A word from the author

I welcome all readers of my blog and those who randomly went to this article, today I would like to tell you about an interesting project based on the already well-known technology of blocking. I suggest starting this story with a small introductory, so that you better perceive information about the project.

Input: credit system, finance.

Almost all kinds of activities in the modern world are somehow tied up in finance. You get a job - you get a salary, you provide the people you need - you get paid, write pictures and sell them - you also get some dividends for your work. And if in these cases everything is extremely simple and the exchange of money occurs literally from hand to hand, then on a broad scale of the financial cycle everything is not so easy and there are difficulties. It's about big business and expensive deals.

Many years ago people came up with banks and other funds to carry out the storage and management of money. For today, no large financial structure can not do without a bank. On the one hand - it's good and a large company can greatly facilitate the management of money by using the services offered by the bank. Today, one of the main sources of the bank's profit is a service for issuing loans (I do not need to explain what it is). It would seem - different thing! But even here everything is not so smooth. I think you have heard stories from your relatives more than once, as some of their acquaintances got into debt on loans and now his life, to put it mildly, "not very".

Problems of the banking system of lending

- Free and full access to credit histories of borrowers.

- Non-targeted use of credit.

- For example, with this type of consumer lending, like consumer lending, it is very difficult to track down what the borrower takes the loan for and how it will dispose of it.

- The probability of non-return of credit funds to the bank.

- The main problem of non-return of funds issued under a loan agreement is as follows:

- a low level of legal and economic literacy of the population;

- biased assessment of their financial capabilities;

- fraud.

The complexity of the mechanism for the implementation of collateral. To ensure its own financial security, in the event of the issuance of large loans, the bank may require the borrower to leave a pledge of something worthwhile, in most cases it is a car or an apartment. However, this process is extremely time-consuming and complicated both for the bank and for the client. Also, an unscrupulous client can easily mortgage the same property to several different banks.

Distributed Credit Chain: idea, essence, principles.

Distributed Credit Chain (hereinafter referred to as DCC) is a revolutionary block-project that is created to establish standards for doing business, providing services and other financial transactions. Thanks to a distributed banking service - an integrated ecosystem of distributed financial services, DCC offers traditional businesses the opportunity to join the established business ecosystem.

Problems of centralization of banks The presence of intermediaries led to the spread of credit services and, consequently, to continuing crises in credit institutions. Below is a list of problems that may arise in such systems.

- Poor management of costs;

- Inefficiency;

- Speculation;

- Borrowers can not independently certify their credit.

Decentralization of the credit system: advantages. The decentralized chain of blocks effectively solves the problems listed above. Decentralized market does not need intermediaries, the presence of many competitors on the market excludes monopoly. In addition, blocking technology prevents data leakage of market participants by third parties. Through a distributed credit management system, users not only have the absolute right to their data, but also can determine their use and storage. The DCC ecosystem encourages lenders and borrowers to cooperate on an independent and equal basis.Cooperation between previous creditors and borrowers within the ecosystem does not depend on previous relationships. Another important advantage of the block is the security and speed of transactions. Despite the fact that modern banking systems have a high level of security and decent processing speed of transactions, the implementation of such a system on the blockbuster will be more effective and promising.

DCC id

The DCC id is the only authorized certificate accepted for transactions in a distributed credit chain. As the financial services system grows, a corresponding increase in liquidity will occur in DCC. The DCC system is reforming the traditional way in which revenue is generated by data institutions. Instead of profit from the resale of user data, DCC earns by providing better services to customers. A single DCC certificate is designed to store data in a secure format. It provides data based on the confirmation of requests using algorithms and calculations. In addition, for data that needs to be integrated and calculated, DCC plans to build a multiparty computing platform with well-known universities and colleges in China.

The DCC Platform

The Open DCC Platform offers the cooperating agency and partners the opportunity to verify, communicate and collaborate with other partners based on their needs. Also, cooperating institutions can publish their labor costs through the DCC platform of the network layer of the distributed credit chain. The network layer protocol adopted by the DCC is scalable, poorly harmonized, with an infectious style and a process group membership protocol.

Unique DCC token

To implement such a large-scale ecosystem, the DCC team developed its own token, which will be the main element for making transactions within the platform.

Distribution and other metrics

DCC plans to issue 200 million digital currencies for Americans and non-Chinese investors, 2.8 billion will be part of the platform, 1.8 billion will be used for private enterprises, 1.5 billion on the market, 1.7 billion will be sold to the ICO and 2 billion will be distributed among the team as a reward for the work done.

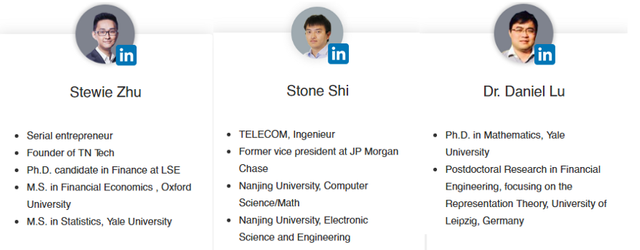

Project team

We believe that before creating a project, it is necessary to lay the most valuable thing in it - its idea. The next step to the success of the project is to realize the idea with the help of talented people in their team. Meet the key members of the DCC team:

I would like to express my own opinion on this project. It consists in the fact that I sincerely believe in its future, because the idea that the DCC team implements is truly interesting. Lending is one of the most popular banking services. Annually millions of people make out a loan in various banks. I implement a revolutionary loan system for blocking, DCC kills two birds with one stone: the first - the credit system goes to a whole new level, the second - the block system and the crypto-currencies thus become better integrated into the modern world and will find real application. In addition, DCC can become an indispensable tool for financial management for large companies.

WebSite: http://dcc.finance/

WhitePaper: http://dcc.finance/file/DCCwhitepaper.pdf

Facebook https://www.facebook.com/DccOfficial2018/

Reddit: https://www.reddit.com/r/dccofficial/

Github: https://github.com/DistributedBanking/DCC

Twitter: https://twitter.com/DccOfficial2018/

Telegram:https://t.me/DccOfficial

Medium: https://medium.com/@dcc.finance2018

Youtube: https://www.youtube.com/channel/UCX0Y5MQwTLGPtIP1jAJm9Ng

Author: https://bitcointalk.org/index.php?action=profile;u=1835919