21st Century CHINA Embraces Leadership Role

Have you noticed how often A.I. (along with Brain chips and other digital-dna-human augmentations) is mentioned in the mass media and corporate sponsored entertainment?

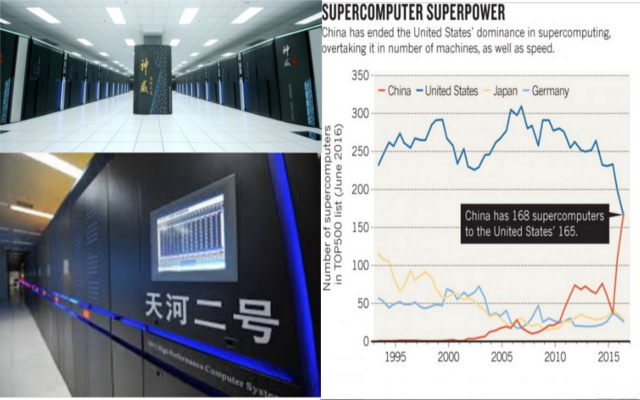

You should note that top500.org reported:

November 2016

The 48th edition of the TOP500 list saw China and United States pacing each other for supercomputing supremacy. Both nations now claim 171 systems apiece in the latest rankings, accounting for two-thirds of the list. However, China has maintained its dominance at the top of the list with the same number 1 and 2 systems from six months ago: Sunway TaihuLight, at 93 petaflops, and Tianhe-2, at 34 petaflops. This latest edition of the TOP500 was announced Monday, November 14, at the SC16 conference in Salt Lake City, Utah.

After US and China, Germany claims the most systems with 32, followed by Japan with 27, France with 20, and the UK with 17. A year ago the US was the clear leader with 200 systems, while China had 108, Japan had 37, Germany had 33, and both France and the UK had 18.

View the complete list.

...

If I 'believed' in coincidences I would say, "Gee, what an amazing coincidence that China has supercomputers devoted to the blockchain's asset digitization and tokens!"

CHINA & IMF Are Implementing The Upgraded Version of the International Monetary System (IMS)

This isn't CHINA vs U.S. - This is a more resilient worldwide monetary system to control everything!

The Brain is the IMS trying to take over the world.

- China has a leadership stake in several influential international consortiums (U.N., IMF, G20, BRICS, SCO, APEC, Pacific Asian Group, et al.)...

- Created Asian Development Bank (AIIB)...

- Modernized Military (Air, Land and Sea)...

- RMB was accepted into the SDR (central banks' reserve currencies)...

- Implemented Credit Rating Agency & international Financial Transaction ("CIPS" a SWIFT Clone for international funds transfer, making worldwide funds available in a more reliable redundant system)...

- BRICS committed to internet nodes, again complementing the WESTERN dominant and reliant system ...

- Amassed great gold bullion reserve...

- Created the Shanghai Gold Exchange (SGE)...

- Began experimental use of RMB/SDR bonds...

- A leader in blockchain tech (and BITCOIN)...

- Funding a massive central bank funded international economic Silk Road Development Project that has Asia Pacific, Eastern Europe, Middle East, and parts of Africa involved...

The economic zone model is engineered, and we see it deployed or in the early stages of being deployed worldwide. The zone model was used for the European (EU, aka Eurozone) economic bloc.

We see its likeness in the UNASUR, NAFTA, ASEAN Economic Community (AEC), and elsewhere. ~Ronmamita

I research and blog these deceptive institutional schemes as part of amplifying awareness.

The comments below will include video sources and their expression of these big changes most citizens are unaware of.

If you find this information useful or of value then please share it with others.

Re-steemit forward. Re-steemit so others can see this too.

If you like this post, do not forget to  upvote or follow me and resteem

upvote or follow me and resteem

Blockchain tech can be used for Right or Wrong

Which is why we need to Amplify Awareness to reach enough individuals who know Right from Wrong

The IMS on the blockchain would usher in the next century of enslavement and that is doing what is wrong.

Title: Mike Maloney On Bitcoin & Blockchain Technology. Cryptocurrency Future?

Video posted 27 Dec 2016 by GoldSilver (w/ Mike Maloney)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Society for Worldwide Interbank Financial Telecommunication ("SWIFT")

Below is the quote from Feb 28, 2017 by Martin Armstrong:

-End Quote-

We Can See The Changes Being Implemented

And we note the LOUD silence from mass media headlining everything except the new version (reset) for the international monetary system (IMS).

Change your U.S.Dollars into something tangible (unless you are a speculator). @ronmamita

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Blockchain Tech is the world's savior?

Distributed Ledger worldwide internet-connected has some advancements for the legacy slave system too.

Thus it is a great challenge to use blockchain tech for decentralized, free source, free markets, competing currencies to defeat the evil empire.

Title: Understanding Blockchain technology

Video posted 08 Jul 2016 by Opus Consulting Solutions

The Money Masters Want Total World Domination

Just Like The Brain:

Title: Pinky and the Brain - Intro Theme (closed captions)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

UPVOTED. very good. I would be happy if you like to follow me and give your opinion about my posts. Thanks

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit