- About zkLink.

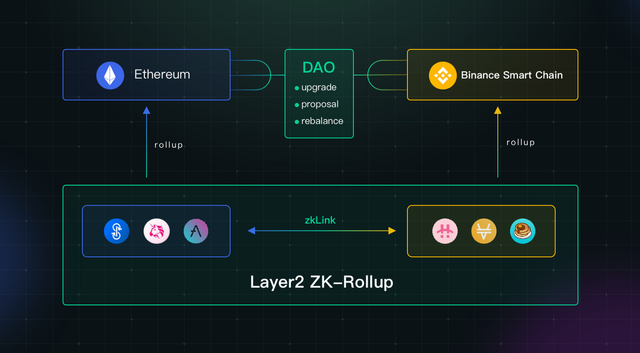

zkLink is a transaction-focused multi-chain Layer 2 platform with consolidated liquidity guaranteed by ZK-Rollups.

The zkLink ecosystem connects various Layer 1 and Layer 2 chains, allowing developers and traders to leverage consolidated liquidity from isolated chains with a secure and seamless user experience, contributing to part of making the DeFi ecosystem more accessible and efficient for everyone.

zkLink creatively applies zero-knowledge technology to multi-chain interoperability with a decentralized and trusted segregation design to ensure the security of assets and transactions as well as multi-chain data transmission. Chain. Furthermore, zkLink eliminates the disparity between stablecoins from different blockchains and different types, achieving multi-chain liquidity aggregation to form a huge stablecoin liquidity pool through a controlled debt mechanism single protocol control (PCD), providing capital efficiency, cost-friendliness, and accessible infrastructure.

💥 Product

As a trustless chain-to-chain interaction protocol, zkLink acts as a middleware to connect isolated chains, empowering traders to solve liquidity problems and provide solutions. multi-chain implementation for Dapps developers.

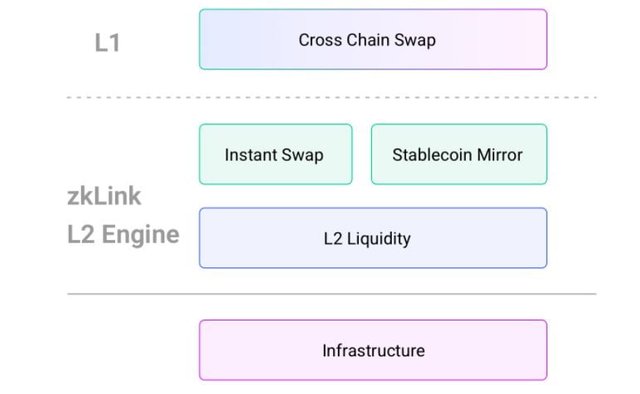

By connecting separate Layer1 networks to a single Layer2 engine, tokens belonging to different ecosystems can be directly swapped with each other on this second layer without the need for an intermediary token.

zkLink solves the problem of liquidity segmentation in a decentralized way. With the implementation of zero-knowledge technology, they realized cross-chain liquidity pairs on the zkLink Layer2 Engine and managed to provide fast cross-chain swaps on Layer1 using the broker mechanism.

zkLink v1 will support Ethereum, Polygon, Binance Smart Chain, Avalanche and in the near future, will also be connected to other smart chains and layer2 protocols like Solana, Optimism, Fantom, etc.

- A multi-chain ZK-Rollup.

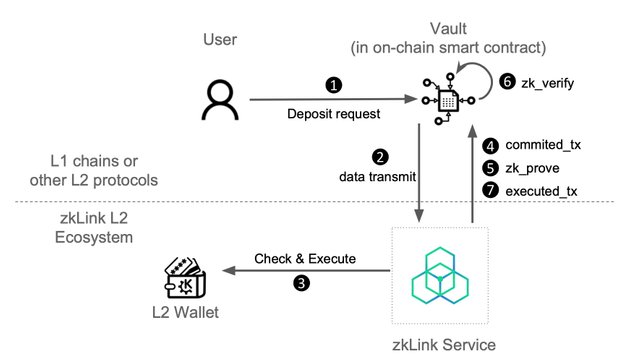

In a classic ZK-Rollup solution, there are usually 3 phases (referring to the Matter Labs implementation): commit, prove, and execute. zkLink goes one step further using ZK-Rollup technology in chain interoperability by adding a ‘consensus’ stage (step 3 in the illustration above) based on the classic solution.

Commit: Multiple transactions occurring on Layer2, including single-chain and cross-chain transactions, are split into a relay and will be uploaded to the smart contract on Layer1 along with ZK-SNARK, responding the ability to provide data so that transactions can be rolled back and account statuses can be restored in the event of any failure on the Layer2 network.

Proof: The ZK proofs are sent to Layer1 and verified by the smart contract. Once approved, it will generate an event and log the corresponding blockchain, containing that current “final_root”.

Consensus: This stage is handled by the oracle network who will do the `final' exchange from each chain and will send it to the smart contract.

Execution: Compared to the classic ZK-Rollup solution, zkLink adds a precondition that the old and current

final_rootmust be consistent. Once this prerequisite ZK proof is proven, requests to transfer funds from L2 to L1 will be made.

- A multi-chain AMM

In the current zkLink V1, multi-chain AMM is implemented using a new concept of “partial LP” as shown in the figure. The two halves of a liquidity pair are stored in two parallel states.

The swap process is also divided into two parallel processes, respectively 'money moved to LP pair' and 'money moved out from LP pair' from the user's point of view.

.png)

- Partial liquidity

When traders notice “live” cross-chain liquidity pairs consisting of tokens from two separate chains, no actual “cross-chain” events occur.

As illustrated below, traders only interact with Layer1 smart contracts deployed on both the source and target chains, to be more suggestive, with a “vault” on each chain containing one type of token. single newspaper – where liquidity providers “put” their funds.

- The High-Availability Architecture of zkLink Layer2

zkLink has prepared at least two active servers for each chain for L2-state storage and has implemented a highly available data synchronization system based on relational databases.

The front-end is hosted in AWS's container service with high-availability, while the API services are deployed based on LBS (load balance service) provided by a cloud service provider. In addition, at least 3 access servers ensure the high availability of service.

zkLink has also prepared an independent internal control system which independently audits whether the data submitted to Layer 1 is correct, to avoid temporary service shutdown caused by computational errors.

- Node Operation

Just like Loopring, zkSync, zkSwap and other successful ZK-Rollup scaling solutions, zkLink nodes are also run by the team. It does not mean that zkLink is a centralized project.

In fact, the zkLink system is FULLY decentralized from a security perspective, eliminating the risk of malicious behavior from operators or validators – not because they don't want to, but because they don't. capable -technology zero-knowledge guarantee this point.

Under the premise of the open source circuit, any off-chain operations must comply with the circuit specifications. Just like the regulatory framework of a company, the circuit is how the zkLink protocol works. Any illegal activity will be exposed during zk verification, handled by smart contract with built-in verification key.

Both the verification key and the zk verification algorithm will be published online. As long as the circuit has been rigorously tested without logic errors, a ZK-based system can be considered safe and stable.

.jpeg)

- Cross Chain Swap

Cross Chain Swap is an AMM-based on-chain trading engine built on top of zkLink’s high-performance and secure multi-chain infrastructure, enabling one-stop cross-chain transactions, where the target token will be reside in the L1 wallet only a few blocks of time.

.jpeg)

- Broker Mechanism

zkLink achieves L1-L1 Cross Chain Swap by calling L2 Liquidity on L1 and creating 'Broker' mechanism to shorten withdrawal time from L2 to L1. There is an inevitable drawback of most Layer2 protocols that withdrawing tokens from Layer2 back to a Layer1 wallet can take hours or even days.

Although the ZK-Rollup solution can achieve the final results of the transactions instantly, it still requires at least half an hour to process the computation. Thus, zkLink initiates this “Broker” mechanism, transferring the long waiting time from the trader to the broker, with some additional fees.

.png)

- Fast Withdraw

“Broker” is a new role in cross-chain trading, who earns the same transaction fees as a liquidity provider, when this person gives up the opportunity cost of locking money, the broker sacrifices time. waiting for a transaction from Layer2 to Layer1.

As soon as zkLink's Layer2 Engine receives a Quick Withdraw request, it notifies the optimal broker who will immediately transfer the appropriate target amount of tokens to the user's Layer1 wallet from its Layer1 wallet, so the user only needs to wait 1 block of time before receiving the target token on the Layer1 wallet.

Then, after the ZK_proof associated with this initial withdrawal request is officially verified, the final_root containing this transaction information is uploaded to Layer1 and confirmed, the zkLink Layer1 contract will eventually send the token to the Layer1 wallet. broker, reaching the balance on the broker’s Layer1 and Layer2 accounts.

- Layer1 DEX Aggregation (In Development)

For those less used tokens, zkLink Fast Cross Chain Swap breaks the barrier and provides a solution where users can trade them across separate chains. And this is effectively achieved without adding a long list of liquidity pairs.

zkLink aggregates many DEXs like Uniswap. When a user initiates a cross-chain request with a source not listed on any of the zkLink L2 liquidity pools, the system compares the different Layer1 DEXs on the source chain in the zkLink aggregator, finding the route and the most efficient exchange rate, then swap the source code to an intermediary listed on the zkLink Layer2 liquidity pools.

They then help the user to swap this intermediary to their designated token and then initiate the Fast_Withdraw protocol. This all happens within minutes, with no manual intervention required.

In this way, the range of available source code is greatly expanded. Theoretically, any token listed on DEXs can be exchanged globally, so traders don't need to bother swapping their source code for something zkLink supports before zkLink is complete. do this for them, saving them even more trouble.

Additionally, with support from third-party Layer1 DEXs, the number of liquidity pairs required on the zkLink Layer2 Engine is significantly reduced, contributing to greater depth and reduced slippage in existing liquidity pools.

- L2 Instant Swap

zkLink supports direct swaps with derived assets for projects of different ecological types and public chain, which completes in seconds.

Designed for high frequency traders to securely trade on Layer 2 at a very low cost.

Based on the AMM model.

End transactions instantly, compared to the long wait times of other cross-chain solutions.

No intermediaries are required, as the liquidity pairs directly consist of the underlying assets from the built-in separate chains.

On the zkLink Layer2 Engine, there are no boundaries between different ecos and local assets can be easily traded globally. For example, users can swap UNI on Ethereum for CAKE on BSC via zkLink Layer2 Engine with just one click and can withdraw targeted tokens to respective chains for full capital usage.

.png)

- L2 Stablecoin Mirror

zkLink supports one-step swapping of stablecoins with stablecoins and fixed assets (e.g. BTC, ETH) on different chains and different types on the zkLink Layer2 Engine, as efficiently and economically as possible.

For example, on zkLink's Layer2 network, users can not only transfer their USDT on Ethereum (ERC-20) to BSC (BEP-20), but also swap their USDT on Ethereum to USDC on BSC.

Designed for DeFi traders and adopters of the zkLink Layer2 Engine, offering lower slippage and low costs, especially for large transactions.

AMM Curve specializes in stablecoins, referring to Curve.fi.

Negligible slippage and low transaction fees.

-Security

The security of the zkLink system is set under the following assumptions:

Security of public chains and extension protocols compatible with the connected VM. The purpose of zkLink is to connect chains together, where the "bucket effect" causes zkLink’s minimum security commitment to be determined by a chain with the lowest level of security among many connected chains. The decision to connect or disconnect a thread should be taken seriously by the community.

zkLink, Chainlink and other oracles are obligated to the DeFi community by acting in good faith with all decisions made, and will reject and report any malicious actions.

Web: https://zk.link/

Twitter: https://twitter.com/zkLinkorg

Telegram: https://t.me/zkLinkorg

Discord: https://discord.gg/9GCwxN7xaJ

Medium: https://zklinkdefi.medium.com