Having a home that is comforting, cozy and lovable is a dream of many, isn't it? Getting your dream home isn't a cakewalk. Thousands of choices regarding locales, area, backyard, security, furnishing and a host of other requirements are required to be sorted before finalizing a choice. Oops! I forgot the most important it budgetary and finance requirements. Often times, people stack up savings enough to book the house but for getting the ownership lets them through rants of tension and worries with huge rates of interest that these housing loans come with or else, burdensome monthly instalments cutting into your already compact kitty.

While sitting with my friends one day, such an issue cropped up. Newly married, they had to relocate for their jobs to an entirely new location. The two lovebirds, I love teasing them, but that was something serious that day. She was depressed about the loan she had taken and was stuck up in a job she hated all because of the monthly instalments. This is the case of so many of us around. Lengthy paperwork and abnormally high rates of interest on part of the borrowers. Frauds, bad debts, loan recovery issues and many more on part of the lenders.

Blockchain with its trustless and immutable structure has helped many businesses to achieve efficiency and productivity. So, why not the mortgage industry. HOMELEND (Website: https://homelend.io/) based on DLT and decentralization with mortgage agreements based on smart contracts is here to usher in a new era. Blockchain will allow for the digitization of documents with unique has identifiers and other metadata.

Homelend P2P mortgage crowdfunding platform works by embedding into smart contracts the business logic of origin processes. These create a system where borrowers and lenders can interact without the need for a trusted financial intermediary.

The P2P mortgage crowdfunding is the base of Homelend. Instead of a financial intermediary such as a bank, the borrowers and lenders are linked through a smart contract that automatically executes a predefined business logic.

The platform takes hold of the three important issues namely, purchase of property, payback of the loan and satisfactory recovery in case of default.

It partakes two kinds of flows namely information and financial flows. When it comes to information flows , it is 'all digital'. The data residing on physical papers are transferred to digital repositories based on DLT and double checked through professional verification.

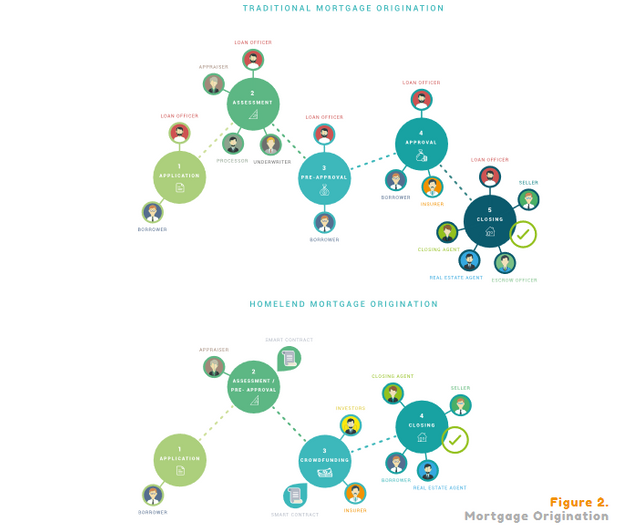

Homelend reduces the number of steps and parties involved thereby increasing the efficiency and reducing time and costs.

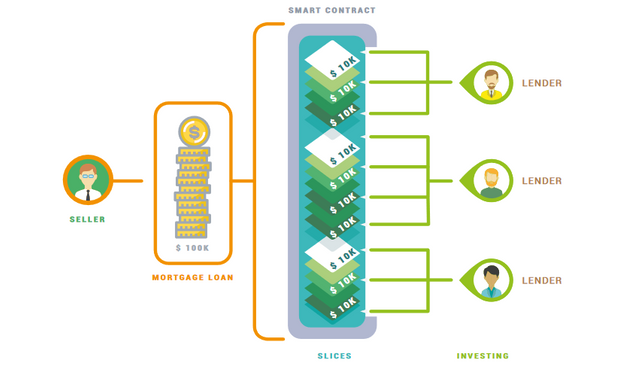

The financial flows are governed by smart contracts. After the down-payment has been done by the client, the further amount of the approved mortgage loan is divided into 'slices' which can be bought by prospective lenders and henceforth, the loan financed by crowdsourcing. The loan amount is fixed in fiat currency due to the volatile nature of cryptocurrency.

The loans will be financed by three methods on Homelend. The first one being Crowdfunding as already discussed above.

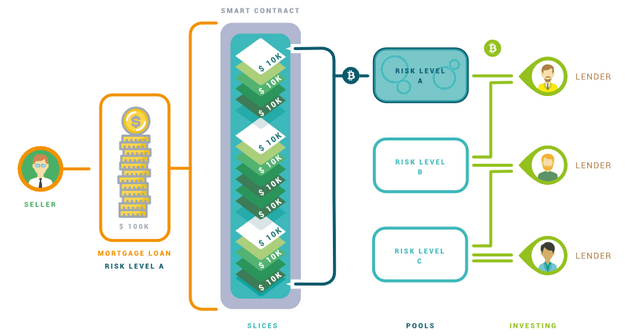

The second is the pooling method which lets investors invest in a pre-approved loan.

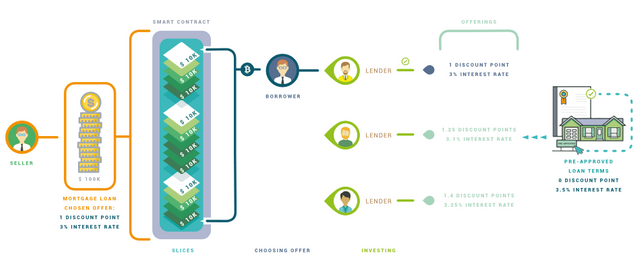

The third method is an auction, where the slices can be auctioned to sell at better interest rates than the preapproved rate or else by providing discount points to the borrower.

Advantages:

- Based on DLT, it offers transparency, efficiency and reliability in the access of information and fulfilment of contracts.

- It reduces the time and costs involved and also, the number of middlemen in the complete mortgage process.

- Smart contracts provide automation and remove the need for a central authority.

- The slicing of loans allows for small lenders to be a part of the platform.

- The investors can indulge in a diverse portfolio of investments based on leveraging the advantages and hedging the risks

- The digitized information flows provide authenticity and security of documents

- The worthy prospects get their loans approved easily without any bias.

- The democratization of services provides the equal scope of opportunity and growth to the parties as well as the platform.

HDM token and its ICO details: Visit (Website: https://homelend.io/)

The HDM token will be a utility token required to access all the services on the platform. It also hedges the platform against volatility from cryptocurrencies. It will be ERC20 compatible token.

The total number of coins issued will be 250 million. 80% of the tokens or 200 million tokens will be in circulation. 36% of tokens will be up for public sale. Discounts of up to 30% are available in stages of depleting proportions.

Concluding Verdict:

Homelend can prove as a valuable platform for both lenders and borrowers if successful. The users can avail of the ease of operations and crowdfunding loan facilities available in fiat. They can also have a say in determining discounts and interest rates subject to conditions. On the other hand, investors can be assured of the HDM tokens backed platform. They can become lenders and create a portfolio of their lending thereby foregoing risks and enjoy different levels of the interest rate as per the projects. The discounts available on token sale can also be availed of. There is a bounty program as well and the reserve fund ensures the feasibility of the project.

For more details visit:

Website: https://homelend.io/

ANN Thread: https://bitcointalk.org/index.php?topic=3407541

Whitepaper: https://homelend.io/files/Whitepaper.pdf

Telegram: https://t.me/HomelendPlatform

Blog By: Lanirm Knayam

BTT Profile: https://bitcointalk.org/index.php?action=profile;u=1308391

Very well written and informative article. Increased my knowledge. You are very well versed in writing. Keep up the good work.

I have followed you, please follow me back. I have upvoted your post and gave comment. Please comment on my blog and give upvote as a return favor. Let’s get successful and rich together. Thanks in advance.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit