VELIC is an all-in-one crypto finance platform aimed for retail or institutional investors. It aims to provide a new ground for doing financial activities, such as trading, loan, and so on in the world cryptocurrency. To put it simply, it's your crypto financial playground.

Unlike any other crypto finance platform, where they offer limited services (only exchange, or loan), VELIC aims to integrate all of them into a single, yet robust platform. It is opened for retail to institutional investors, with the goal to unlock the maximum potential and opportunity provided in the world of cryptocurrency. What makes VELIC stand out?

Institutions as Targets

Institutional investors are predicted to be an integral part of the whole cryptocurrency ecosystem in the near future. With this idea in mind, it makes sense to build a product which can be used by them, and of course gain profits from it. In this aspect, VELIC clearly stated that institutional investor is one of their key customers.

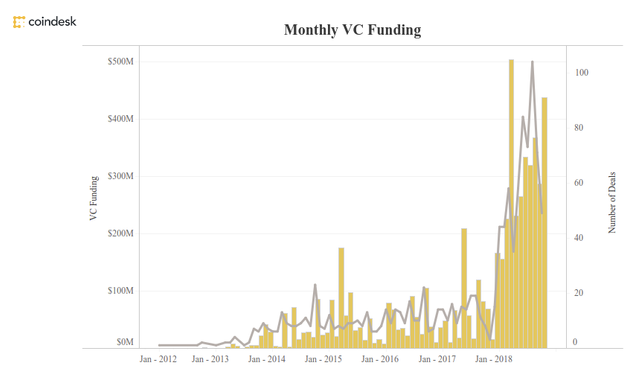

VC Funding from 2012 till 2018. Source: Coindesk

But, is that really true? One way to find this is to look at how many products or funds went to the ICO/cryptocurrency industry. Coindesk report showed us that the amount of venture capital funding increase drastically in 2018, even though the market went bust. This shows that institutions or big players realize the potential of the cryptocurrency industry. They might not get a return from all of their investment, but 1 or a few successful projects that they support should give them more than what they invested.

Targeting institutional investor is a smart and maybe necessary strategy if VELIC wanted to stay competitive with other exchanges, loan or crypto finance platform. And this is strengthened by the fact that VELIC is backed by ICON and other influential players in the crypto industry.

Private Key Management

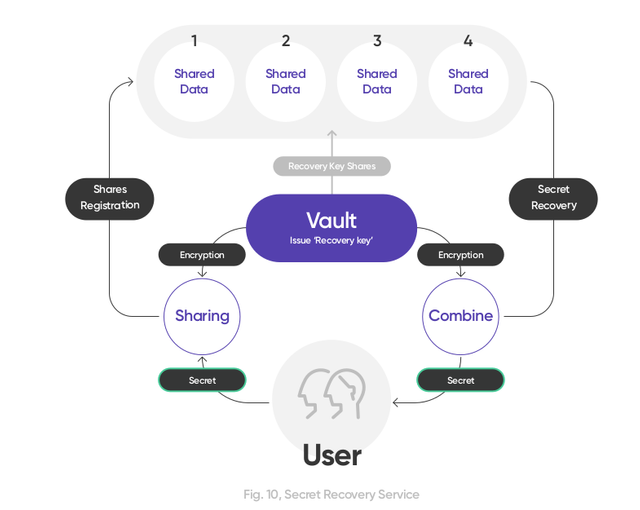

One of the key features from VELIC is the private key management. It aims to solve the complexity and security of storing the private key in order to help users backup and store their private key. The solution is quite simple, encrypt the private key, split it into different parts and then spread it to several storage points. By doing this, the idea is to make sure that somebody has to acquire the entire units and then decrypt it.

Compared to other exchanges, or loans provider (crypto of course), VELIC provides an additional backup for customer private key. Of course, they need some degree of trust in order for this to works. However, users should be able to detect if there's some malicious activity on their account which suggests there's some abuse on the system.

VELIC Vault. Source Velic Whitepaper

This feature might be useful for a retail or institutional investor who doesn't want to face the hassle of backing up or manage their private key. It's ideal for those who prefer simplicity and ease of access over security, to some degree. Of course, this private key management is not enough. There should be some additional security features such as 2FA, strong password generator, SQL injection protection and so on.

In the end, VELIC must combine security with ease of access if they want to be the market leader.

UX & UI

Another aspect that VELIC should deeply think about is the UX and UI. It's no secret, beautiful UI and powerful UX is an important part in order to survive the competition. Most exchange, loan, or vault ecosystem which don't have great UX and UI (like, BiteBTC, Cryptopia, and so on for me) won't survive for long. Even if they did, I really believe customers will simply leave them after they find another powerful exchange that meets their standard.

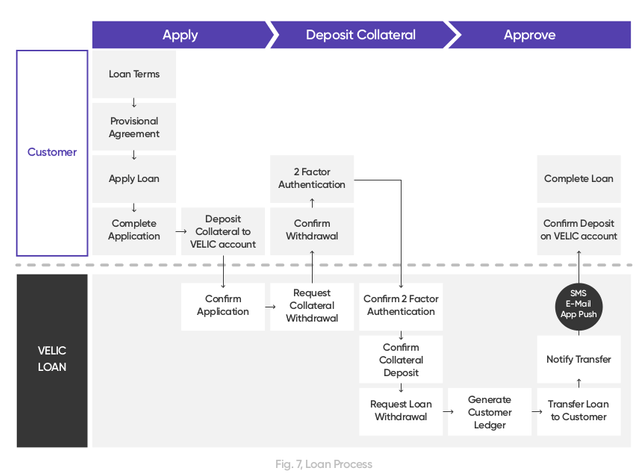

Sleek design of the loan process. Source Velic Whitepaper

Binance, Bittrex, to name a few, are one of those who manages to create an ecosystem with good UX and UI. But of course, it can be improved. At this moment it is hard to determine what kind of UI and UX will VELIC deliver to its users, but considering how well they design the whitepaper, website and so on, I'm expecting something nice. I'd personally try the beta when it's available to see the prospect of the UX and UI.

Team & Partnership

Exchange, loan, or other crypto finance business, is more or less saturated. There's a lot of competition, new business come and go, and that's why it's important to have a strong team and key partnership to make sure a business survive the competition. Take an example of BitTorrent, which even though the product is not that revolutionary (torrent is free from the beginning), but their partnership with Tron & Binance cause a lot of FOMO. But this is not what a crypto finance aims. Rather than focusing on the short-term token sale goal, a long-term vision and key partnership should be prepared.

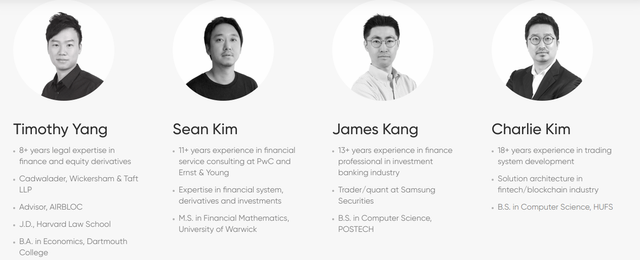

In the case of VELIC, the core team according to their website consist of 4 people. Timothy Yang, Sean Kim, James Kang, and Charlie Kim. Their details are as follow.

As you can see from above, all of them has at least 8 years experience in the world of the financial ecosystem. This is important because VELIC product is mainly related to financial products, such as trading (exchange) and so on. Two people, Timothy Yang and Charlie Kim look like the people who will be in charge of developing the solution/architecture for the blockchain related parts such as tokenomics, security and so on. Timothy is known for its involvement in AIRBLOC, one of the famous crypto project which recently has a partnership with Bflysoft. However, the team of the developer of the ecosystem itself is not present on the website.

This platform will be backed by ICON & Deblock

What about the partnership? According to their website, VELIC has two key partnership, with ICON and Deblock. Actually, Deblock itself is founded by ICON, so more or less we can say that VELIC key partnership is ICON. What's the nature of this partnership? First, ICON/Deblock will support VELIC through funding, which is a good thing for a new startup. This means the soft cap is more or less guaranteed, and the product should be available to the public asap. This is proven by how VELIC aims to offer its token, through VELIC IEO which means that the exchange should be ready first. This is a good thing, product first, token sale follows.

Tokenomics

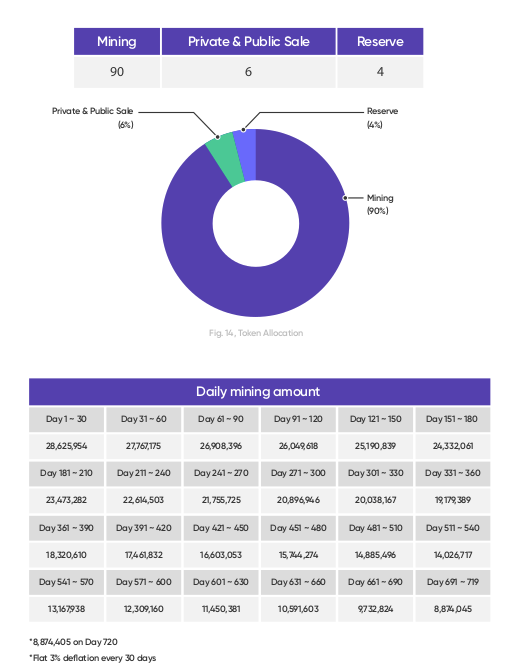

VELIC token or VELT is a token run on top of the ICON blockchain. Total supply is 15 billion, with 90% of them will be produced through trans-fee mining. 6% will be for private and public sale, and the rest will be for VELIC services. This put out roughly at 900 million initial valuations. There is no lock-up, so buy/sell pressure will happen since the first day after the sale is finished.

Mining will be done daily with 2 years mining period. This means for every day in 2 years, new tokens will go to the circulation. If there's no demand for the token, then we can expect a decrease in price. Because of this, VELIX product must be ready as soon as possible and customer acquisition must be finished asap. I personally think it's a challenging task considering that much trans-fee mining exchanges are struggling to keep their token demand and users to use their exchange, but if VELIC can deliver their product, customer love to convert their token to VELA or in other words use the ecosystem, then price should not be a big problem.

Tokenomics details

Bottom Line

VELIC will undoubtedly face a challenging task to tackle and acquire customer due to the nature of competition. But if their product is well designed, it's no surprise if customers, especially institutional investors who want an all-in-one solution to come aboard and use VELIC. Will they able to do it? The best answer would be let's see how VELIC delivers their product.

Read more about VELIC here:

This article is written by joniboini, who has registered on VELIC platform with email [email protected]. Any information, analysis or interpretation from the original sources is the writer's own opinion. Readers should do their own due diligence about VELIC.

Congratulations @littlejohn16! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit