Financial institutions can’t linger in their experimentation with blockchain technology — they need to move aggressively or be left behind by the rapid pace of innovation, according to our study.

Financial services organizations are among the earliest adopters of blockchain technology. Many firms, however, remain content with learning about the technology and testing proofs of concept internally until the future direction comes into focus.

Waiting for clarity, though, is not a viable option, according to our global survey of 1,520 executives from 578 financial services firms, which focused on how financial services firms see blockchain impacting their industry and the steps they are taking to prepare.

To ensure they are not left behind, firms must move quickly to determine how to apply blockchain thinking and technology, build the required capabilities into their business processes and infrastructure, and become comfortable with collaborating on projects with external partners, customers and even competitors on emerging third-party ecosystems.

Key insights from our study include:

1.Blockchain is a financial services game-changer.

Blockchain can dramatically boost efficiency and reduce costs in a wide variety of areas, including trade settlement, trade finance, KYC/identity management initiatives and collateral management.

More importantly, however, blockchain will open new markets and spur additional competition from nontraditional players in existing markets. For example, by applying blockchain technology to a KYC solution, banks can more easily share credentials and turn a portion of the business that has historically been a cost center into a profit center.

In our study, 91% of survey respondents said blockchain will be either critical or important to their firm’s future, while nearly half said it will fundamentally transform the industry. Most respondents said their firm is looking to gain competitive advantage through blockchain, and roughly three-quarters predicted that revenues will grow by more than 5% from its adoption.

- Clarity won’t come easily.

Only 48% of respondents said their firm has developed a blockchain strategy. A top barrier to adoption is defining use cases, according to 53% of respondents. Another is evaluating cost benefits of use cases, cited by half of the study respondents.

It’s best to see blockchain as a strategic imperative rather than a cost-benefit equation. Firms may not be able to precisely determine the benefits of a project at the outset because many outcomes will emerge over the long term and be strategic in nature. However, they should work to specify the objectives they want to achieve so they can judge success.

3.Waiting is not an option.

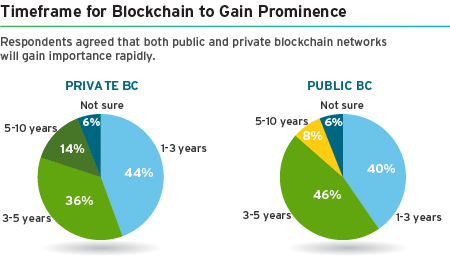

Respondents agreed that both public and private blockchain networks will gain importance rapidly, with 86% indicating that public (i.e., permissionless) blockchains will gain prominence within the next five years, and 80% saying the same about private (i.e. permissioned) blockchains (see figure below).

Moving too slowly introduces the risk of being usurped by technology providers offering financial utility models. Roughly two-thirds of respondents are concerned that the disintermediation facilitated by blockchain will have either a significant or moderate adverse impact on their firm.

Platform selection is a vital success factor.

With a wide variety of blockchain platforms on the market, firms need to carefully choose the appropriate technology for each business case. To avoid becoming locked into a proprietary technology, firms should consider the increasingly popular open source blockchain networks, while remaining alert to additional tactics that limit the ability to switch networks, such as the need for proprietary services or hidden infrastructure costs that only become apparent over time.

Firms are well-advised to gain experience with a variety of networks, including those such as R3 that are distributed ledger technology platforms built through industry-wide collaboration, as well as those that are broader ecosystem initiatives, such as Ethereum and four different Hyperledger frameworks.Concerns loom over privacy/security and scalability.

The biggest external obstacles to blockchain adoption, according to respondents, are privacy/security and scalability/latency (each named by 69% of respondents).

Despite the security concerns, blockchain networks actually provide much greater security than traditional approaches since their design prevents data from being tampered with or changed, and these decentralized networks lack a single point of failure. We expect executives to recognize the greater security of blockchain networks as they gain more experience with the technology.

Scalability and processing speeds are an issue for business applications that have large transaction volumes or cannot tolerate delays, such as in capital markets. Firms should keep abreast of the fast-developing innovations in these areas to ensure they are designing a solution that can remain competitive with blockchain’s first-movers.Blockchain requires a culture of collaboration.

The greatest benefits will accrue for firms that participate in networks of partners, customers and competitors. This will be a new experience for many firms; 56% of respondents cite working with ecosystem members as a principal obstacle to adoption.

Firms need to develop a “network-first” mindset and embrace the idea that it can be more important to grow the size of the market than just their own slice of the pie. To spur this shift, organizations should consider the ability to collaborate successfully when evaluating blockchain proofs of concept.

7.It’s OK in the short term to just modify, not overhaul, business processes and technology systems.

Financial services firms realize pursuing blockchain use cases will require changes to the associated business processes and technology systems. Fifty-eight percent of executives said they believe blockchain will significantly impact their firm’s operating models, including business processes and technology systems.

But in the near term, most firms are assessing how to modify their existing processes and systems to support blockchain. For example, 48% of respondents believe blockchain will add to their current operating models without drastically changing them. Similarly, 41% of respondents said their firm plans to replace some parts of the legacy system to enable blockchain adoption, and 23% said they were looking for a hybrid solution that retains the legacy system as-is. Firms that integrate blockchain with existing processes and systems will be able to quickly implement new blockchain solutions.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.cognizant.com/whitepapers/financial-services-building-blockchain-one-block-at-a-time-codex2742.pdf

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit