Website Explorer Explorer 2 Litepaper Twitter Reddit Telegram Medium Coinmarketcap

Some people in the world trade goods based on Blockchain technology in exchange for services. Along with the development of mankind, money has become increasingly important. People created money to make trading and exchange easier. Currency also requires someone to control its use and production. A group of financial companies was formed with the aim of arranging and arranging available currency offers for circulation.

With the increasing importance of blockchain technology, the power of exchange services has also increased. The developing project is also starting to develop. At the same time, most of the developers are using various advanced technologies to interact more quickly. Therefore, creating a turning point for this industry is very important. That's why the project team created the RISE Protocol, an integrated asset restoration with the only ability to immobilize any asset or combination of assets.

What is Rise Protocol ?

Rise Protocol is a decentralized synthetic rebase asset with built-in advanced financial tools that allow it to function as a hedge against any crypto asset class. The starting stake for Ethereum (ETH) was chosen because of its basic importance in DeFi as a whole. This peg is also easy to digest, because investors have to buy RISE using ETH.

The Rise Protocol is the world’s most advanced elastic supply device. it is initially pegged to 0.01 ETH, but with the ability through governance to adapt and dynamically be pegged to any asset class depending on investors and market sentiment. This level of adaptability is unique in today’s competitive crypto environment.

The Rise Protocol manages price volatility through elastic supply, deflationary mechanisms, frictionless yields and industry-leading governance. This combination of technology and human contribution enabled Bangkit to grow rapidly, but not exceeding demand or supply. So, the token symbol is named – RISE.

Token adjustments occur every day. If the Rise price is above the stake, then because of the price elasticity, a rebase occurs, meaning that the holder will automatically receive more tokens in their wallet. If the price rises 5% below the benchmark for 3 consecutive days, the bid adjustment will be made. This reduces the number of tokens in your wallet, but increases their value. Your total wallet value will be the same after an inventory adjustment. A strong deflation mechanism is in place to maintain the Upside value pegged with the introduction of the Supermassive Black Hole. It is a viewable burn address that increases in size over time through a special burn of each transaction and results without a hitch. Supermassive black holes also scale with rebase. 1% of every sale goes to the Supermassive Black Hole. As the Hole gets bigger, the deflationary effect also gets bigger, creating a feedback loop that exponentially scales the deflationary effect over time. Just by owning a Rise token, you will receive a gift directly to your wallet. Easy, frictionless yield aggregation automatically sends a percentage of each transaction to all Rise holders. No fuel is used, and your wallet balance will increase automatically after each transaction. Automatic distribution of prizes for liquidity providers. A percentage of each sale will be sent to the contract, and automatically distributed to all liquidity providers. No need to stake your LP token. Just hold the Uniswap LP token in your wallet to receive the prize. Automatic distribution will be triggered once the contract gets 100 tokens Up. This distribution will be tagged to the next transaction. The sender of this transaction will automatically be over-compensated in the Up token for additional gas costs.

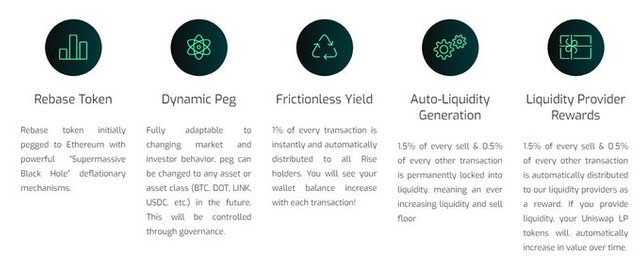

KEY FEATURES of Rise Protocol

Token Rebase

If the RISE price is above the benchmark price, the supply of RISE will increase and everyone will automatically receive additional RISE tokens into their wallet. If the RISE price is 5% below the stake price for 3 consecutive days, the supply of RISE will decrease.Dynamic pegs

Initially pegged to 0.01 ETH, RISE has the revolutionary ability to peg an asset, asset class or a calculated metric in the future based on investor / market sentiment.Frictionless results

A portion of each transaction is distributed directly to all holders.Automatic liquidity generation

A portion of each transaction is permanently locked in liquidity.Automatic distribution of liquidity provider rewards

A portion of each transaction is automatically distributed to the liquidity providers.Supermassive Black Hole

The publicly visible combustion address that generates RISE via multiple mechanisms, scales exponentially over time to provide a particularly strong deflationary effect.Sustainable, Adaptable, Fair and Safe

these are the four principles established by the Rise Protocol. Every aspect of tokens, presales, smart contracts, etc. Created with these core values in mind.

Many other DeFi projects sacrifice one or more of these values, which creates scenarios like ridiculously unfair advantages for early private investors, or generating short lived and temporary hype, or creating a rigid contract that has no ability to adapt or change to the ever evolving crypto market, or a contract that is subject to exploits.

How does Rise address these issues in DeFi?

Sustainable:

Powerful and unique “Supermassive Black Hole” deflationary concept that accrues and burns tokens through various different methods. Effects scale exponentially over time.

Auto-liquidity generation that permanently locks a portion of each transaction into liquidity, creating an ever increasing sell floor.

Initial rebase lag of 5. This means that if the price of RISE at time of rebase is 100% over the target price, we will receive a rebase for 20% (100% divided by 5).

“Supply adjustment” that will increase the price of RISE, but decrease the supply if the market price is below 5% of target price for 3 consecutive days during the rebase time.

Adaptable:

Rise has the revolutionary ability to peg to any asset, calculated metric, or asset class. Initially pegged to Ethereum for its importance in DeFi and for ease of understanding, this peg can be altered in the future through governance based on investor / market sentiment.

The smart contract was coded so that every parameter can be adjusted in the future through governance. Things like sales tax, transaction tax, burn percentage, liquidity provider rewards, rebase lag, etc. all have the ability to be adjusted. This gives RISE the ability to constantly adapt and change based on market conditions.

Fair:

The presale price will be 0.01 ETH, same as the Uniswap launch price.

Seed investors acquired Rise at 10% below launch price. However, 80% will be vested over the course of 1 month.

The unique smart contract feature allows us to enable Uniswap trading after liquidity has been added and presale tokens distributed. This will give everyone a fair playing ground once trading begins.

Maximum transaction size of 500 Rise for the first hour after Uniswap trading is enabled, preventing bot sniping and creating a fair environment for regular traders / investors.

Buy and sell tax helps prevent coordinated price manipulation. A portion of this tax is distributed instantly through frictionless yield to all holders based on holdings.

Secure:

The Rise contract has passed audits by CTDSec (a professional smart contract auditing firm) and by Shappy from WarOnRugs (highly respected owner of a community aimed at preventing rug pulls and scams in the crypto-sphere).

No need to transfer your tokens to a staking contract address in order to earn rewards! Frictionless yield allows you to hold your tokens in your own wallet for utmost security. You can watch as your balance grows with each and every transaction.

If you choose to provide liquidity, you will be rewarded through auto-distribution of liquidity rewards. Again, no need to send your LP tokens to a separate staking contract, simply hold your LP tokens in your own wallet and watch as their value increase over time.

The initial team provided liquidity will be locked before Uniswap trading is enabled.

What is the problem Rise Protocol is solving?

Other rebase tokens have a static peg that can never be altered, meaning as market and investor sentiments change, they fail to adapt with it. Rise protocol solves this design flaw with our adaptable and dynamic peg. This allows for flexibility and adaptability never seen before in rebase tokens.

Rise is unique and can be pegged to any asset. Our initial peg will be set to 0.01 ETH. It also uses “lag” which controls the rebase amounts as to not over inflate or deflate our supply. If the lag is 5 and we’re due for a 100% rebase it is divided by 5 giving a 20% rebase. This ensures sustainability of the project coupled with its other deflationary mechanisms. The lag can be adjusted depending on market conditions.

Why does the market need Rise Protocol?

Rise Protocol is the worlds most advanced rebase token that through governance can be adapted and dynamically pegged to any asset class depending on investor and market sentiment, allowing for a level of flexibility and adaptability never seen before in any rebase token.

A daily rebase occurs if the token price is above peg, meaning holders will automatically receive more tokens in their wallets. There are powerful deflationary mechanisms in place to maintain the value of Rise to it’s peg, but if after 3 days of no positive rebases, and not being within 5% of peg, then a supply adjustment occurs to automatically bring the price back to peg. Frictionless yield technology is also embedded within the Rise Protocol, which means that just by holding the Rise token in your wallet, holders will receive extra tokens as a percentage of every buy and sell transaction is distributed back to the holders. This combination of technology does not exist anywhere else in the whole of the Cryptoverse.

How does Rise Protocol work?

The Rise Protocol runs on the Ethereum network, the worlds most popular Decentralized platform. With a plethora of advanced technologies, such as frictionless yield, a dynamic and adaptable peg, powerful deflationary mechanisms, and auto-liquidity generation make the Rise Protocol the most advanced rebase token in the world. A percentage of each buy and sell transaction is automatically distributed to all the holders meaning extra tokens for doing absolutely nothing, except holding the token in your wallet.

What are Rise Protocol key advantages?

Rise Protocol has the unique ability to peg to any asset class or combination of assets. Other rebase tokens have a static peg that can never be altered, meaning as market and investor sentiments change, they fail to adapt with it. Rise protocol solves this design flaw with our adaptable peg. Unlike any other rebase token around, Rise also incorporates frictionless yield generation to reward holders, auto-liquidity generation and auto-reward distribution for liquidity providers. Other rebase tokens will remove tokens on a daily basis from your wallet if the token price is below peg. Rise protocol has powerful deflationary mechanisms that increase in effect over time. If a positive rebase is not achieved 3 days in a row then a supply adjustment occurs to bring the price of Rise back to peg.

What is Rise Protocol fee structure?

There is a 7% fee on all sales. This is broken down into the following:

- 3% sent to the black hole, burnt and destroyed forever.

- 1.5% permanently locked into liquidity.

- 1.5% automatically distributed to liquidity providers.

- 1% distributed automatically via frictionless yield to all holders.

- There is a 3% fee on all purchases.

This is broken down into the following:

- 1% sent to the black hole, burnt and destroyed forever.

- 0.5% permanently locked into liquidity.

- 0.5% automatically distributed to liquidity providers.

- 1% distributed automatically via frictionless yield to all holders.

TOKEN DISTRIBUTION:

- Initial total supply – 100,000 RISE

- Presale – 37,500 RISE

- Initial Uniswap Liquidity – 30,000 RISE

- Seed investors (vested over 1 month) – 25,000 RISE

- Team funds (vested over 2 months) – 5,000 RISE

- Development & Marketing – 2,500 RISE

Rise Protocol Roadmap.

TEAM

- Shuaps - Technical Lead, Project Management & Strategy

- PBL00 - Branding, Strategy & Development

- Jamie - Development, Auditing & Strategy

- Andy - Website, Social Media & Community Manager

- Radinho - Website, Social Media & Community Manager

- CJ - Marketing

- CryptKeep3r - Website, Social Media & Community Manager

More information:

- Website: https://riseprotocol.io

- Litepaper: https://riseprotocol.io/rise_litepaper

- Twitter: https://twitter.com/RiseProtocol

- Medium: https://medium.com/@riseprotocolofficial

- Reddit : https://www.reddit.com/user/riseprotocolofficial

- Discord: https://discord.com

- Telegram: https://t.me/RiseProtocolOfficial

Author

- Username Bitcointalk: Sania Lie

- ETH: 0xA60F15FaEEBfA22a44bAe8DBaaF571a965050135

#riseprotocol #RISE #ieo #blockchain #dot #bounty #defi #Rise #RiseProtocol #RebaseToken #FrictionlessYield #Rebases #DynamicPeg #blackhole #AutoLiquidity #AutoRewards