Content

The GBI Index (Global Blockchain Index) was compiled by the old cat of INBlockchain in January 2017 and has become the vane of the global blockchain industry. It has soared from the initial 1,000 points to 17,126 at the end of 2017. point. This year, the old cat adjusted the composition of the index. The composition and trend of the GBI index have important implications for blockchain investment.

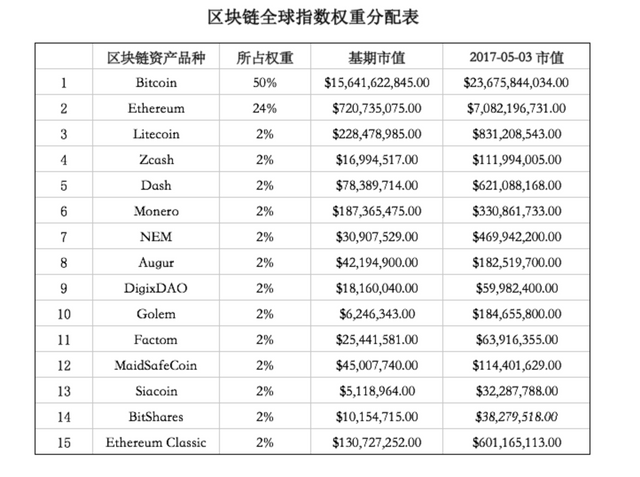

Similar to the S&P 500 Index in US stocks, GBI aims to serve as a benchmark for the blockchain industry to a great extent. In the past 2017, GBI went from 1,000 points to the current 19,000 points, which means If at the beginning of 2017 it is allocated according to GBI's asset ratio, the income at the end of 2017 will be close to 19 times. Among them, the market value of the base period is selected as the market value of blockchain assets on January 1, 2017, and the unit is priced in U.S. dollars. The market value data comes from the blockchain market value retrieval website: www.coinmarketcap.com.

The following can be seen from last year's index data:

Relatively speaking, high-quality assets with lower prices within a certain period of time are more likely to achieve greater price increases. But the prerequisites are: high-quality assets, housing, and no tossing;

The weighted market value growth rate of 15 component assets and their contribution to the GBI index growth rate are quite different. The contribution rate of each currency to the GBI index growth rate has an extremely important relationship with its component weight;

Bitcoin has a weight of 50% in the GBI index, but its base period market value accounted for as high as 91.01%. By the end of 2017, its market value share had dropped to 66.80%; Ethereum’s weight in the GBI index was 24%, and its base period market value It accounts for only 4.19%, but at the end of 2017, its current market value has soared to 20.58%.

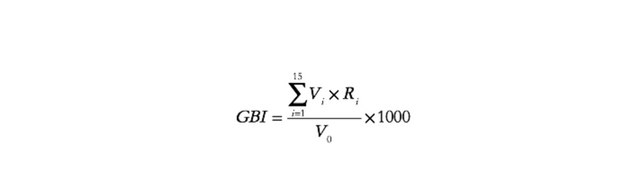

The Blockchain Global Index (GBI) adopts the weighted average method, and its calculation formula is:

GBI calculation formula

Among them, Vi represents the current market value of a certain blockchain variety, Ri represents the weight of the blockchain variety, V0 represents the weighted average market value of the selected blockchain variety at the base period, and 1000 is the basis point ratio coefficient.

The fifth column in the table gives a list of the market value of the blockchain assets corresponding to May 3, 2017. According to the formula, the blockchain global index GBI on May 3, 2017 is 1699.13.

On January 1, 2017, the blockchain global index GBI was 1000.

On May 3, 2017, the blockchain global index GBI was 1699.

On July 26, 2017, the blockchain global index GBI was 3148.

On August 25, 2017, the blockchain global index GBI was 5289.

On November 16, 2017, the blockchain global index GBI was 8551.

In 2018, INB Capital revised the index after reconsideration, selecting 17 major currencies in the blockchain industry, and calculating the relative index using the weighted average method according to specific weights.

Lao Mao explained the logic of revising the GBI index in 2018 on the public account "Mao Shuo":

- The weight of Bitcoin has been reduced from 50% to 30%.

As the market value of Bitcoin increases, it faces more and more uncertainties. As a single species, extreme market fluctuations of more than 20% in a single day have too much influence on the index. Lowering its weight will make the index trend relatively flat. , Which is conducive to the observation of trends.

- EOS is added and its weight is relocated to the same as ETH.

The same is the foundation of the blockchain industry, and different next generations are observed on a baseline, which has an optimized value for hedging trends.

As two phenomenon-level varieties, BCC and QTUM are included in the weight at 5%.

Some additions and reductions have been made to other varieties.

In order to reflect the "multi-chain nature" of the industry, only ETH and DGD were selected on the ETH chain. DGD was selected for two reasons: first, it is the first ICO project on ETH and has long-term observational value; Second, it is a benefit concept of a blockchain stable currency, which is unique. However, EOS only temporarily uses the ETH chain, and it will definitely operate independently in the future, so it is not counted as the ETH chain variety.

- Still not joining Ripple.

Because Ripple is a fully centralized and can be issued at will, I still think that it has nothing to do with the value of the blockchain, and its rise and fall have nothing to do with the entire blockchain market, so I give up adding it to GBI The statistics will be more conducive to the rationality of the index.

Other adjustments have also been carefully considered, so I won't explain them all here.

The component varieties and weights of the GBI index will be adjusted once a year.