The World Economic Forum has ranked Switzerland as #1 on its global competitiveness rankings out of 140 countries. With a blockchain startup ecosystem counting more than 430 start-ups, one of the most liberal, direct and decentralized democratic political system, a natural attitude to endorse new technology instead than protect the status quo, its famous financial privacy tradition, the lack of state control over repatriation of capital and profits and its openness to entrepreneurship — with several federal and regional incentives for new foreign investors, which are treated in the same way as local companies, but often can benefit from tax and financial incentives — Switzerland is already riding the wave of the economy of tomorrow.

Could you believe the most of the merit goes to a small and picturesque town just 25 km south of Zurich with only about 30,000 residents, once focused on heavy industry and agriculture and today impacting the FinTech world?

“Zug has long been home to citizens from around the world, with over 30 percent of its population being foreign nationals: high quality of life, openness, pro-business mindset and favorable tax structure make the city attractive to people from around the world”. Word of Oliver Bussmann, President of the Crypto Valley Association (CVA), that made the so-named “CryptoValley Zug” its own home, together with Xapo, Monetas, Ethereum, ShapeShift and much more.

Why Zug?

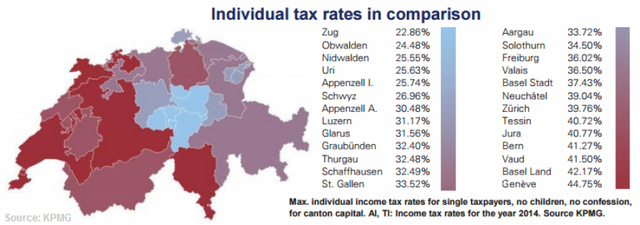

It’s breathtaking, is easy for foreigners to move to, has one of the world’s best regulations for FinTech businesses and one of the lowest tax rates in Switzerland (maximum individual income tax rates for single taxpayers in 2014 was 22.86% in Zug, 44.75% in Genève — KPMG research).

The city, which recently has even trialing a blockchain-based voting system, has established a global hub for virtual currencies, has hosted a large number of blockchain innovations and has attracted the team behind Ethereum, the leading open-source, public, blockchain-based distributed computing platform supporting the cryptocurrency (and Bitcoin Suisse helped advise the group on its ICO in 2014).

“Zug has a forward-thinking government, strong participation from regulatory bodies, a first-class FinTech ecosystem, as well as Switzerland’s tax-friendly reputation. […] as an early adopter of bitcoin, the Crypto Valley has demonstrated its commitment to the digital transformation of the city.” declared Gianluca Giancola, co-founder of Qiibee, a crypto loyalty firm offering crypto-based rewards systems, so merchants can offer consumers branded tokens instead of cash back in dollars or points, that relocated to Zug, finding it a “this-must-be-the-place” spot. Is the same for the bitcoin service provider Xapo, that after having relocated here from Silicon Valley, created a dedicated page to point out the top ten reasons why they felt FinTech startups should be moving to Switzerland.

Starting from 2014 Switzerland has started imposing negative deposit rate: instead of offering interest on deposits, now Swiss banks must charge 0.25% on sight deposits, which is the cash-like holdings of commercial banks at the European Central Bank (ECB). It cut rates to below zero in June 2014 and now it charges banks 0.3 percent to hold their cash overnight: this is a good news for the FinTech companies offering online versions of their precious metals and cash, such as bitcoin, and this is the line political will and economic wisdom seem they want to follow.

Switzerland finds itself at a crossroad when it comes to crypto: in the past, most of its banks have been refusing banking services to a growing number of startups residing in the country’s Crypto Valley and this was beginning to suffocate growth in the FinTech sector. So far, only very few legacy institutions — such as Neuchâtel Cantonal Bank and Neue Helvetische Bank, Hypothekarbank Lenzburg — have declared readiness to offer services to the 200 Zug-based blockchain and crypto firms.

According to Swissinfo, the bottleneck has become acute since the ICO craze brought $1.46 billion to Switzerland last year. A recent report by the Crypto Valley Association revealed that token sales through May this year have attracted nearly double the funds raised in 2017.

So, late in January, economy minister Johann Schneider-Ammann, who loves to refer to its country as a “Crypto Nation” and finance minister Ueli Maurer, established a working group with representatives of the Swiss Bankers Association (SBA), the financial regulator and the central bank to set up a taskforce in order to establish a set of standards for ICO startups in order to simplify the process of opening bank accounts. “Both we as an association and the banks have an interest in business relations in this growth area. Banks see the potential that the blockchain technology offers for their industry and Switzerland as a financial and technology hub,” the SBA said in a written statement quoted by Swissinfo.

Heinz Tännler, the finance director of the canton of Zug, declared to the Financial Times he expected Swiss politicians and regulators to remove the obstacles in the coming months, which would allow crypto companies based in the country to operate with banks just like any other business. “We hope to clarify relationships by the end of the year at the latest. Time is pressing — other jurisdictions such as Malta and Singapore are very active and making a lot of effort to attract these companies. The lack of access to bank services is a significant competitive disadvantage.”

Some Swiss startups, indeed, have started to open bank accounts in neighboring Liechtenstein using the services of local banks such as Frick and Alpinum. Other representatives of the industry have warned that if crypto businesses are not provided with access to banking services they may start looking for better conditions elsewhere.

Some Swiss startups, indeed, have started to open bank accounts in neighboring Liechtenstein using the services of local banks such as Frick and Alpinum. Other representatives of the industry have warned that if crypto businesses are not provided with access to banking services they may start looking for better conditions elsewhere.

“Starving startups of bank accounts is akin to killing the goose that laid the golden egg,” said blockchain and cryptocurrency expert Guido Schmitz-Krummacher, former director of the Tezos foundation and advisor to projects like Cardano. “I am already seeing projects choose Singapore, Malta and Gibraltar because they can’t get a bank account in Switzerland. They will be followed by projects already established in Switzerland unless the banks and politicians address this topic.”

The lack of access to normal banking services is worrying, also according to Alain Kunz, chief executive of Coinlab Capital, a startup offering blockchain asset management services. “You can do a lot with crypto but you can’t pay rents and salaries,” he points out.

Experts are persuaded that the voice of all those businessmen will soon be heard and crypto companies based in Switzerland will receive access to regular banking services as early as this year.

Nice step....

Love @beingindian

https://steemit.com/mgsc/@beingindian/blog-title-of-the-blog-is-it-important-c87572fa5ac29

Upvote / Follow / comment

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit