Introduction :

The growth of financial institutions, enterprises have made the access of capital and laons very hard to come by. What more and what could solve these issues as market place is already breaking down? Here pngme got you covered. Lets look into pngme

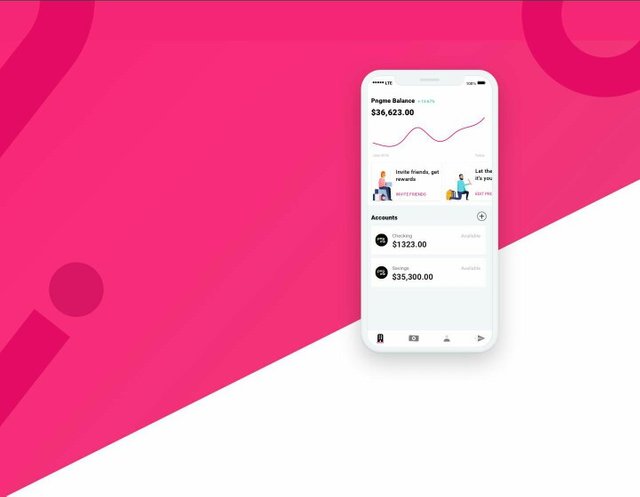

Pngme:- is a global lending marketplace that gives investors access to lending assets, users of payment will be able to make mobile payment, earn interest on savings, take out assets backed loan and it is much more all using the pngme mobile app that had been built with

• Mobile payment

• Peer to Peer loan.

• Piggy bank to save money etc..

The web and mobile application to ease the process of loaning the first mobile finance platform that connects MSMEs in rising markets with reachable, low-fee credit score through modern white and grey label era. MFIs and Mobile Money Networks use Pngme’s cellular app to reduce their value of mortgage origination operations and skip this on as financial savings to their customers, with the system architecture lending marketplace is implemented using a hybrid blockchain technology of both centralized and decentralized stack utilizing a Proof-of-Authority Ethereum sidechain, IPFS, smart contracts, ERC-721 non-fungible tokens, and USD-C stable coins for settlement.

The system architecture consists of seven parts: Web App & Mobile App User API

Custody & compliance API

Sidechain API Credit scoring API Digital bond API

Digital bond auction API

The web App will be used to suit the institutional partners and facilitate a power friendly user experience while the mobile app for businesses who are looking for a non custodial banking experience.

Why is Pngme important :-

The market place lending has grown rapidly in the past few years with lenders seeking to get more profits on their assets with this comes the digital credit score model which allows Oneness provide users, investors, business owners with credit ratings, with the introduction of the pngme apps to make lending assets easily available pngme looks to get to the highest peak in the market.

Apart from being a new lending marketplace, it is built on a decentralized blockchain technology and it uses liquid digital assets to fund loans etc. Unlike the normal marketplace loaning platform that exchange rates are set by individuals, Pngme uses novel auction and matching algorithm to promote transparency and accuracy, additionally the mobile application allows micro finance institution to serve their customers easily, Pngme has a vision to lower the cost of credits while increasing the accessibility therefore increasing sustainable economic growth.

Pngmehas made a competitive lending marketplace that has opened a proper entry to virtual asset based totally capital marketplace, it has created an hybrid credit rating that allows borrowers without a formal credit score rating score to access value effective credit score through a network of MFIs and Mobile Money Networks which leverages the cellular app and lending market to control operations and serve customers properly.

Pngme Token:

Pngme token name is Pngcoin and it is

based on the Ethereum ERC-20 platform, The Pngme token which is pngcoin will be used in all Pngme network (the Pngme Marketplace, web and mobile apps)

The PNG tokens can be easily earn by users through these mediums, signing in, referring friends and or through a secondary marketplace.

Final Thoughts

Pngme is coming into the marketplace to answer the prayers of the enterprises, entrepreneurs etc on the establishment of a good, safe, technological advanced lending platform, pngme has come to fill up that gap.

Contact Pngme using the link :

To have more insight about pngme, kindly click on the links below:

Website: https://www.Pngme.Com/

Whitepaper: whitepaper: https://docsend.Com/view/m8fighb

https://docsend.Com/view/929pjg2

Telegram: https://t.Me/pngmecommunity

LinkedIn: https://www.Linkedin.Com/enterprise/pngme/

Twitter: https://twitter.com/pngmemobile

Writers Details

Bitcointalk username: KnowlesB

Bitcointalk profile link: https://bitcointalk.org/index.php?action=profile;u=2439436;sa=summary