Don't have more than 25% of your entire investment portfolio in CryptoCurrencies, and only invest what you can afford to have locked in for the long term.

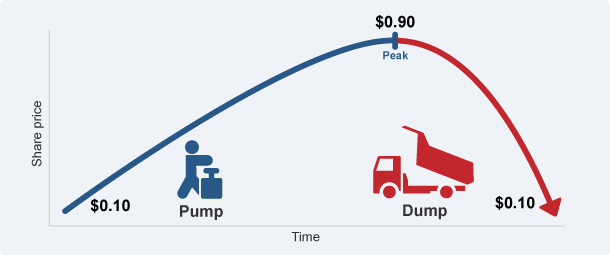

Don't chase a pump

Never buy on rapid upswing on the candlestick chart if you're not sure why it happened and can't figure it out. The reason is likely that it is a P&d. P&D is "Pump and dump" and it refers to a trading scam where people organize to coordinate the laddered purchase of an asset, then wait for others to come in at some delay and further increase the price before coordinating the unloading of their position once a specific price target is reached. This is illegal in the stock markets, but since Crypto markets are unregulated such schemes are rampant. There are many P&D groups and today they are largely organized on Discord channels. They are now structured into tiers where the top tiers get a signal earlier than the bottom tiers and usually by the time the bottom tiers get the signal its too late, so unless you pay money to part of the top tier or have a connection with the admins its not even profitable. They are bad for the market as a whole and they prey on those who are looking for short term moons to latch onto. Don't look for things that you think will moon today, look for investments.

HODL'ing will give you more returns over a year than day trading.

You will find that most people who made six figures or more in the Crypto coins market, by holding over the long term, very few get rich by day trading. That said you should definitely learn a few indicators to see if you're getting in at a reasonable entry point. I find that the MACD (moving average convergence divergence), RSI (relative strength index), market depth and support-resistance lines are the most useful indicators.

MACD is useful for looking at where the long term price should be in divergence to the short term movement.

RSI gives you an 0-1 rating of how overbought/oversold it is and support-resistance lines gives you a floor and ceiling for how high it will move in your buying period.

If you do short term trading, do it when you have high certainty that a specific news will lead to an increase. Some of these specific events are: upcoming roadmap releases, airdrops, forks, additions to new exchanges and partnerships.

DYOR - Take your time and research what you are putting your money into.

I cannot stress this enough, you are buying an asset with your hard earned money, and it should have some utility. Start by reading the whitepaper that is on the main site for the coin. You can avoid a lot of scams by simply critically evaluating the question: "Why does this coin exist?" Is it simply trying to apply a Blockchain to something that doesn't need it or is there a transactional inefficiency/problem that the unique properties of the Blockchain can solve? For example, the Blockchain is immutable so the use case of tracking designer luxury goods across a supply chain and guaranteeing authenticity of a item makes sense. On the other hand trying to push the Blockchain transactions into dentistry makes little sense. Designer good companies have a problem with counterfeit goods entering the supply chain and need some solution, dentists don't have a problem with charging people on their VISA for fixing cavities. Ask yourself what value the actual token would have in the ecosystem its part of. Does it pay out some kind of dividend like some coins, or is its value in that its used as part of transaction fees and is thus being burned? You can make a simple checklist for every coin/token and just answer these questions for each project you look at:

• What is the problem or transactional inefficiency the coin is trying to solve?

• What is the Dev Team like? What is their track record? How are they funded, organized?

• Who is their competition and how big is the market they're targeting? What is the roadmap they created?

• How will they attract their target market, how is their marketing?

• How does the coin derive its value? Is there some sort of dividend structure, profit sharing plan, or is it a store of value within a digital economy? What is the float schedule like going forward (ie. how many coins will be released or burned)?

Learn to recognize FOMO when it arises within you

If you ever feel this itch to get in on an rapid upswing because you don't want to miss out on some new development that is causing it, stop yourself from knee jerk reacting to this feeling. This is called FOMO: "Fear of missing out" and its what drives the market now. It happens to everyone and it leads to emotional investing and knee jerk buying/selling.Recognize that lots of people actually are also losing money.

Accept that you will miss out on a lot of moon missions, and that's perfectly okay

Understand the float.

Look at the float distribution and who owns what supply of the coin. You can avoid most scam coins by simply considering how much of the supply the owner assigned to themselves and organizations they control. A lot of coins have no purpose other than giving a substantial portion to the owner, who then hypes the coin all over social media and unloads his stake for real money.Think of not only individual position, but how they fit in your portfolio and your diversification

Its good to diversify across different opportunities, but too much diversification is just saying you don't feel confident about your positions and are just casting a wide net hoping to hook something. Generally 6-12 positions is the ideal diversification spread in my opinion. It gives you a good spread across sectors, doesn't spread you too thin and any more than that is too much to keep track of.

I like to think of the portfolio in terms of these segments:

Core holdings - BTC, Ethereum, LTC...etc

Privacy coins - Monero, Zcash, PivX..etc

Finance/Bank settlement coins - Ripple, Stellar...etc

Enterprise Blockchain solutions -VeChain, Walton, Libra...etc

Promising/Innovative Tech coins - Raiblocks, IOTA, Cardano...etc

Speculative/Moon shots - BountyX, FUN...etc

Your risk tolerance should dictate how much you allocate

between your Core holdings (which are generally considered more "safe" since Bitcoin and Ethereum will be around for a long time) and the various segments. I personally am okay with a 30% core holdings, 70% across various other segments. However 60/40 splits between core and other segments is probably a good starting point for most newbies.

Look for red flags and recognize that 90% of these coins have a net present value of zero.

Look at every new coin you evaluate with a skeptical eye, because now there is way too much hype for vaporware and coins that have no use case and are just yet more ERC20 (Ethereum-based) get rich quick scams by the founders. For a lot of these coins there is a lot of shilling that tries to pray on your emotions. Recognize red flags:

Massive portions of the float are assigned to the founders of the coin. Anonymous teams or members with a sketchy pasts are also a huge red flag.

Use case does not require or benefit from a Blockchain

Empty Github repositories, or there being scant useless code

Vague whitepapers and websites filled with technobabble that sounds impressive to people who don't know tech.

No clear or well developed roadmap

A team that focuses almost entirely on shilling rather development.Try to not check your portfolio more than once a day.

Congratulations @rodik! You have received a personal award!

Click on the badge to view your Board of Honor.

Do not miss the last post from @steemitboard:

SteemitBoard World Cup Contest - France vs Croatia

Participate in the SteemitBoard World Cup Contest!

Collect World Cup badges and win free SBD

Support the Gold Sponsors of the contest: @good-karma and @lukestokes

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit