Introduction

Not many would dispute the advent of the Crypto – Era in the 21st Century. It is only a matter of time before this particular phase will be called the Crypto-Age and we would be the participants of this Age. Not a bad time and place to be, especially that, it is only starting to get interesting. We are still on day zero of the launch of the Crypto-Age and yet a lot has been done already.

Bitcoin, no doubt, brought the Crypto and Blockchain principle to the world and since then a lot has happened. It brought in the aspect of decentralized, digital currency, which today is being traded with real currency; there cannot be a better statement of acceptance. One interesting aspect is the advent of Ethereum and the introduction of “Smart Contracts”. Smart Contract gained such popularity that almost all ICOs have had some level of usage of the principle, and of course, few tried to improve upon them too.

Ethereum also has an inherent advantage of being a better blockchain protocol and thereby, proves robust for other blockchain solutions to build over them rather than build independently. That said, a small percentage does exist, wherein we will see the block being built from scratch. So future crypto solutions have to be compatible with both, the Ethereum based solutions as much as those being built from scratch. So, this gives us an idea of what has happened in the crypto world and what needs to happen further.

Now, let’s talk Finance

Whether you are an entrepreneur or a salaried employee, big conglomerate or a home-maker, finance impacts us all the same. Whether you are buying for your basic needs from the market or you are manufacturing and supplying the products that the market needs, all of us are calling on the tenets of finance to fulfill basic transactions. The quantum may differ but the impact is definitely the same. The sheer exposure that finance has in our lives has led to many blockchain solutions to focus on this area. For crying out loud bitcoin was an alternate currency in the crypto world, so isn’t it obvious that not only the currencies but also the underlying principles of real-world finance will sooner or later be substituted by the crypto world? The answer is yes but with the underlying strengths of a blockchain which probably real-world solution can’t achieve.

So, if I were to ask - what is the main challenge in the financial world which impacts us all? It may take you a bit of time but on careful analysis, you would easily come to know that one of the well-known economic theories of demand and supply impacts us the most. It decides at what price we buy gas for our vehicle, it decides what rate we buy food for our children, it decides at what rate we buy essential, it decides almost everything we buy with money.

Demand and Supply is not only a strong concept but one with a high level of fluctuation which could be caused by scarce rains to undependable logistics. It is such a high impact reality that the real world figured out a way to handle these fluctuations. How? We are talking about Derivatives.

Derivative is a financial instrument deriving its price from a currency, stock or raw-material (commodity) as the case may be. Derivative allows us to forward contract at a specific price and thereby, protect us from fluctuations in the near-term.

Now, can the crypto world give us the stability that we intend to achieve through derivatives or is still far from making that happen?

So what have we seen so far?

- Bitcoin introduced a decentralized, digital currency which has had a good amount of acceptance across the board

- Ethereum based Smart Contracts was in a way an improvement over the base blockchain concept

- More ICOs are coming with Ethereum as a base, however, there are many more built from scratch as well

- Real world finance has demand and supply impacting our lives everyday

- Derivatives help handle the demand-supply fluctuations to certain extent

The transcending of the real world finance into the crypto world will necessarily need a good amount of thought on the above points. Forget giving thought, has anyone even started looking in that direction? Apparently, somebody has and that is what makes this all the more exciting.

Let’s get to know Firmo

Well, that somebody that we just discussed is Firmo. A ten-second introduction in their own words as mentioned in their technical paper would read as:

“Firmo is creating an alternative infrastructure for financial contracts [which is/will be] transparent, fair and trustless.”

What does it mean? The benefits of derivatives are not securely available in the crypto world and those of us having an understanding of the crypto world would know that much like the real world fluctuations cryptocurrencies too experience volatility. Firmo intends to enable smart derivatives for exchanges to handle such volatility.

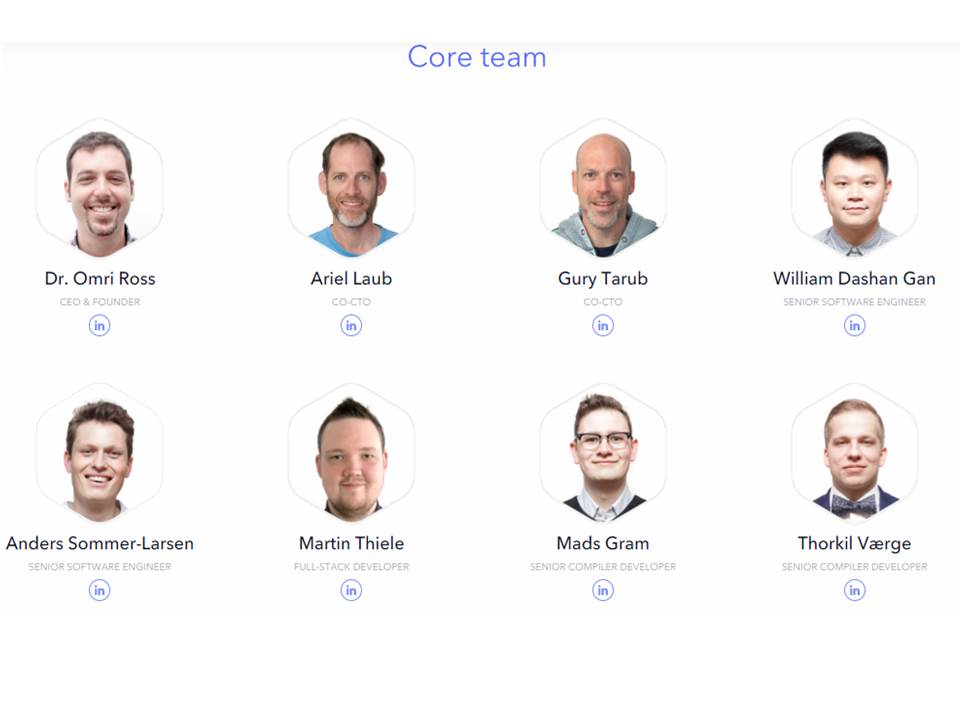

Firmo has been founded by Dr. Omri Ross and there is quite a bit of enthusiasm behind it. You can hear Dr. Ross speak over here:

https://www.youtube.com/watch?v=9pbxTD7Co9c

So, what’s the story about?

Firmo is helping change and manage the highly volatile crypto world. It allows users to create smart derivatives and operate with a diverse selection of liquidity providers (ICOs, coin traders, etc.) on one end and exchanges on the other end. As such Firmo is providing a path for the evolution of the crypto world. Much like the real world, a contract can be entered into where parties involved promise its execution at a later time and the contract can be managed at the exchange for execution at the defined time period. This would be autonomous and lead to a world of reduced dependence on human intervention.

The smart derivatives can be executed in three modes. They are elaborated below:

1. Full Coverage

This is easy to understand. Those of us who understand escrow or L/C in case of international trade would be aware that money, in this case, can be held by a third party, a bank, until the contractual obligations are fulfilled. Once the contractual obligations are fulfilled, the escrow or L/C will release the asset (money in this case) to the party which fulfilled the obligation.

Full Coverage is a similar operation in the crypto world and Firmo is expected to be launched with this functionality. In this case, the users participating in the smart derivative will pledge assets which will be stored and upon maturity, the transaction will be completed on behalf of the one who fulfilled the obligation.

2. Variable Collateral Coverage

Here the operation is similar to the margin calls in the traditional brokerage roles. The Firmo Protocol will allow users to lock margin of the pledged asset class with another asset class of equivalent value. This feature will be made available after the launch of Firmo Protocol on testnet.

3. Zero Coverage

This is one of the innovative features of the Firmo Protocol and attempts to replicate the aspect of Trust in the real world into the crypto world. Here the users executing a smart derivate will have little or no collateral. This feature alone could be useful for a huge market base in Asia where there is anyway a lack of solid contracts in the real world and most of the work happens on trust. This feature is expected to be built by the Firmo community in the future.

And Exchanges?

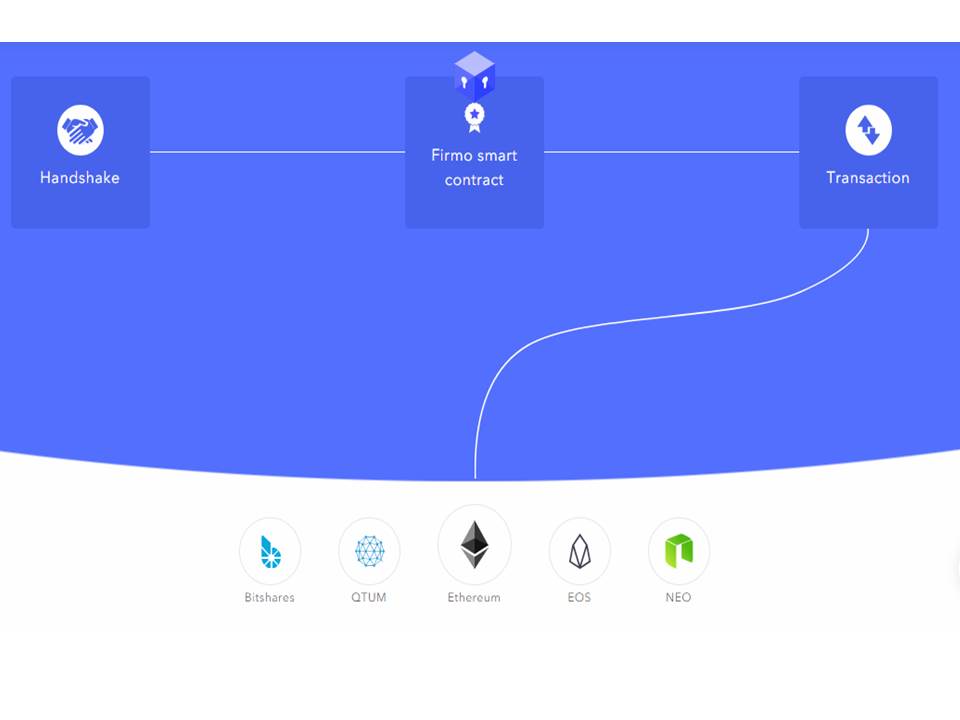

When talking about exchanges, Firmo can work with any of them but currently is working on Ethereum. As we speak, they are looking at other strategic partnerships.

Here is a pictorial representation of the how Firmo will work with third parties and exchanges:

So I need Firmo Developers? What about Security?

Much like with any development work in the real world on coding languages like Java, .net and the likes, the spend of organizations on developers is huge. If a critical platform has a high dependence on developers, market sooner or later increases the price of such developers (Demand and Supply again :)) and eventually increases the cost of management of the platform for the organization.

So, it’s not going to be any different with Firmo, right? Wrong.

While Firmo is aware of the cost of operation problem, the other known problems in building smart contract have also been noted by them. The known vulnerabilities, redundancies or errors in ‘smart contracts’ written on Solidity is also noted. Firmo, therefore, solves this by introducing FirmoLang, its own verified and domain-specific language. There are ready templates which allow users to create smart contract or users can code on their own with the available simple syntax.

And guess what? To handle hacks, Firmo offers the same level of security that planes, trains, and satellites use to operate securely. It is as if the Crypto-Age is carrying forward the learnings of the Jet-Age.

Not only that, the very use of FirmoLang is intuitive and hence heavy dependence on developers is reduced. In fact, the ready templates coupled with easy to learn syntax makes it an easy proposition for users. So good-bye to high maintenance cost.

Third and the most important point is the ability of Firmo to be versatile and work with the exchanges or products available today or expected in the future. Here again the Firmo API makes it easy to integrate and hence makes it easy to get started with all available platforms.

Bringing Certainty in times of Volatility

The core principle on which Firmo is based is quite strong and is catering to one of the most desired aspects in the crypto world. To be honest, the world has not even migrated fully to the crypto world yet and the reason for many staying out is exactly the lack of real-world dynamics. With solutions as that of Firmo, the crypto world is becoming more and more like the real world, albeit its disadvantages. The future does seem bright for a decentralized, trustless and autonomous contract execution.

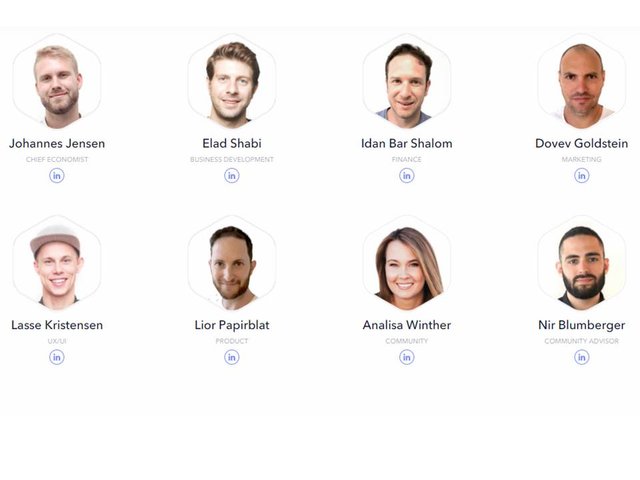

Now, a look at the team behind the concept:

It is also recommended that readers understand more about Firmo through any of the following informative resources:

This article is written in response to the originalworks’ call on authors’ thoughts on Firmo as a concept. It can be read here

Omniloquent was brought to you by @yallapapi. This article was written by @oivas and reproduced by this magazine with express permission from the author.

Are you interested in writing for us? Writers earn 40% of the SBD payout of all cryptocurrency/finance posts they submit.

Send all submissions to [email protected].

To read more about The Omniloquent Project, click here.

Or join the Discord group

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://steemit.com/blockchain/@oivas/firmo-bringing-financial-certainty-to-the-volatile-crypto-world

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit