In July of 2014, the crypto-world was introduced to the idea of a blockchain democracy, when Dan Larimer invented a new consensus algorithm for a decentralized exchange called Bitshares. This algorithm was called delegated proof-of-stake (DPOS) and it had the unusual property of encouraging its users to elect its network’s block producers or masternodes.

For the first time in blockchain history, the vast majority of a network’s users actually had a say in how its protocol would evolve and adapt to their ever changing needs. Unlike classic blockchain protocols like Bitcoin, Bitshares was not wholly dominated by an unruly and haphazard collection of masternodes called miners.

Bitcoin's protocol compels miners to act out of their own selfish self-interest, and it does not hold them accountable to the millions of crypto-investors who happen to use the same network. Mining empty blocks or batches of data with no transaction information, is just one example of the kind of selfish behavior that crypto-investors have come to expect from a proof-of-work governance structure.

Some miners are willing to mine empty blocks for the coinbase reward and forgo the transaction fees of filled blocks, because they are afraid of losing all their potential block rewards to competing miners, who might solve the more profitable full blocks before them.

These kind of miners tend to ignore the growing number of unconfirmed transactions in the blockchain’s memory pool, so that they can mine the less competitive, but empty blocks. Which brings us to an important question: why should crypto-investors transact on a blockchain in which block producers have a financial incentive to ignore their transactions?

Bitcoin’s recent surge in popularity, has however; increased the overall number of full blocks and made empty block mining an unprofitable affair. But why design a blockchain that encourages such behavior in the first place? And why should block producers have the freedom to prioritize short-term profits over long-term network growth?

Bitcoin apologists might argue that the block producers of DPOS blockchains have the ability to censor transactions, which is worse than having the ability to mine empty blocks. But Bitcoin miners have in fact censored transactions from blacklisted addresses. If DPOS stakeholders dislike the censorship policies of their elected block validators, they can simply vote in another set of block validators. But in proof-of-work protocols, miners can censor the transactions of whichever wallet addresses they deem untrustworthy and they won’t face any repercussions.

Address blacklisting is in fact, a useful tool that DPOS blockchains can adopt to better govern their networks. Some crypto-maximalists might feel that address blacklisting makes a cryptocurrency less fungible and therefore less valuable as a form of currency, but blockchain democracies like EOS have proven that being able to freeze the accounts of criminals is more important to crypto-investors than having a fully fungible cryptocurrency.

Furthermore, semi-fungible cryptocurrencies have higher market capitalizations and are,therefore; more popular than Monero and other privacy focused coins that harbor criminal enterprises. And they might become even more popular if future government regimes publicly support blockchain democracies that have account blacklisting features.

Elections, account freezing, and other democratic actions that dogmatic proof-of-work supporters cry out against, prove that the financial incentives of block producers in DPOS blockchains are aligned with the needs of their respective communities.

Elections are in fact, the most essential aspect of blockchain democracies. In Bitshares, and several other blockchains that have developed various iterations of its consensus algorithm, one can only become a masternode if one has enough votes to become one of the top 30 or top 21 full node block producers: servers that store the full copy of the blockchain’s history and reap all the financial rewards of being a masternode. To become a partial node, or a stand-by block producer in one of these blockchain democracies, one has to receive enough votes to be in the top 70 or top 100 elected block validators.

Elections determine who can and who cannot become a block producer in DPOS blockchains. And they ensure that the policies that candidate block producers choose to support, have a large impact on whether or not these potential masternodes are actually elected. Whereas consensus protocols that spawn amorphous leadership in blockchain communities like proof-of-work, rarely lead to the adoption of popular policies and often create social inertia.

Some of Bitcoin’s hard forks, were in fact responses to its social inertia or inability to democratically evolve in line with the wishes of its community of investors. These hard forks spawned numerous competing networks including: Bitcoin Cash, Bitcoin Gold, and Bitcoin Private. It’s hard to take Bitcoin seriously after so many chain splitting hard forks.

The sheer number of these hard forks, also brings into question the idea that proof-of-work is the “most secure” consensus protocol ever invented. This obsession with protocol security, is however; a distraction from one of blockchain technology’s most useful attributes: decentralized leadership.

A consensus protocol’s security mechanism should serve the needs of its leadership, rather than have its leadership serve the needs of a dogmatic faith in decentralized financial security.

Many miners and software developers tried to establish themselves as the leaders of the Bitcoin community, but their efforts failed and they instead created chain splitting hard forks to achieve their respective goals.

Bitcoin’s decentralized decision making structure, the Bitcoin Improvement Proposal (BIP), failed to unite its developers; even with the promise of funding from private companies like purse.io, and more chain splitting hard forks followed suit. Unlike Blockchain democracies, proof-of-work protocols cannot directly fund software development with monetary inflation, and this makes them less coordinated than their DPOS counterparts.

Even after protocol changes such as BIP 9 — a method for broadcasting imminent or ongoing soft forks to the entire network — which set the foundations for a potential Bitcoin governance structure , Bitcoin developers still haven’t managed to create a coherent leadership model.

Some crypto-maximalists believe that any attempt to create a governance structure violates the trustless nature of blockchain technology. But this point of view could not be farther from the truth. Like the complex cryptography that underpins blockchain accounting, governance structures make it easier for the general public to trust protocol changes that receive grassroots support.

Furthermore, many developers eventually realized that Bitcoin miners often place their own interests above the needs of the community. This was especially true for a feature called Segregated Witness: a protocol change that would remove Bitcoin’s block size limit and increase its transaction speed. Bitcoin’s community tried to use its User Activated Soft Work (UASF) feature — a social method for initiating protocol changes— to launch Segregated Witness as a soft fork, but their efforts ultimately failed.

Much of the social inertia seen in Bitcoin’s protocol developments was the result of a misalignment of incentives and interests between miners and everyone else who happened to use its blockchain.

Social inertia may also explain why, after 4 years since Ethereum’s founder, Vitalik Buterin — first suggested a protocol change, Ethereum still hasn’t transitioned to a proof-of-stake consensus algorithm. To make matters worse, Ether’s phenomenal price rise at the beginning of the year, drew the attention of avid cryptocurrency miners — who then raised its hashrate difficulty. Ether mining is no longer profitable, but Ethereum’s miners still won’t fork the blockchain to a proof-of-stake protocol.

Some Ethereum miners might be waiting for miners with smaller or cheaper mining rigs to drop out of the mining race as soon as the mining difficulty reaches a certain level. But the lack of protocol development may cause Ether’s price to drop, which would make this bullish strategy unprofitable and pointless.

Some diehard Ethereum supporters might argue that its developers needed more time to further develop Casper: the suggested protocol upgrade. There are two different versions of Casper being proposed: Vitalik Buterin’s Friendly Finality Gadget (FFG) — a hybrid PoW/PoS consensus mechanism, and Vlad Zamfir’s Correct-by-Construction — a full PoS consensus algorithm in which the validity of a new competing chain is determined by the number of nodes who agree on the correctness of said chain rather than how closely related its new blocks are to the genesis block (the first block or batch of transactions in the Ethereum blockchain).

Regardless of which version of Casper they choose to implement, they will still have to convince miners that they can replace Ethereum’s proof-of-work with a perfect proof-of-stake algorithm. Ethereum’s development team have in fact, spent years trying to convince miners that Ethereum needs a new and more efficient consensus mechanism, even though the proof-of-stake protocol could have been implemented incrementally. If Ether investors could vote on Ethereum’s protocol, they would have probably agreed to a progressive switch to proof-of-stake.

Miners’ irrational fear of a protocol change has forced Ethereum’s development team to tackle highly improbable problems that real world proof-of-stake blockchains have never faced. These theoretical problems include the dreaded long-range attack and the infamous nothing at stake dilemma. The latter problem — which some developers believe is entirely fictional — is especially unlikely to occur, because block validators in any kind of consensus protocol, have to forgo more than one opportunity cost, when they decide to fork a given blockchain.

In a traditional proof-of-work protocol, miners are faced with two principal costs when they decide to fork the blockchain in question: the cost of creating new blocks on the new chain and the forgone block rewards that they would have received if they continued mining the old chain. If the new coin of their forked network is ignored by most investors — and the price of said coin is sufficiently low — they will have not only wasted their mining rigs’ power, but also forgone the opportunity to continue earning block rewards on the previous chain. Moreover, the block rewards of the new chain may be far lower than the rewards of the old chain.

The nothing at stake problem, which could be more accurately described as the multi-chain production problem, is about proof-of-stake block producers having the ability to simultaneously produce blocks for multiple chains without incurring any costs for every new block they validate. But they will, however; incur the cost of managing a more expensive server because each new chain will require more RAM to process transactions, and more hard disk space to download some of, if not the entirety of, the blockchain’s transaction history.

The idea that proof-of-stake block validators have “nothing at stake” when they produce blocks for multiple chains, ignores the fact that server costs increase as a blockchain network’s activity grows. Ethereum’s network activity, has for example, grown to the point that many stand-by block producers cannot afford to manage the server costs of their partial nodes. Producing blocks for multiple chains increases one’s server costs, regardless of which consensus algorithm the network in question uses.

Pedantic commentators, might argue that the sunk cost of buying or creating a server and upgrading it when the blockchain grows in size, is far less than the accumulated cost of producing new blocks in a new chain. But it would be disingenuous to say that there is no cost, whatsoever, for producing multiple chains in proof-of-stake protocols.

DPOS blockchains make multi-block production even more expensive by forcing block validators to spend time and energy convincing stakeholders to vote for them. Block producers who attempt to start a new chain or a competing network have to convince the stakeholders who had previously voted for them to run the old chain, to vote for each and every new chain they create. DPOS thereby solves the nothing at stake problem by introducing the social cost of garnering votes. There are real tangible costs to managing several social media accounts with thousands of followers, and building free to use applications, in the process of garnering stakeholder votes.

To solve the imaginary nothing at stake problem, Buterin and Zamfir developed the idea of the slasher protocol, which will force new block validators in a proof-of-stake version of Ethereum to have security deposits. If some of these block producers try to validate more than one chain of blocks at a time, they will lose their security deposit: the stake they had bought to become block validators.

The fanatical desire to maintain a proof-of-work algorithm has forced Ethereum’s development team to cook up novel proof-of-stake problems to please their blockchain’s miners. While some problems like weak subjectivity — the idea that many proof-of-stake block validators stay online intermittently to validate blocks — are legitimate decentralization problems, other factors such as speed and scalability might have a greater long-term impact on mainstream blockchain adoption.

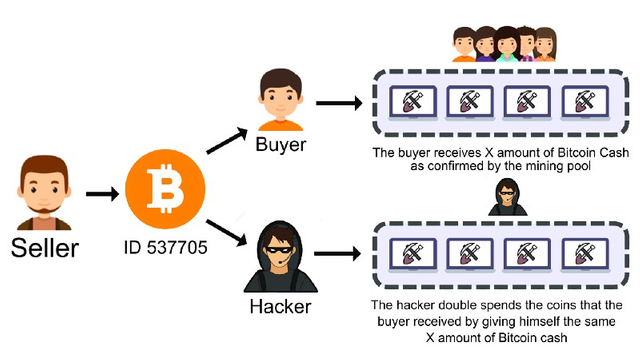

Proof-of-work blockchains have, however; proven less secure than the proof-of-stake protocols that Ethereum’s development team have been trying to improve. Miners had, for example, double spent millions of dollars worth of Bitcoin Cash when they realized that because it was a new coin; too few miners were mining it, and its resulting hashrate difficulty was low enough to be taken advantage of.

DPOS blockchains have the same security features as proof-of-stake coins in addition to having a clear governance structure and being orders of magnitude faster. The scalability trilemma makes DPOS blockchains, which have fewer nodes, faster but less decentralized than PoW and PoS protocols.

Unfortunately for Ethereum’s most fervent advocates, its founder — Vitalik Buterin — seems to care more about security than speed and decentralization. Unbeknownst, to most Ether investors, any applied iteration of the PoS Casper protocol would produce an outcome in which most nodes would be unable to afford the security deposits required by the network and only the richest investors would continue to manage the nodes of the Ethereum blockchain. This is exactly what happen when Dash’s price rise made becoming a masternode extraordinarily expensive.

Security deposits would also worsen the centralizing effects of Ethereum’s network growth. This subtle, but inevitable problem, hasn’t stopped Vitalik Buterin from suggesting that the EOS blockchain adopt his version of the Casper protocol to improve its byzantine fault tolerance. If EOS had implemented the Casper protocol before its mainnet launch, the wealthiest rather than the most popular block producer candidates would make up the majority of the top 21 block producers.

Dan Larimer — the founder of EOS — in an article in which he refers to security deposits as bonds, pointed out how Buterin’s Casper Protocol worsens income inequality among participating nodes and thereby increases network centralization:

The end result of this economic arrangement is that participating in Casper will only be profitable for a small subset of whales, likely a dozen or less. The only way to increase participation would be to increase fees which will primarily pad the pockets of the whales who have the highest margins while the smallest participating stakeholders barely break even.

Larimer concluded his point on the centralizing effects of the Casper protocol with the following observation:

Casper is an innovative approach that will probably work in the same way that Proof of Work, Peercoin, Nxt, and Ripple all ‘work’: a consensus will be reached, transactions will be confirmed, double spends will be prevented. Unfortunately, it will also fail in the same ways as every system before it: unaccountable centralization of control in the hands of a concentrated minority.

In the above statement, Larimer described transaction fees as an external source of revenue for block producers. Unlike the proposed Casper Protocol, EOS’ DPOS consensus algorithm funds the activities of block producers with a changeable monetary inflation rate, which can be described as an internal source of revenue that effectively holds block validators accountable to voters.

Security deposits would also make it harder for block producer candidates from poorer countries to join the network. This is a particularly unpalatable idea for EOS, because it’s the world’s first international blockchain democracy and many of its block producer candidates come from less well-off regions of the world, like Latin America and Africa.

Buterin had also claimed that blockchain democracies are plagued by social problems such as voter bribery and voting cartels — both of which would lead to the creation of a plutocratic oligarchy. The following quote sums up his argument:

The flaw in all of this, of course, is that the average voter has only a very small chance of impacting which delegates get selected, and so they only have a very small incentive to vote based on any of these high-minded and lofty goals; rather, their incentive is to vote for whoever offers the highest and most reliable bribe. Attacking is easy. If a cartel equilibrium does not form, then an attacker can simply offer a share percentage slightly higher than 100% (perhaps using fee sharing or some kind of “starter promotion” as justification), capture the majority of delegate positions, and then start an attack. If they get removed from the delegate position via a hard fork, they can simply restart the attack again with a different identity.

The gist of his argument is fairly sound, but there are a few minor holes in his reasoning. First off, EOS has more block producers who have publicly revealed their identities than any other blockchain democracy. There are far fewer anonymous block producers in EOS than in Bitshares, Steem, and Lisk, which makes vote bribery a much riskier revenue earning strategy in EOS than the aforementioned blockchains. An EOS block producer company caught giving out bribes, could have its reputation permanently damaged and creating a new account wouldn’t help it salvage its reputation, because its members would likely all be publicly known figures. No other democratic blockchain is as transparent as EOS.

Secondly, Buterin readily admits that many of the voters who accept bribes don’t really understand why vote bribing is a bad thing. A re-education program organized by block producers, could easily help voters understand how vote bribing negatively affects a blockchain democracy’s long-term network growth.

Voters who accept bribes risk electing unproductive block producers who do nothing, but confirm transactions. Fairly elected block producers tend to produce a lot of non-profit dapps to strengthen their blockchain’s economic ecosystem. EOS bock producers have, for example, built several block explorers and a voting tool, which all make voting; a clear, transparent, and user-friendly process.

Thirdly, not all forms of collusion are bad. Collusion may sometimes come in the form of productive coalitions in which block producers agree to coordinate their individual efforts into specialized tasks. For example, one block producer can focus its efforts on building a user friendly wallet, while another block producer agrees to focus its attention on building a decentralized exchange. If these two block producers choose to vote for each other with their immensely large stakes, they will in the long-term add value to the network, and inspire confidence in the small investors who make up the majority of the blockchain’s electorate. Collusion is only a bad thing when the majority of a cryptocurrency’s investors cannot hold the blockchain’s block producers accountable for the latter’s misconduct.

Some block producers have already formed small coalitions to finance the development of essential dapps like Chintai: an EOS leasing platform. These kind of coalitions can also help end ideological disagreements, and bring unity to the community. Moreover, voting restrictions make such coalitions more competitive: EOS has about 80 block producer candidates, but EOS stakeholders cannot vote for more than 30 block producers.

EOS also has some additional features to strengthen its democracy such as vote decay, which reduces the value of a given vote over a six month period. Vote decay prevents voter apathy, by forcing stakeholders to continuously evaluate the performance of the block producers they vote for. On the other hand, Block One — the company that developed the code behind the EOS blockchain — readily admits that vote decay is not a perfect way to increase voter activity:

We recommend that the constitution contain language forbidding the use of automated voting bots as the purpose of vote-decay was to ensure that voters re-evaluate their decisions rather than “set-it and forget it”. While it is not possible to prove the use of bots, it will be possible to prove that people do not use smart contracts to auto-vote.

EOS’ dynamic leadership model can, however; be used to improve its voting algorithm and other protocol limitations. In time, blockchain democracies will come to dominate the crypto-space.

If you liked this article and would like to support my writing, you can leave a cryptocurrency donation:

Bitcoin: 1HiYu3Q7G9dczPmEtKTUw4dPbNfHJhRgC1

Bitcoin cash: qplsmz3m6hvzvnhfusa7zpa477djzp5cpsuewgjgr5

Ethereum: 0x9693CBe2D364f1EB6ef7C883d5DBE2562161013f

Ethereum classic: 0xDA3caBFe304502f2D2c22eFb59597F38197cC897

Litecoin: LKieBwqfQyMcESWDmR8X2d8pHHabzBFsGw

Dash: Xqv4C8MtmShLdvJbYZfeZpDXoGF75gaBXb

Hi! I am a robot. I just upvoted you! Readers might be interested in similar content by the same author:

https://steemit.com/blockchain/@judezambarakji/protocol-evolution-and-the-future-of-blockchain-governance

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @judezambarakji! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit