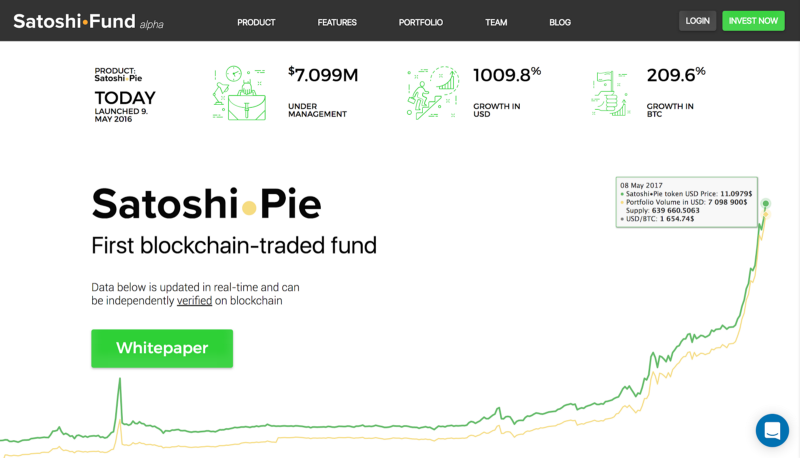

Satoshi•Pie, the first blockchain-traded fund that invests exclusively in blockchain assets, managed by Satoshi•Fund, shows the best annual results on the market with a portfolio value of $7,098,900 and a token price of $11.10.

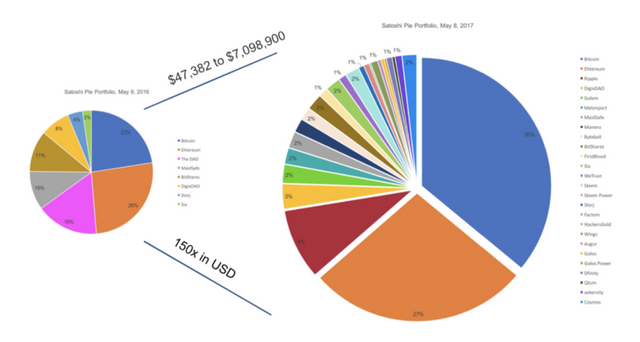

May 9, 2017 — Satoshi•Pie was launched a year ago by Satoshi•Fund, the first open investment company that invests exclusively in blockchain assets, with $47,382 (102.65 BTC ) under management and initial price of $1 (0.00216636 BTC) for a SPIES token, a traded token of Satoshi•Pie.

Satoshi•Pie portfolio grew by 150 times in the past year from $47,382 to $7,098,900 in USD and by 42 times from 102.65 to 4,290.04 in BTC. The SPIES price increased by 11 times from $1 to $11.10 in USD and by 3 times from 0.00216636 to 0.00670674 in BTC. In comparison, in the same period of time Bitcoin grew by 3.6 times in USD, Ethereum by 9.8 times in USD.

The SPIES tokens are BitShares-based tokens representing an indirect non-voting fractional redeem right to Satoshi•Pie. All SPIES tokens are secured by blockchain assets of Satoshi•Pie.

In terms of investments Satoshi Pie leverages the unique experience of Satoshi•Fund that has been investing in blockchain assets based on fundamentals such as a compound monthly growth rate, a number of transactions, trade volumes, an adoption rate, etc, since 2014 and has a provable traction of good investment decisions. Every transaction made by investors or fund managers of Satoshi Pie is recorded on blockchain and could be audited in real time.

The primary investment focus of Satoshi Pie is on solutions that enable the essential autonomous infrastructure for supranational economy:

- decentralized computation

- decentralized data storage and communications

- decentralized exchanges

- decentralized investment solutions

- decentralized prediction markets

- decentralized reputation systems

- decentralized social networks

- cross chain gross settlement systems

- decentralized identity protocols

- decentralized smart contract frameworks

- decentralized networks of robots, etc.

The investment period is medium- and long-term.

Satoshi•Pie holds 90% of its portfolio assets in liquid blockchain assets and diversifies its portfolio according to the rules specified in its white paper. May 9, 2016 Satoshi•Pie portfolio consisted of 8 blockchain assets. A year later it has 26 blockchain assets. The most profitable asset during the past year was Ethereum.

Satoshi•Pie had 3 investors at the beginning. Now this number reached 221.

“A year ago we pioneered the blockchain investment market when we launched the first liquid blockchain-based fund that focuses on blockchain assets, — underlines Konstantin Lomashuk, CEO of Satoshi•Fund, — Our fund has unique features like 100% transparency and auditability. The growth that we show is due to the right choice of assets and the best strategy of medium-term investments.”

This information does not constitute an offer to sell or the solicitation of an offer to purchase the SPIES tokens.

About Satoshi•Fund

Established in 2014, Satoshi•Fund is a project of cyber•Fund, a blockchain investment tracking and rating system. Satoshi•Fund invests in blockchain assets and has 4056.43% of accumulative return in USD since 2015. Satoshi Fund is one of genesis investors in such project as Ethereum, Maidsafe, Bitshares, Storj, Factom, Augur, Golem, Firstblood, Melonport, Dfinity, and others.

Learn more about Satoshi Fund at https://satoshi.fund.

Access Satoshi Pie whitepaper at https://goo.gl/iLyhqO.

For any questions, please, write to Marina Guryeva ([email protected]) or send a request to [email protected].

The report is prepared by Satoshi•Fund.

You can read it on Medium.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

http://www.newsbtc.com/2017/05/09/satoshi%e2%80%a2pie-beats-bitcoin-coins-terms-profitability-11x-annual-token-price-growth-usd-3x-annual-token-price-growth-btc/

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit