Get it? It's “steam power”. Let's dig into whether you can make money with Steemit, and how Steem Power, Steem, and Steem Backed Dollars play into this potential income source

What's Inside This Article

I. Introduction

II. How To Use Steemit's Token Economy Functions

A. Introduction To the Tokens

STEEM

STEEM Power (SP)

Steem Dollars (SBD)

B. Where Do The Tokens Come From?

C. How Are The Tokens Distributed?

D. How Does The Steem Blockchain Achieve Consensus?

E. Is Steem A Scam?

III. How to Use Steemit

A. Account Registration

B. Site Navigation

Feed Page

Profile page

Post Creation Page

Wallet

C. General Blogging With Steemit Notes

Display of Payout Amounts

Tagging

Frequency Of Posting

How Does Steemit Compare To WordPress or Medium?

Other Services On Steem

IV. Can You Use Steemit to Make Money?

A. Strategies For Making Money

Attracting Upvotes To Your Content

Curating Content

Using Steemit As A General Purpose Blogging Platform

B. Converting STEEM to cash

V. Conclusion

Have You Made Money With Steemit?

I. Introduction

Steemit is a social media and blogging platform founded in 2016 that uses blockchain technology to allow its users to earn cryptocurrency rewards for creating content and interacting with the site. It can be compared to both Reddit and the blogging platform Medium. Steemit runs on an independent blockchain called Steem, which is continually creating new digital tokens and distributing them as rewards to users who interact with the platform. In the words of the company’s whitepaper, “Steem aims to support social media and online communities by returning much of its value to the people who provide valuable contributions by rewarding them with cryptocurrency, and through this process create a currency that is able to reach a broad market, including people who have yet to participate in any cryptocurrency economy.”

Users can receive digital tokens from Steemit in two ways. First, tokens are awarded in proportion to the amount of upvotes their content and comments receive from other users. Second, users get tokens for the upvotes they have given to others, known as curation. These tokens can be traded on exchanges for other cryptocurrencies such as Bitcoin. Thus, it is possible to turn the STEEM tokens earned on Steemit into fiat currency with the proper exchanges.

Steemits homepage looks like any other blogging platform instead of a confusing cryptocurrency hub!

In order for users to be rewarded for their contributions to the platform, the creators of Steemit have created a sophisticated voting and rewards system. Steemit determines the influence of a user’s vote by the number of special illiquid Steam Power tokens he or she holds. (Steem Power will be further explained in the next section.) Steam Power cannot be easily sold in order to ensure that members have a financial incentive to vote in a way congruent with the long-term interest of the Steemit platform.

II. How Steemit’s Token Economy Functions

A. Introduction to the Tokens

The developers of Steemit chose to have not one but three different types of tokens that are issued to users. These are STEEM, Steem Dollars (SBD) and Steem Power (SP). Two of these tokens, STEEM and Steem Dollars, can be swapped for other cryptocurrencies such as Bitcoin or Ethereum through third-party exchanges.

STEEM

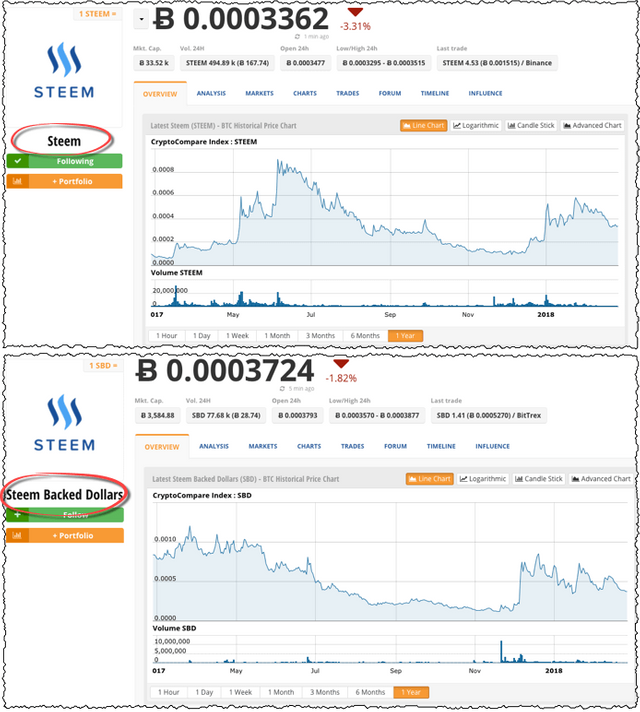

Steem is the base liquid cryptocurrency token in the platform. It is similar to bitcoin, so it can be bought and sold on exchanges. Currently on Coinmarketcap, Steem is the 28th largest cryptocurrency, with a value of around $3.50 USD per token and a market cap of $900 million USD. It can also be traded to other users as a form of payment.

STEEM Power (SP)

Steem Power is a measurement of how much influence a user has in the Steem network. When users vote on content, their influence over the distribution of the rewards pool is directly proportional to the amount of SP that they have. Users with more SP have more influence on the distribution of rewards. The exact formula for determining how much influence a user’s upvotes have will be discussed in the voting section below.

A user can trade SP for STEEM, but the conversion will happen over a 13-week period. This means that SP is locked up on the platform and can’t be traded away easily. This is because the creators of Steemit want users to be committed to the platform and have a long-term perspective. Without the vesting protections of SP, users could theoretically hold STEEM short-term and influence the community in detrimental ways.

SP holders are also paid interest on the balance of SP that remains vested. 15% of the yearly inflation is paid to SP holders as interest. The amount of the interest that they receive is directly proportional to the amount of SP they hold relative to the total amount of vested SP across all users.

Additionally, SP can be loaned, or delegated, from one user to another. New users are usually loaned some SP when they first create an account by the system.

Steem Dollars (SBD)

Steem Dollars also known as Steem Blockchain Dollars (SBD) are liquid stable-value currency tokens designed to be pegged to $1 USD. They are designed to make the value of STEEM on crypto markets more stable. They can also be transferred to other accounts for commerce or exchange.

In order to determine the rate that SBD can be converted to STEEM, there is a price feed which is maintained by members called witnesses. Witnesses are elected from among Steem users and are paid to maintain an accurate price feed. The actual price used for conversions can be derived as the median of the feeds. In order to prevent corruption of the price feed, Steem factors out short-term price fluctuations by using the median price over a period of 3.5 days. The median published feed is sampled every hour on the hour.

All conversion requests from SBD to STEEM must be delayed for 3.5 days in order to prevent people from gaming the system. SBD has a market cap of around $40 million USD, which places them at around 239th on the Coinmarketcap list. They trade for around $4 USD each.

The charts above show the value of Steem and Steem Backed Dollars VS Bitcoin. Bitcoin price fluctuations will affect this value, of course

SBD normally pays interest, as long as its value is below $1. This is because Steemit views those who hold SBD as holding debt. The interest rate is set by the same people who publish the price feed. Note that SBD, though designed to be worth around $1 USD, currently have a value of four times that. Thus, SBD currently pays no interest. According to the white paper, this is because the market is willing to extend more credit than the community is willing to take on. The white paper says:

“Any time Steem Dollars is consistently trading above $1.00 USD interest payments must be stopped. In a market where 0% interest on debt still demands a premium, it is safe to say the market is willing to extend more credit than the debt the community is willing to take on. If this happens a Steem Dollars will be valued at more than $1.00 and there is little the community can do without charging negative interest rates.”

Compared to SBD, it seems that STEEM is the better token to hold because it has a larger market cap and is more liquid.

B. Where do the tokens come from?

STEEM tokens were mined at the beginning of the Steem blockchain using proof-of-work, like Bitcoin. Starting December of 2016, Steem stopped using proof-of-work, and began creating new tokens at a yearly inflation rate of 9.5%. The inflation rate is decreasing about 0.5% per year, and will continue decreasing at this pace until the overall inflation rate reaches 0.95%. This will take about 20.5 years.

C. How are the tokens distributed?

Every day, a fixed amount of STEEM tokens are allocated to the network reward fund, commonly called the “reward pool.” 75% of the new tokens that are generated go to fund the reward pool, which is split between authors and curators. 15% of the new tokens are awarded to holders of Steem Power. The remaining 10% pays for the witnesses to power the blockchain.

There are two ways to receive distributions from the reward pool. The first is by having your work upvoted by other users. Steemit calculates how much reward you will earn on your post depending on a variety of factors, including how much Steam Power the voter held. All payouts from this type of activity are received in 50%-50% split of Steem Power and SBD.

The second way to earn rewards is by curation, or upvoting other users’ posts. Up to 25% of a post's payout is awarded to curators as a reward for discovering the content. The other 75% is awarded to the author. If curators vote for a post within the first 30 minutes of it being created, a portion of their curation reward is added to the author payout. This portion is linear to the age of the post between 0 and 30 minutes. Therefore, upvoting at 15 minutes old will donate half of your potential curation reward to the author.

According to the white paper, users are allotted a fixed amount of voting power which is determined by how much Steam Power they have. Every vote that is cast uses a percentage of remaining voting power. Users can vote for more posts, but each vote will be worth less, and it will take longer to reach full voting power again. Voting power recharges at a fixed linear rate of 20% per day.

Payouts occur seven days after posts are made.

D. How does the Steem blockchain achieve consensus?

Steem’s blockchain uses a system called delegated proof-of-stake to achieve consensus. The term “achieving consensus” means ensuring that transactions recorded in Steem blockchain are accurate. In the case of Steem, the transactions recorded are the votes taken by users.

This is a different system than the proof-of-work used by Bitcoin. Steem’s blockchain has what are called witnesses. Like with bitcoin miners, witnesses need to have servers running specialized software. These servers, or nodes, allows them to analyze the transactions of the Steem blockchain and ensure they are accurate. This requires a fair amount of technical knowledge.

But having a witness server is not enough. Once someone has a server up and running, they must get other users to vote for them to be a witness. 21 witnesses are selected to create and sign each block of transactions. 20 of these witnesses are selected by approval voting and one is timeshared by every witness that didn’t make it into the top 20 proportional to their total votes. The 21 active witnesses are shuffled every round to prevent any one witness from constantly ignoring blocks produced by the same witness placed before.

What this effectively means is that users of Steemit can vote for witnesses. Witnesses are chosen on the basis of their reputation and can be voted out if they inaccurately count transactions or engage in any kind of fraud. To be done properly, this requires that users do some investigation and research into the people asking for their witness vote.

For a further explanation of how delegated proof-of-stake works, see this article. Note that Steem’s system is the same as the one used by Bitshares, as it was created by the same people.

Now that the technical aspects of Steemit have been explained, let’s look at how to actually use the platform.

E. Is Steem A Scam?

Here's a debate (it's pretty long) between a Steem lover and a Steem skeptic. The skeptic, Tone Vase, is a “Bitcoin Maximalist”, meaning he pretty much thinks all crypos are trash except for Bitcoin. He regularly identifies actual scams within the crypto space, so it's not like he's just some hater that wants to see the price of Steem drop. He's a very smart dude, and his arguments against Steem are compelling.

This is an awesome video to watch if you are seriously thinking of investing in Steem. If you are just planning to make some Steem then convert it to Bitcoin or cash, well, that's another story.

Another “warning sign” of Steemit possibly being a scam, or at least in danger of imploding at some point is the high number of users on YouTube and other social media with video thumbnails like this:

Video Thumbnails like this remind me of network marketing scams like Empower Network and WakeUpNow. They aren't all terrible though. Actually, the center video is a good one and featured below.

You want to make money? Oh! All you have to do is join the site and it's super easy money!

Well, the good news is that you don't get paid to refer people to Steemit, so there's really no incentive for these people to make videos promoting Steemit other than being excited about the platform. Perhaps you could make the case that they want more followers, thus more upvotes, and more money. Also, you see many of the same style videos for other types of crypto like Litecoin or Dash. People are excited about crypto and want to see their “top pick” win.

So, if you are wondering if Steemit is a pyramid or ponzi scheme, it's my opinion that it's not. But can you make money with Steemit? Keep reading.

III. How to Use Steemit

A. Account Registration

To register a new account, Steemit requires an email address and phone number. Steemit’s FAQ says this is because registering a user on Steemit requires the creation of a user account on the underlying Steem blockchain, which costs a small amount of cryptocurrency that has a real monetary value. In order to prevent people from creating multiple user accounts for free, Steemit wants verification beyond just an email address.

If you want to avoid giving up your personal information to Steemit, there are four other ways to open an account that involve third-party tools, each of which is detailed in the FAQ:

SteemCreate accepts credit cards, or BTC to create a Steem account. You do not need to have an existing Steem blockchain account to use the service, but there is a charge on top of the blockchain account creation fee for using the service.

AnonSteem accepts bitcoin, Litecoin, STEEM, or Steem Dollars to anonymously create a Steem account. You do not need to have an existing Steem blockchain account to use the service, but there is a charge on top of the blockchain account creation fee for using the service.

SteemConnect allows you to create accounts by paying or delegating the account creation fee. There is no additional fee to use the service but does require an existing Steem blockchain account to pay the account creation fee to create the account.

BlockTrades accepts bitcoin, Litecoin, STEEM, Steem Dollars, BitShares, Dash, Dogecoin, Ethereum, and more to create a Steem account. You can also send extra tokens to pre-load the account with additional Steem Power. You do not need to have an existing Steem blockchain account to use the service, but there is a charge on top of the blockchain account creation fee for using the service.

Once you have created an account, you are able to start blogging.

B. Site Navigation

- Feed Page

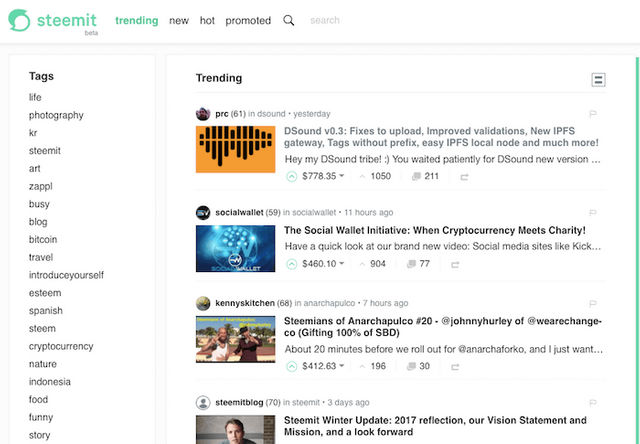

If you click on your user icon and then “Feed”, you will be taken to the feed page. This is where you access content from other users, including those you follow. On this page there are four categories across the top: trending, new, hot and promoted. According to the FAQ, trending refers to “posts with the most number of votes, stake-weighted, recently,” while hot refers to “popular posts at the moment.” The exact difference between these is unclear. Promoted posts are listings that are boosted by Steem Dollar payments for greater visibility. The new post category shows the latest posts.

When you click on a tag you will be shown the posts that are trending for that tag. Click on any of the other categories, such as new or hot, and you will be shown the new or hot posts with that tag. You can also search for key phrases or tags in the field next to magnifying glass.

The tagging system is a bit confusing. Posts seem to sometimes have tags that are chosen because the tags are popular, not because the post is related to the tag. Also, many of the tags are vague, such as “price”, “love,” “fun” or “life.” There are also some tags, such as “cn”, “sndbox” or “zappl” which don’t make sense unless you have spent time on the site and researched them.

- Profile page

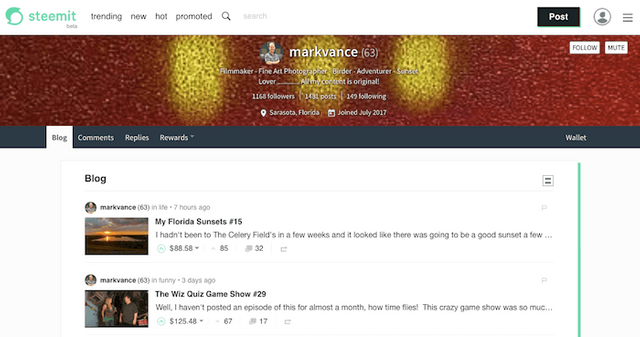

If you click on your user icon in the upper right, you will see an option for the “Blog” page. This is your profile page. At the top will be your username with a number in parenthesis. This number is your reputation score. It starts at 25 and goes up from there and increases based on interactions with other users. Below your display name is the number of followers you have, the number of posts and comments you have written, and the number of people you are following. It also shows the month and year when your account was created.

Aside from “Blog,” across the top of your profile pages you will see “Comments”, “Replies”, and “Rewards,” as well as “Wallet” and “Settings” on the right-hand side. Clicking on comments show the comments you have. Replies shows replies that other users have made to your posts.

Clicking on “Rewards” reveals a dropdown menu where you can see your rewards broken down by Curation awards (for upvotes) and Author rewards (for posts you make).

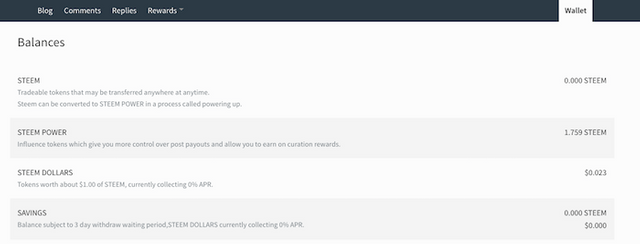

On the “Wallet” page, you will see how much STEEM, Steem Dollars, and Steam Power that you have, along with the estimated account value in US dollars. Note that you can also check the size of the wallet of any other user on Steemit.

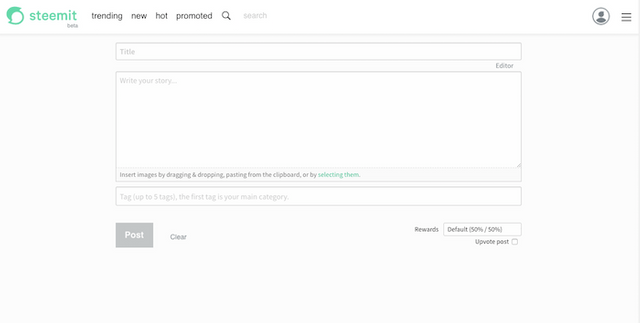

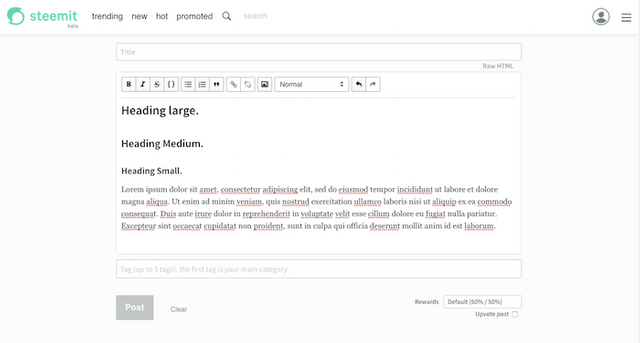

- Post Creation Page

Clicking on the “Post” button will take you to the post creation page where you can write blogposts. The basic blogging interface is fairly straightforward. There is space for a title and room for up to 64,000 characters in the body text. Steemit is optimized for mobile natively. The default setting is to write in Markdown mode.

Writing in the Editor mode should be the default since it has more options for formatting. You have a limited choice of heading sizes and you can add bold or italics. Also, there is the option to add quotes and embed hyperlinks, and a spell checker. You can also add pictures, though they can only be displayed in one size that stretches across the screen. After adding and formatting text in Editor mode, you can see the HTML by switch to “Raw HTML” mode.

In regard to videos, you cannot directly upload a video to Steemit, it must be stored elsewhere. Steemit supports embedding only of YouTube and Vimeo files. You just copy the link into your blogpost and it will be embedded. All in all, it is a fairly rudimentary editing experience with just the essentials.

- Wallet

Yes but it is not easy.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for this post it has helped me a lot

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit