The Bitcoin Gold (BTG) blockchain recently suffered a 51% attack and it resulted in approximate $70,000 worth of BTG being double spent.

The first attack took place on 23rd Jan, 2019. 14 blocks were removed from the blockchain and then 13 were added. 1,900 BTG were double spent in this case. Again on 24th Jan, 2019, there was another attack to remove 15 blocks and add 16. 5,267 BTG were double spent in this case. Bitcoin Gold was previously 51% attacked in May, 2018 and up to $18 million worth of BTG was double-spent. Not only Bitcoin Gold, but also many other cryptocurrencies like Verge(XVG), Etherereum Classic(ETC) also suffered 51% attack earlier.

Image Source – Digitally modified by the author

What is 51% attack basically?

If an entity acquires control of over half of the mining power on any proof-of-work blockchain network, it would gain the ability to do certain things that is not normally possible and it creates security risk. Any blockchain has list of transactions or blocks and anybody can update the blockchain by adding transactions or blocks by maintaining certain rules. As a blockchain is trustless system, here the miners only update the blockchain in absence of any centralized authority. Now, when a miner entity obtains more than half of the network’s computation power, it obtains power to manipulate the blockchain also. It can block future transactions by denying to validate the transactions in new blocks or can attempt to double-spend new transactions. This is called 51% attack! The attacker generally begins to compile a private version of the blockchain and sends some coins to an exchange and cashes out. Actually the attacker never sent any coin to the exchange and no transaction happened in its private version. But the exchange sees the transaction in the public blockchain and allows the attacker to cash out. Once the attacking entity cashes out, it broadcasts the private secret version of the blockchain and claim the attack. If the attacker has high hashpower, it can hold its claim for longer time. 51% attack does not change the blockchain. It leads to double-spending only.

Can 51% attack happen to PoS blockchains?

For a proof-of-stake(PoS) blockchain, the attacker would be needing 51% of the cryptocurrency to carry out a 51% attack. The PoS avoids the tragedy of commons by making it disadvantageous for a miner with a 51% stake in a cryptocurrency to attack the network. It is really difficult and expensive to accumulate 51% circulating supply of a reputed cryptocurrency. Also it is a fact that an entity holding such huge stake of a particular asset, would not be wanting to attack that particular network. It does not make much sense!

Cheap to attack?

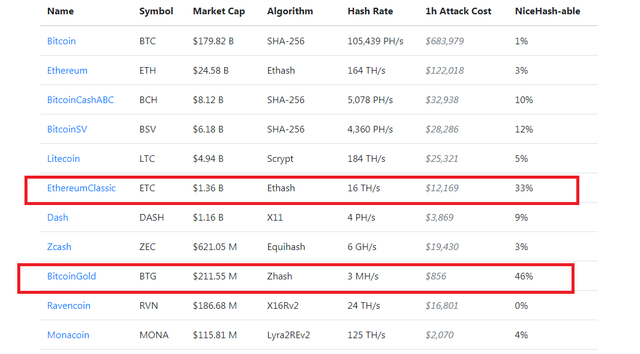

Yes, the cost of computing power to compromise a blockchain is generally high. The cloud mining site NiceHash sells CPU and GPU based hashrates. It is quite popular in the mining world. You need money to obtain high hashrate. For example, 1 hr attack on Bitcoin network will cost approximate $683,979 (1% NiceHash-able i.e NiceHash miners, who are mining Bitcoin, only capture 1% of the network). But if we look at Bitcoin Gold, 46% of the network hashrate is coming from NiceHash and cost to conduct 1 hr attack is only $856. For Ethereum Classic, 33% of the network hashrate is coming from NiceHash and cost to conduct 1 hr attack is $12,169. We get good logic why Bitcoin Gold or Ethereum Classic are favorites of the attackers. It is quite true that if there are hard forks of the original network, it becomes easy for the attackers to accumulate 51 percent of the network’s total hash rate.

Image Source 51Cryoto - PoW 51% Attack Cost

In 2018, for the first time in the world, Michigan state of US introduced a bill to criminalize data manipulation on blockchain. Blockchain technology is still at nascent stage. The technology is continuously evolving. It is need of the hour to protect the eco-system. We need to prevent data manipulation for committing fraudulent activity on blockchain. But till now, 51% attacks are successfully happening on large scale. Really! Blockchain’s biggest nightmare! Law may not be able to protect blockchain. Blockchain needs self-defence and self-reliance. In 2018, Ethereum co-founder Vitalik Buterin proposed a new Consensus Algorithm to make 51% attack obsolete. Blockchains will surely find the way to resist 51% attack in very near future.

Consider that a 51% can be do e with ...40% if the mining pools are geographically close and agree on it

Im bitcoin has never happen: it is easy to verify with some forensic

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Ok, we upvoted and reblogged your post to thousand followers.. So many thanks to approve us as your witness and curator.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It seems that scammers are everywhere my friend.

I am surprised that they have not invented blocks to these kinds of attacks.

All loopholes must be closed ASAP.

Blessings!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes. Technology growth creates more technical scams.

Posted using Partiko Android

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Totally agreed with you my friend.

Blessings!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I'm not a crypto head so had no idea about this 51% thing. Very well explained. Thanks! :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I hate it that people are able to do such things :o

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Scammers will continue to exist.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit