An Introduction to Blockchain Technology

By QBIC

Table of contents

-- Chapter One: What is it?

1.1 Objective of this Primer

1.2 What is the Block & Chain?

1.3 Public Key and Private Key

1.4 Bitcoin - The First chain

1.5 Innovative Benefits Of The Next Internet Technology.

1.51 Efficiency and Reliability

1.52 Immutability

1.53 Democratic

1.54 Borderless

-- Chapter two: What can it do?

2.1 Privacy & Security - The Secure Internet

2.2 Directories & Databases - Storing Information In A New Way

2.3 Assets & Currency - Cryptocurrencies

Altcoins Examples

2.4 Smart Contracts - Next Generation of Function

-- Chapter Three: What should I take away from this?

3.1 Where is it All Headed?

3.2 What is QBIC?

3.3 Local Blockchain Technologies

3.4 Conclusion

-- 4# - Appendix

4.1 Glossary

4.2 Technical terms

-- Chapter One: What is it?

1.1 Objective of this Primer

Blockchain technology and cryptocurrencies. Our focus here encompasses what blockchain is and what it does, while cryptocurrencies will be touched upon briefly. The extent and nature of potential repercussions associated with blockchain are still undetermined. Consequently, there exists substantial confusion regarding this technology, particularly in the media. This primer seeks to de-mystify blockchain and debunk misinformation preventing discursive clarity, while also providing an overview that is both comprehensive and accessible.

1.2 What is the Block & Chain?

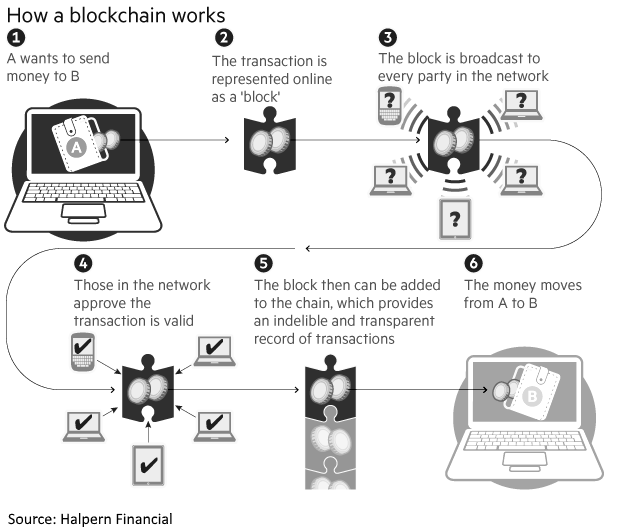

A blockchain is best understood as a continuously growing list of data-containing records, called “blocks”. These blocks are linked and secured using an encrypted method of storing and transmitting data in a particular form; only those intended can read and process the block. Each block validates and verifies the previous block, increasing the length of the chain with each validation. The security of the chain grows with each block added.

These blocks are represented in a publicly-distributed ledger supported by a peer-to-peer network. A system of consensus algorithms is then undertaken to ensure uniform replication across the computers and databases involved. Blockchain’s cryptographic, peer-to-peer nature ensures a secure, decentralized, and incorruptible system. It provides an unprecedented capacity for verification and consensus.

1.3 Public Key and Private Key - A Fundamental Concept

Understanding the encryption process of blockchain and cryptocurrency begins with an understanding of public and private key encryption. Access to the public key enables encryption but does not enable the decryption of transaction information. With a cryptocurrency such as Bitcoin, using the public key enables you to view the balance of an account or use it as a receiving address. However, access to a private key is required to use funds from that account. A private key secures the funding and prevents its unauthorized movement, in other words, a private key is required to move funds. This method of encrypted security permeates and fuels Blockchain technology.

1.4 Bitcoin - The First chain

Bitcoin is the first, the simplest, and the most recognized example of cryptocurrency. Bitcoin is an influential global, decentralized, and borderless payment method created by the anonymous entity, Satoshi Nakamoto.

To record payment transactions in bitcoin’s blockchain, you send a message created by your private key to move your bitcoin. Miners—computer users connected to the bitcoin network over the internet -- verify and confirm these transactions. Data is then placed into the next block of transactions. The new encrypted block records your transaction, i.e. that you have sent a given amount in Bitcoin. A recipient receives, and now has the sent-amount of Bitcoin stored in their account.

A primary innovation of Bitcoin, as well as the source of its decentralized nature, is the use of miners. Miners are paid a small amount of bitcoin for each block they confirm and add to the network. As a result of the immense computational power required for mining, Bitcoin’s network, likewise, requires massive amounts of power. With each confirmation of increasingly complex encrypted transactions, miners require more electricity and computational power at their disposal. The more a Bitcoin is worth, the more individuals are willing to mine for them. Power usage is thereby connected to Bitcoin price. These factors all converge, generating a system based on keys and encryption. This system can be anonymous or identifiable while being run by a peer to peer network sans third parties. In place of the regulatory structure imposed by banks and other third parties, Bitcoin utilizes an agreement computer code.

Innovative Benefits Of The Next Internet Technology

1.51 Efficiency and Reliability

Blockchain has the potential to make financial transactions and the exchange of information more efficient, reliable, private and secure. Prior to blockchain, moving money or assets was only possible through a centralized body. For example, if I wanted to send money from Person A to Person B, my options would be through a bank, credit card, Paypal etc. These centralized bodies have drawbacks, because they are often inefficient, exclude parties, and entail exorbitant transaction fees.

For families who wish to send money to relatives in another country, transactions may take days to confirm, while an average fee of 9% significantly reduces the final amount received. However, Blockchain eliminates the requirement of a bank, confirms payment much quicker, and with significantly lower fees.

Blockchain’s automated-trust mechanism enables this, alleviating the necessity of an intermediary. Instead, coding and cryptography perform the traditional functions of a bank, which ensures a successful transaction between two parties. Banks can no longer monopolize the movement of currency, nor are there restrictions of movement based on accepted geographical borders. Many blockchain-encrypted currencies are already faster, and more reliable than the banking system, particularly when moving money internationally.

1.52 Immutability

Blockchains encryption method (section 4.2.8), is a function that converts an input of letters and numbers into an encrypted output of a fixed length, creates an unalterable ledger that allows anyone to see the entire history of all transactions. Therefore, it is impossible to forge transactions, exploit, or manipulate the system, which would require either hacking, or owning 51% or more of the global hashing power for that blockchain. A hacker would have to take control of 51% of the millions of computers on the blockchain network. A task that is unfeasible due to the time commitment and economic resources required.

1.53 Democratic

If 51% of the system agrees on a ledger, that agreement is the ledger—making Blockchain a functioning democracy of sorts. Blockchain is consensus building on a massive scale, which is suitable given that the technology is built around consensus algorithms. A lack of central authority means that there is no single source of corruption or control in the system. Across some applications of blockchain, such as the original form of Bitcoin, any change in the underlying code required complete consensus from 51% of investors. This is similar to how firms require the consensus from a board of directors before changes are made.

In the case of Bitcoin, there was no consensus among investors over proposed changes, consequently, a portion of Bitcoin separated and formed another cryptocurrency, Bitcoin Cash. Ultimately, it is crucial to understand that no one individual regulates a blockchain, the system is run by an entire network, operating on a vast network of computers.

1.54 Borderless

An advantage of blockchain is its capacity to transcend borders. The blockchain is only limited by the reach of the internet, which could usher in a global market with no obstacles to participation. This increases the potential for growth and diversification in our economy. Since these transactions are digitally-based and borderless, individuals and companies are able to reach the entire global market. It has also become common for people to seek funding on the chain rather than the stock market for their start-up company cash. By engaging in Initial Coin Offerings (ICO’s), as opposed to stock offerings, companies are able to raise funds in unprecedented ways. Blockchain technology often operates without government oversights due to its borderless nature as well. Limited government intervention has several benefits, including enhanced efficiency due to less bureaucratic red tape. The negatives such as scams, economic volatility and power consumption of older poof of work systems are real.

-- Chapter two: What can it do?

To ascertain blockchain's applicability to an industry, technology, or problem, etc. knowledge of four applications is necessary. SmartContracts, DataBases, Assets/Currency and Security.

2.1 Privacy & Security - The Secure Internet

Privacy and security have been difficult to maintain on the internet. However, one’s online-identity and information can be stored on the blockchain at a public address, secured by your own private key or password. Blockchain is a technology that will allow citizens to take control of and protect their data, potentially ending the corporate practice of accumulating and selling customer information.

Examples: Recent security breaches such as the Equifax hack, where millions of identities and financial data files were stolen. Spam control, where someone's email could be linked to multiple public keys. They would know who shared your email and remove mailing consent instantly. The same premise could be used in sharing and owning games, movie, music, even patents, any kind of intellectual ownership.

Blockchain offers a viable method to store and protect data. Cyber attacks would face monumental barriers as databases and critical information could be encrypted and distributed using blockchain technology. This is the fundamental promise of all blockchain technology - a secure internet.

2.2 Directories & Databases - Storing Information In A New Way

Blockchain is essentially a database. The nature of the technology ensures safe and private storing of data, which has many benefits. One example is personal medical records. Imagine if the same medical record was shared with multiple hospitals. These records couldn’t be decrypted without the agreement of the hospitals. Your personal data is kept safe and private. Now imagine each part of the record is encrypted differently. Hospital researchers are able to search for a record of people contracting a spreading from illness. They can check one part of the hospital, with no personal information included. There is already a start-up planning to do the same with DNA records. Governments are also experimenting with titles, deeds, citizenship, passports, employment, and tax record. This is not an exhaustive list. Any important database can make use of the reliable, secure, and decentralized capacity of blockchain.

It is important to note that blockchains are great for managing small and important database information. However, for large files storage, modern blockchains are far too inefficient for managing massive amounts of data. New upcoming concepts like the interplanetary file storage - IPFS are being integrated to solve this problem.

2.3 Assets & Currency - Cryptocurrencies

More can, has been, and will be written on this aspect of blockchain than this primer could ever cover. Currencies connect needs with supply. It could be said, “blockchain brings consumer and producer closer together”. It does this in a way older currency systems could not.

Imagine an aspiring musician could trade their music for cash, and you the supporter gets a token. Soon, the musician takes off, and the only way to their concert is with the tokens you have. You can sell them, trade them, attend or even hold. You have the choice, in a simpler, safer, and more transferable way than ever before. Many see this as the beginning of a new decentralized sharing economy. In mid-2017 over a thousand cryptocurrencies were in circulation. The industry is bloated with hundreds of “Initial coin offerings” (ICO’s). Blockchain has revolutionized crowdfunding creating a new and yet unstabilized monetary system. It's called “The Token Economy”

This monetary system contains all of blockchain's previously listed advantages. It is mostly out of government control. Most investors are either throwing in any funds they can find, or terrified of this new economic system. Only time will tell when and how these systems will enter our everyday financial lives.

Altcoins Examples

Ripple - Designed for big banks, to be their new payment and settlement network.

Bitcoin Cash - Bitcoin fork with more developer support, allows for larger file-size blocks, and the possibility of smart contracts.

Dash - Short for digital cash, a decentralized autonomous organization (DAO) with a focus on privacy, scalability and instant transaction confirmations.

Monero and Zcash - More anonymous and private cryptocurrency.

Tether - A cryptocurrency exchangeable for one U.S. dollar. Its value is always nearly exactly one U.S. dollar, yet has the advantages of trading as a cryptocurrency.

IOTA - Not supported via blockchain, uses an alternative structure called the DAG/tangle. Look for it in the future.

2.4 Smart Contracts - Next Generation of Function

So we now have a secure database system; one that can revolutionize multiple internet industries, and our financial world. Now imagine that this database could execute programs like a computer. These automated operations are called smart contracts. They use information like a secure digital identity, other forms of information, currency, or almost always work without human intervention. Major examples of the smart contract platforms Ethereum, Neo, and Cardano, The limits of this technology are just being touched on now.

DApps (Decentralized Applications) Applications built to run on a blockchain network, leveraging its advantages. Paying for the smartcontracts execution with cryptocurrency as the cost of running or using these apps on the network.

ICO (Initial Coin Offering) Most modern ICO’s are actually on a smart contract platform You can buy and sell with the already existing platform. This way, not every new ICO has to set up its own blockchain system. They just pick a smart contract platform instead. Very little set-up, yet all the blockchain advantages retained. Transactions are paid by paying for a smart contract.

DAO (Decentralized Autonomous Organization) — an organizational structure that is run using smart contract code, assigning voting rights to members via cryptocurrency/token ownership system.

Many theorize financial derivatives, the conditional sale of patents and information, land deeds and titles; even democratic and institutional structures will make use this technology. The Canadian national research council is already experimenting with the use of ethereum to control costs and spending. Another example E-Estonia, a project to digitize an entire nation, could be put down as a use can in itself. It has Blockchain based voting, citizenships right/status and is taking this technology as far as it can

Concluding this chapter we hope the reader is now more awake to the diversity of blockchain's potential applications. We hope the reader see it as a dynamic and technological tool; one, which gives us chance to better organize the world's data, finances, and institutions.

-- Chapter Three: What should I take away from this?

3.1 Where is it All Headed?

Skepticism of Bitcoin and other cryptocurrencies can be overblown. Furthermore, skepticism of Bitcoin does not justify skepticism towards blockchain as a technology. Blockchain isn’t simply Bitcoin, it also powers Ethereum, Ripple, a myriad of startups, and applications used in everyday life. Major companies such as HP, Intel, IBM, Microsoft, Google, Goldman Sachs, J.P. Morgan, and Canada’s five biggest banks are all investing heavily in this technology and its ideas. They are using their money, time, and effort for good reason. We are not trying to hype blockchain beyond measure. It only needs to be understood: like the internet, and other revolutionary technological innovations before it, Blockchain is here, and here to stay. The Ideas and concepts underlying it are changing our world. Right now and into the future.

3.2 What is QBIC?

The Queen’s Blockchain Innovation Community was founded in the fall of 2017 and consists of students across various faculties, including economics, philosophy, and computer engineering. Our purpose is to discuss topics and ideas central to blockchain. We also promote user adoption, research, and reporting on blockchain here at Queen’s University. QBIC seeks to advocate and foster awareness of the importance of blockchain through organizing non-profit seminars, and linking student and associated talent with private partners. This non-profit group and its projects are sustained solely by the passion and curiosity of a volunteer collective. If you are as passionate about the possibilities of blockchain technology as we are and would like to get involved, or you have any questions please reach out so that we can work with each other in a collaborative capacity. We are always willing to provide a PDF copy of this article.

www.qbic.tech

3.3 Local Blockchain Technologies

BitSwift is an Internet technology company specializing in Blockchain technical support and consulting. Bitswift offers expertise on blockchain-based currency, inventory management, and security systems. The company essentially advocates for the use of cryptocurrency in everyday trade. They have a passion for helping small business make sense of cryptocurrencies and more.

Sparc is an emerging player that understands the supply-and-demand problem. Most of the world’s computing power is uncultivated. Sparc has created a system based on existing technology to utilize untapped computer power. It can run on almost any modern machine. You rent out your computer and get paid in sparc tokens (cryptocurrency). Billions of computers around the world sit idle. All the while everyone from gamers to researchers are building bigger and more powerful machines to run their systems. Sparc intends to bridge these two areas.

3.4 Conclusion

Blockchain is a world changing, adaptive, and secure internet database technology, consisting of local and global players. Its power is not linked to a single application, but a family of ideas and uses. The technology will strengthen the consumer-producer relationship by rendering intermediaries obsolete, as well as simplify transactions and trade. Blockchain redefines ownership, agreements, and contracting. Like all new technologies, blockchain is disruptive. Expect institutions to appear, disappear and change because of it.

In the city of Kingston, Ontario, which is home to two emerging blockchain-related companies, BitSwift and Sparc, as well as a population of 150,000, blockchain has a real presence. It may not be a part of your everyday life just yet, but blockchain is growing here and all over the world. You will see it more and more. Blockchain has the potential to create a better future for everyone, we hope you will join us in helping create this future. QBIC is currently working on a primer on a future decentralized society. It will touch Direct/liquid Democracy influenced by the concept of the DOA and Blockchain on the Developing World. If interest continues we will post it here and take community input.

Sincerely,

QBIC

V 1.1 Lead by James Hazlett & co-authored by Josh Malm, Oliver Philpott, Michael Krakovsky, Zachary Spencer, Nickolas Chan and Kris Jones.

4# - Appendix

4.1 Glossary

4.1.1 Blocks

Data-containing records, linked and secured using an encrypted method of storing and transmitting data in a particular form so that only those for whom it is intended can read and process it.

4.1.2 Public Key

Access to the public key enables encryption, but does not enable the decryption of transaction information.

4.1.3 Private Key

A private key secures the funding and prevents its unauthorized movement, in other words, a private key is required to move funds.

4.1.4 Encryption

The process of encoding a message or information in such a way that only authorized parties can access it and those who are not authorized cannot.

4.1.5 Ledger

Collection of an entire group of similar accounts in double-entry bookkeeping. Also called book of final entry, a ledger records classified and summarized financial information from journals (the 'books of first entry') as debits and credits, and shows their current balances.

4.1.6 Initial Coin Offerings

An ICO is a fundraising tool that trades for a new emerging crypto in exchange for crypto of immediate, liquid value.

4.1.7 Crypto

Short for cryptocurrency.

4.2 Technical terms

4.2.1 Block Height

Block Height alludes to the number of Blocks connected in a Blockchain. For example, a Block Height of 0 would be the first block (also known as the genesis block) in a blockchain.

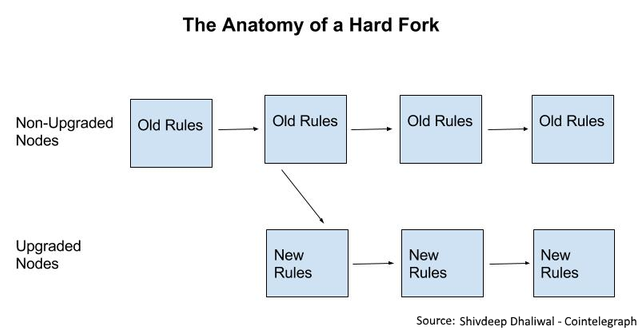

4.2.2 Hark Fork

A hard fork, or forking, is a type of blockchain evolution. There are 3 main types of forking protocols. The first occurs when two miners mine two different blocks at the same time, temporarily splitting the blockchain into 2 different versions called “Orphan blocks". This type of forking is quickly rectified and is a natural part of the blockchain.

The second type of forking occurs miners do not simultaneously update as the system does, resulting in two chains at a “fork”. The third occurs when a disagreement among developers about the progress of the blockchain results in a separation, and creation of 2 distinct blockchains. Examples are Ethereum Classic and Ethereum, and the many bitcoin forks (e.g. Bitcoin Cash, Bitcoin Gold, and Bitcoin Diamond).

4.2.3 Mining

Creating a new block requires running, and validating, a block through a HASH. This is a computer-intensive process. For your work, you accept a cryptocurrency reward. Mining is one of the biggest innovations of Bitcoin, as it rewards the decentralized system. Few cryptocurrencies function without miners and they almost all have a governing authority of some kind (e.g. IOTA, Ripple).

4.2.4 Confirmation

Bitcoin blocks are made every ten minutes. This means you need to wait ten minutes for anything to go through. On some exchanges, multiple block confirmations are required prior to the confirmation of a transaction.

4.2.5 Proof of Work (PoW)

Cryptocurrency blocks must be hashed. An added variable, timestamping blocks, and transactions all must be validated. Since Hashing is difficult and takes considerable computational power, a hashing a block is considered proof of work.

4.2.6 Proof of Stake (PoS)

Proof of stake is an alternative way to determine consensus similar to proof of work (PoW). The process in PoS is called forging or minting instead of mining. While there is still decentralized power to confirm transactions, the “minter” that adds each block is chosen as a result of holding their stake (possession of currency or a token). The minters still process the changes and retain transaction fees, however there is typically no block reward in a PoS system. The main goal of proof of stake is to improve the efficiency of blockchains. There are several examples currently in use, such as NEO, Decred, PIVX.

4.2.7 Application Specific Integrated Circuit (ASIC)

Otherwise known as Application Specific Integrated Circuits. These are computer chips

designed to accomplish a single task, namely mining cryptocurrencies. Bitcoin miner, Bitmain has a plethora of these chips, entitling them to over 25% of the computational power on the Blockchain. Since Bitcoin employs consensus algorithms, this single mining company’s vote is worth 25%, in terms of determining the future of bitcoin.

4.2.8 Hash

The Hash is a generic term referring to a wide array of cryptographic algorithms. Usually, they turn an input, a string of letters, into an output. With Bitcoin, every ten minutes a letter is added to this sequence, making a new output for that block and time stamping that block. The next block begins with a reference to the previous hash. This way every hash is linked, timestamped and validated by the previous block in the chain. To break any new block by adding fake transaction, you need to break every previous block at once. Bitcoin uses Secure Hashing Algorithm (SHA) 256. Right now you cannot break SHA-256. it has“1157920892373161954235709850086879078532699846656405640394575840079131296396” Combinations. Checking each one is impossible.

- Quantum computer will likely lead to massive changes in how hashes work. They can crack SHA 256. Even though they are not here yet, many current generation blockchains are already being built and released with quantum resistant ledgers.

Hey @qbic, the markets are pretty crazy right now. Crypto is back to a weird space but I know long term it's still what we're all hoping it will be! Cheers

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

✅ @qbic, I gave you an upvote on your first post! Please give me a follow and I will give you a follow in return!

Please also take a moment to read this post regarding bad behavior on Steemit.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great work putting this together and publishing here 😁

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit