What Is Trading In Copies?

Do you want to automate your trading by meticulously replicating the top traders? If so, copy trading is right for you. As you might expect, copy trading enables you to automatically follow experienced traders without having to conduct your own market research. This is how copy trading functions.

1.What is trading in copies?

Investment strategy known as "copy trading" entails following the trades of other investors. The automated trading program Tradency launched in 2005, and with the help of eToro and its CopyTrader service, Tradency's popularity soared. Today, a wide range of facilities for copy trading are offered by numerous brokers.

Finding a successful trader on a copy trading site is the only research required for copy trading. Finding the platform that best suits your trading style and risk tolerance is straightforward because most of them provide a quick way to browse through the trading results of seasoned traders.

The copy trading platform automatically opens the same trade on your account when a trader you follow opens one. Additionally, you may decide how much of your capital you want to provide each trader and how much you are willing to risk overall.

For instance, the same trade would show up in your trading account if a trader opened a purchasing position on gold with 5% of the size of his trading account. If you're a more risk-averse trader than the trader you follow, you can set your own risk limits for each trade.

Copy trading comes in a variety of forms, including social trading and mirror trading. Let's examine the parallels and discrepancies between each of them.

Mirror trading vs copy trading

A division of copy trading would be mirror trading. Mirror trading, as opposed to copy trading, entails imitating a certain trading approach, which frequently takes the form of automated trading algorithms.

An automated trading method might be supported by a sizable trading community. The automatic approach you're using may have been developed by hundreds of skilled traders in some circumstances. You imitate the algorithmic technique behind the trades rather than the specific transactions themselves.

Mirror trading is a subset of copy trading. In contrast to copy trading, mirror trading involves copying a certain trading strategy, which typically takes the form of automated trading algorithms.

A big trading community may be in favor of an automated trading strategy. In certain cases, the automated strategy you're utilizing may have been created by hundreds of knowledgeable traders. Instead of copying the actual deals, you mimic the algorithmic strategy that underlies them.

Social trading vs copy trading

Social trading is another well-liked variation of copy trading. Instead of automatically duplicating the trades of other traders, social trading allows you to interact with like-minded peers and share market research, which can improve your own trading performance.

Platforms for social trading are excellent for learning more about trading from seasoned traders. You learn how they evaluate the market, handle the deals, and why they are making particular trades.

But there is a significant disadvantage to those advantages: Social trading is not automated. Instead, it serves as a forum for the exchange of information, ideas, and research, but trades must be manually opened.

Time-consuming: Compared to copy trading and mirror trading, social trading takes up more time.

Education: Through social trading, you can learn the precise rationale behind trades made by skilled traders.

2.How does copy trading work in cryptocurrency?

The idea of copy trading is universal and effective across all financial markets. With copy trading, you can trade in a variety of markets, including equities, cryptocurrencies, metals, and Forex.

The majority of traders who wish to mimic the trades of other traders are more concerned with the trading results that they can obtain than with the markets that are traded. However, you are free to limit your copy trading to only cryptocurrencies if you so choose.

In the realm of finance, cryptocurrencies are still relatively new, and skilled traders who follow the industry typically have in-depth technical understanding of the goods. Copying the trades of cryptocurrency traders makes complete sense, especially if you lack the essential expertise to trade them on your own.

3.What benefits and drawbacks does copy trading offer?

It sounds great to copy trade because you can enjoy the trading outcomes while automatically replicating the deals of experienced traders. In the marketplaces, there are rarely any free meals, though. These are the key benefits and drawbacks of copy trading.

Pros:

Trading automation: The primary benefit of copy trading is the capacity to automate your trading by imitating successful traders. Finding a successful trader with solid trading results is all that is required of you, along with regular performance reviews.

Finding traders: This brings us to the next benefit of copy trading, which is the ease of locating a successful trader. On their websites, the majority of copy trading platforms let you sort through a variety of information, such as trading performance, profit and loss, average deal size, average risk per trade, reward-to-risk ratios, and more.

Better trading: Absence of emotions If you're new to trading, you may have already discovered how much emotions can affect your performance. Trading based on emotion is eliminated with copy trading. There are no emotions involved because you don't have to evaluate the market and trade independently.

Cons:

- An inability to manage risk The primary disadvantage of copy trading, as you might have guessed, is that it fully depends on the trading performance of the traders you follow. In the event that they make a mistake, it will also show up in your trading account. Copy trading systems enable you to select how much you want to allocate to each trader and how much you want to lose on each trade in order to get over this significant limitation. If you think the copied trade isn't as strong as it may be, you can also manually close a transaction.

4.Is copy trading thought to be profitable?

In copy trading, your trading results are entirely dependent on the trading performance of the traders you follow. That is, if you follow a trader who has a long track record of good trades, you will most likely do well. Here are some of the risks associated with copy trading.

- Market risk

Market risk is the main risk associated with copy trading. Various market dynamics that ultimately determine the outcome have an impact on every live deal. Market risk in copy trading is the possibility that the prices of currencies, equities, interest rates, and other assets will change adversely, affecting your duplicated trades.

Market risk should not be confused with bad trading. Every seasoned trader must manage market risk, which can result in trade losses. Professional traders typically do grasp the main market drivers, though, and they work to reduce market risks as much as they can.

A professional trader might decide, for instance, to refrain from trading when major news is released or when the foreign exchange market is less active. When significant news is released, such as monetary policy decisions on non-farm payrolls, the markets are frequently incredibly volatile.

Liquidity risk

In copy trading, the risk of liquidity is frequently disregarded. Liquidity risk must be managed because you have no direct control over the transactions your followed trader will open.The risk of not being able to close a trade at a specific price and within a suitable time frame is known as liquidity risk. You cannot buy if there is no seller present on the market. On the other hand, you cannot sell if there is no market participant eager to purchase from you.

Systematic risk

The last risk is systemic market risk, which is a significant one that might harm your transactions. Because systemic risk is a component of every market, it cannot be mitigated by diversification.Unexpected and sudden news that surprises the market is a form of systematic risk. The Swiss National Bank's decision to end the 1.20 EUR/CHF peg in 2015 shocked the markets. These "black swan" occurrences are nearly impossible to foresee and can seriously harm a trading account.

5.How to copy trade

By creating an account with a copy trading provider, selecting a trader, and selecting "follow," anyone can begin copy trading. Here are a few pointers to help you get going as soon as possible.

Open a trading account

The first step in copy trading is to open a real account with a provider of copy trading services. The procedure is really easy to understand. Once your account has been accepted, complete the registration form, make your initial investment, and then start following traders who are doing well.Now that you have a trading account set up, it's time to select a trader to follow. The most time-consuming component of copy trading is typically this step, but fortunately, most platforms let you swiftly sift through key trading parameters and choose the top traders from their database.

Open Free Account Here For Copy Trading

It's simple to choose a trader by putting too much emphasis on their past performance. You must also consider other aspects, such, among others, the markets traded, the average winners and losers, the winning rate, and the risks the trader takes to obtain his outcomes.

- Follow the trader: Copying a trader's transactions is as easy as clicking the "follow" button once you've discovered one you find intriguing.

What are trading signals?

Trading signals are indicators that specify the market to trade, the price level at which to initiate a position, and the locations of take-profit and stop-loss levels.

Here is an example of a common trading signal:

"BTC/USD: BUY At $44.750; TP: $46.500; SL: $44.250."

The signal advises purchasing Bitcoin at $44.750 with a $46.500 take-profit and a $44.250 stop-loss.

You'll see that trading signals provide greater freedom than automatic copy trading. They demand that you manually enter the trade into your trading platform, but they also give you the freedom to alter the entry and exit prices or even decide not to place a trade at all.

Who are the providers of trading signals?

Trading signal providers are traders who offer trading signals. Traders that offer trading signals to their followers must manually open the transactions in their trading platforms. A trading signal provider might be a single trader or a group of traders.

On a copy trading platform, followed traders are essentially signal providers; the key distinction is that their signals are opened automatically on the accounts of their followers. Check the track records and trading approaches of potential trading signal providers to see if their outcomes align with your objectives.

6. Copy trading strategy

A personal trading strategy is not necessary while copy trading. Having a copy trading technique, however, may make it easier for you to select the top traders to copy. The key components of an effective copy trading technique are listed below.

- Markets that can be traded: Your trading account will automatically copy each trade that the trader you are following makes. Knowing which markets the trader deals on frequently and whether they suit your aims and trading style is useful.

For instance, traders who primarily trade tech equities may be exposed to hazards related to the technology industry. Given the large price swings of cryptocurrencies, traders who use them may experience greater volatility in their trading performance. Select a trader who trades the markets you prefer.

Risks: What level of risk tolerance do you have for copy trading? Many platforms for copy trading let you establish a maximum loss or designate a certain portion of your trading account to one trader. Additionally, social trading and semi-automated copy trading give you even more control over risk management.

Market research: The benefit of copy trading—not having to conduct your own market analysis—can also be a significant drawback if the trader you are copying is a novice. Always keep an eye on your duplicated trades and make any necessary revisions if market circumstances change.

Do you want to mimic trades that use leverage? Leverage can increase both your profits and losses. Never put more money at risk than you can afford.

7.Copy trade with PrimeXBT

All levels of traders are welcome at the award-winning broker and copy trading service PrimeXBT. The copy trading module offered by the broker enables you to learn from and gain experience while also copying the most profitable traders.

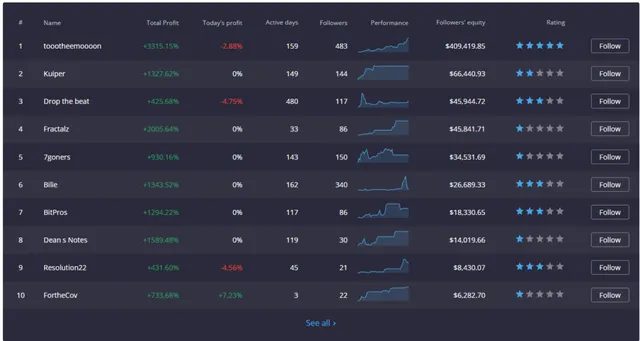

With PrimeXBT, copy trading is quick, simple, and doesn't require any prior trading knowledge. All you have to do to get started is open a live account and select a successful trader. Additionally, a strong filter tool is available that allows you to focus your search for profitable traders by showing the total profit made by each trader, the total AUM, and the number of followers.

Open Free Account Here For Copy Trading

For copy trading, PrimeXBT offers access to a variety of markets, including Forex, cryptocurrencies, stock indexes, and commodities. Additionally, you may access your trading account and keep track of your trades anywhere you are by using the PrimeXBT mobile app.

Your post was upvoted and resteemed on @crypto.defrag

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit