135 Blockchain Startups With ICOs

We identified 135 blockchain startups that have closed significant initial coin offering rounds for their tokens since 2014 and organized them into sixteen categories, from healthcare to computing to gambling.

WHERE IS THIS DATA COMING FROM?

While some thought Q2’17 was blockchain’s wildest quarter, Q3’17 looks like it’s going to take the title by a landslide.

Year-to-date, ICOs (“initial coin offerings”) have raised more than $1.6B. In first place, core infrastructure and blockchain governance platform Tezos raised $230M in Q3’17. Distributed file storage platform Filecoin claimed the second-largest closed ICO with its approximately $210M token sale in Q3’17 according to two Form D’s submitted by the company, although other sources put the total raise higher at around $250M. Both ICOs closed within a matter of weeks, and both projects have yet to release a consumer-ready platform. Notably, Tezos used some of the cash to launch a $50M venture fund that will support development on top of Tezos.

Blockchains are cryptographically secured distributed ledgers, first developed as the underlying technology of the popular cryptocurrency bitcoin. Our blockchain definition includes cryptocurrency-focused companies as well as distributed ledger-focused companies applying the technology across sectors.

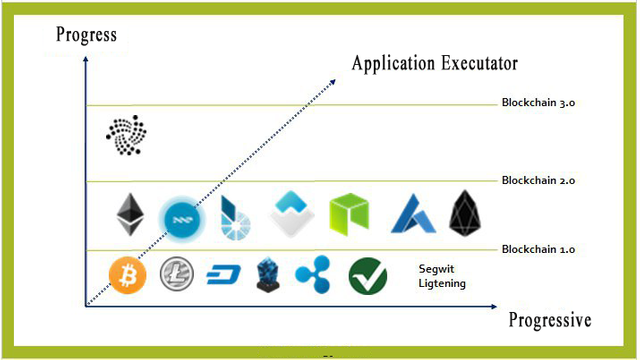

Bloclchain Progress

DEFINING ICOS: ARE THEY SECURITIES?

Initial coin offerings — ICOs — are sales of tokens or coins offered by blockchain companies looking to exchange tokens for cash, typically denominated in ether or bitcoin. Tokens are subsequently traded on cryptocurrency exchanges, and rise or fall in value nominally based on the company’s projected product and market capitalization.

Certain offerings appear to be no more than poorly-disguised unlicensed and unregulated securities issuances. In a July 25th note on cryptocurrencies, the SEC pointed to the Howey Test as a barometer by which to measure how likely a particular blockchain token is of being a security under federal law. According to the test, an investment contract is determined a security when it constitutes “an investment of money in a common enterprise with a reasonable expectation of profits to be derived from the entrepreneurial or managerial efforts of others.”

Using this rubric, regulators concluded that one of the first prominent ICOs (and largest at the time, at $150M), the hacked “Decentralized Autonomous Organization” or the DAO, was an illegitimate securities offering.

However, other tokens and ICOs differ from the DAO in terms of offering structure and use case, presenting fertile ground for a counterargument. For example, certain tokens allow access to and/or utility within a blockchain network; bitcoin serves first and foremost as a payments network, with the bitcoin “token” as the network’s exclusive means of exchange.

Looking beyond whether tokens constitute securities, there’s still plenty of room for skepticism around ICOs. Many companies holding ICOs are pre-product and pre-development, with little more than a team, a whitepaper, and an eager crowd of unaccredited speculators.

Additionally, there are questions around incentives to consider — when companies in pre-development can raise upwards of $20M regularly, what’s stopping them from misusing the funds or failing to release a product, even with vesting schedules in place?

As a result, possible over-capitalization should be taken into account in any serious valuation. In contrast to ICOs, traditional blockchain venture financing sees an average of $3M for early-stage deals (seed / angel or Series A).

Congratulations @momandbaby! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPDownvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

STOP

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.cbinsights.com/research/blockchain-ico-tokens-startup-market-map-expert-research/

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Tks robot

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit