As the world’s economic event of every year, the 4-day World Economic Forum Annual Meeting (aka Davos) of 2019 has come to an end on January 25. Themed Globalization 4.0: Shaping a Global Architecture in the Age of the Fourth Industrial Revolution, the event gathered the world’s most influential leaders and heavyweights to discuss and explore some of the most important matters of the global economy — two of them being blockchain and digital assets.

Being a frontier technology in the FinTech space, blockchain and digital assets are still the talks of this year’s Davos, despite the recent challenging market conditions. While many great minds have shared their opinions on the technology and the asset class, what insights can we draw for the industry? Here are the key takeaways of the event:

WEF is taking blockchain seriously

Dubbing blockchain as “a relatively nascent technology”, WEF founded the Global Blockchain Council under The World Economic Forum Center for the Fourth Industrial Revolution based in San Francisco in Davos 2017. The council is set to offer an international platform for facilitating the global technology policy making and corporate governance, ensuring innovation can continue alongside policy that supports its continued progress.

This year, WEF appointed Elizabeth Rossiello, CEO and Founder of BitPesa, to be one of two co-chairs of the council, along with Sheila Warren, the Head of Blockchain and Distributed Ledger Technology at the WEF. The council is scheduled to hold its first convention in May in San Francisco and officially begin its advisory role to the WEF.

“We chose Elizabeth as one of the co-chairs for this committee, not only for her diverse background in this space, from technical expertise as well as regulatory, but also for her ability to bring together members of this often fragmented ecosystem,” said Sheila Warren.

After the hype the blockchain and cryptocurrencies experienced last year, it has been observed that the talking point about blockchain technology has shifted from “if” to “when.”

Clearly, WEF’s new appointment is the first step for bigger plans in the futures. It is expected that more WEF or government-backed blockchain projects will be rolled out in the coming year.

Institutional investors are optimistic about blockchain technology

Given that blockchain is gradually reaching maturity, businesses have become keen to adopt the technology in their operations.

A survey conducted by the Global Blockchain Business Council (GBBC) finds out that 40 % of the 71 interviewed institutional investors think blockchain “could be the most transformative technology since the internet.” The results were announced at Davos 2019.

Additionally, the findings revealed that 1/4 of the interviewees agree that public companies need to outline blockchain technology plans in the next few years, and 1/3 of them agree that businesses will soon need to set up a Head of Blockchain role on their boards within the next five years.

“There is little doubt about the potential impact blockchain can have on most sectors, and key areas of everyday life,” said GBBC’s CEO Sandra Ro at the WEF.

After the growth of venture funding for blockchain startups has cooled down, the industry has stepped out of the hype, moving forward from the growth stage to the shakeout stage in 2019. Having that said, the findings reassure the potential of blockchain technology. With more resources being allocated back to down-to-earth R&D, we can expect large-scale advancement and adoption of the technology this year.

How can blockchain and crypto firms succeed in stock market? Hong Kong authority gave some tips

Whenever a crypto firm files an IPO application, it is like dropping a bomb in the industry, because every industry player is so eager to see public acceptance to blockchain or digital assets. Unfortunately, there are not many successful cases to mention so far.

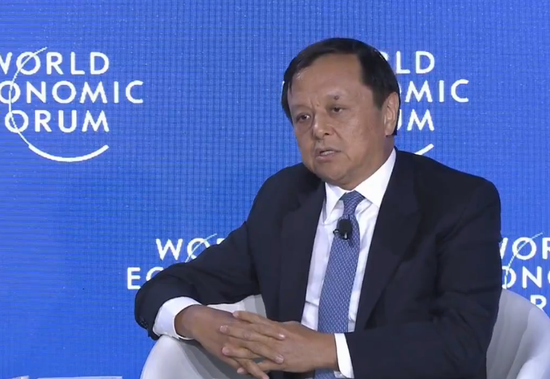

At Davos 2019, Charles Li, CEO of Hong Kong Exchanges and Clearing (HKEX), gave the industry some tips on a successful IPO application. The head of the world’s third largest stock exchange called on cryptocurrency firms to develop consistent and sustainable business models when commenting on the IPO applications of mining giants, namely Bitmain, Canaan Creative, and Ebang.

“If a company made billions of US dollars through Business A, but suddenly said it will do Business B without showing any performance, or said Business B is better, then I don’t think the Business A featured in their application will be sustainable…Besides, if regulators were hands off [on Business A] in the past but will regulate it in the future, will you be able to continue the business and still make money from it?” said Charles Li.

Although an IPO can bring in benefits like a broader client and user base from the traditional financial market, convincing financial regulators has been a hurdle for a blockchain or crypto company when going public. While the industry is expecting more robust regulatory frameworks to be established across the globe, the comment of Li, as the head of the world’s leading stock exchange, would be a valuable remark for those who wish to fit into the traditional market.

Charles Li, CEO of HKEX

Africa is a land of opportunities

Blockchain is revolutionary in a way that it may enable developing markets like Africa to bloom in certain aspects. And at Davos, South Africa’s President Cyril Ramaphosa voiced his vision.

“We now need to be getting into artificial intelligence — in a very smart way, clever way — blockchain, and all these other technologies. And Africa now has this great opportunity, having lost out on the previous revolution, that we’ve had to leapfrog,” said Cyril Ramaphosa. “We’ve got the skills, we’ve got the technology, we should now have the courage to be ahead of the curve, and embrace technology in the fullest way.”

One potential opportunity lies in the rapidly growing demand for fast cross-border payment service as more African companies source goods and services from abroad. However, the local financial sector is still held back by limitations, such as poor regulation, high fees, and lack of cooperation among financial institutions. Blockchain technology, which allows instant and low-cost cross-border transfer, has the potential to change the game on the continent and open Africa to much bigger international markets.

Cyril Ramaphosa, South Africa’s President

Follow OKEx on:

Twitter: https://twitter.com/OKEx

Facebook: https://www.facebook.com/okexofficial/

LinkedIn: https://www.linkedin.com/company/okex/

Telegram: https://t.me/okexofficial_en

Instagram: https://www.instagram.com/okex_events

Steemit: https://steemit.com/@okex-official

Website: https://www.okex.com

Warning! This user is on my black list, likely as a known plagiarist, spammer or ID thief. Please be cautious with this post!

If you believe this is an error, please chat with us in the #cheetah-appeals channel in our discord.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @okex-official! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard:

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit