profile;u=1829722

ethereum address : 0xcffc8423875b2161db5b00a6f24ea50a4dd318cf