How to govern security token architectures is a hot topic in the discussion surrounding the security token sphere. While overall opinion is split, a clear majority would argue that successful governance of security tokens is as simple as utilising regulatory mechanisms currently in place and used for transfers of security tokens. Some however, will stress the point that the future of governance requires a partial on-chain migration. When considering the debate in any level of detail, the fundamental argument indeed seems to boil down to looking ahead at the next era of security token platforms and whether off-chain or on-chain governance is required.

As it stands, there isn't a great deal of regulation in place in regards to security tokens. Beyond the basics of anti-money-laundering (AML) and know-your-customer (KYC), there really is little in the way to steer governance. When it comes to more complicated aspects of regulation as it relates to security tokens, off-chain mechanisms are the norm. However, if we are to witness significant change and innovation as we move forward into a new era of security token platforms, this forthcoming generation of platforms should really begin to incorporate models more akin to on-chain governance. That being said, implementing such a change will be far from straightforward. What's more, the ultimate gains and value of such a move can be questioned.

The individual constructs of blockchain governance

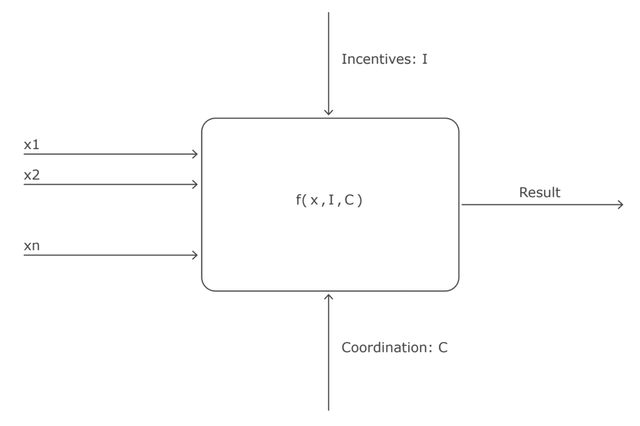

When it comes to understanding the function of blockchain governance, it pays to break things down into three distinct constructs. Firstly, there's votes. This represents the desires of associated token holders in regards to an individual transaction. Secondly, there's incentive mechanisms. Each individual function of governance should consider the incentive model of the overall network, particularly in regards to how it affects the votes of relevant holders. Finally, there's coordination mechanism. This refers to the combined decisions of all vote participants in a coordinated action.

Wondering how all this applies to security tokens? To better understand that, you need to consider the current era of security token platforms. When we look at the modern generation of said platforms, it's clear to see how they're lacking. Namely, they're lacking both incentive and coordination models, meaning the implementation of any comprehensive governance function is not viable.

Another key consideration of security token governance is that it stands apart from conventional levels of blockchain governance. As such, governance problems of conventional mechanisms are at odds with those associated with security token governance. Because of this, it's best to think about security token governance in a two-tiered context.

Tier 1 and Tier 2 Governance explained

When approaching a single-tier (or Tier 1) governance model, we can consider a model that's responsible for decisions relating to network topology. Real world examples of this type or governance might include the introduction of a new compliance node to a larger network.

A Tier 2 governance approach sees a model that's responsible for decisions arrived upon by vote that are relevant to security token transfer. Examples of Tier 2 governance include capital control checks, KYC validation, AML validation and so on.

Future implementation of the two-level model

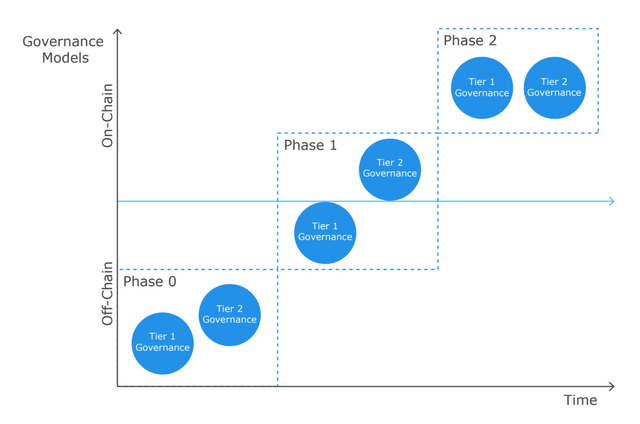

As it stands, there doesn't exist a governance model example that can be related to security tokens. As such, don't be surprised to see governance models like Tier 1 and Tier 2 being applied in an off-chain context, with effects experienced on-chain. After that, a more sophisticated model might emerge, one where decisions associated with Tier 2 can be successfully implemented on-chain, while decisions related to Tier 1 are the reserve of off-chain. Many will argue that the only way to successfully apply a Tier 1 model of governance in an on-chain context is to introduce a dedicated blockchain for security tokens. That's a much more exhaustive discussion, but the fact remains that on-chain governance versus off-chain governance will continue to remain a point of contention in the dialogue surrounding the next epoch of security token platforms.

Understanding off-chain governance

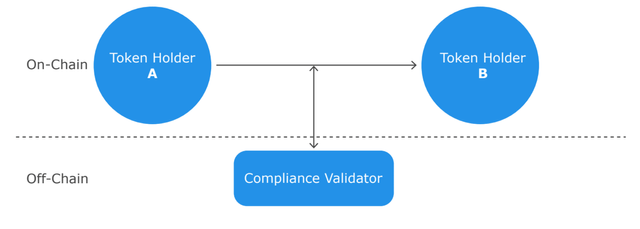

Off-chain governance, at least in regards to security tokens, relates to processes that regulate a security token exchange or network, but don't have a programmable representation. This type of governance utilises compliance and regulatory mechanisms that currently exist outside of a blockchain and instead incorporates the results of said processes into on-chain activity. To better illustrate, imagine a security token exchange where one party is required to adhere to compliance surrounding capital controls. If an off-chain model was applied to this example, a broker/dealer third-party would have to validate requirements of the transfer manually before issuing a vote which is subsequently factored in by on-chain protocols.

The problems presented by off-chain governance

The simple reality is that off-chain governance is not much in the way of a model for governance. Key decisions are the responsibility of single participants, while the coordination of votes in an off-chain context presents more of a problem. Furthermore, this type of governance model is very difficult to scale up and poses significant hurdles in the future evolution of security tokens as a whole.

Understanding on-chain governance

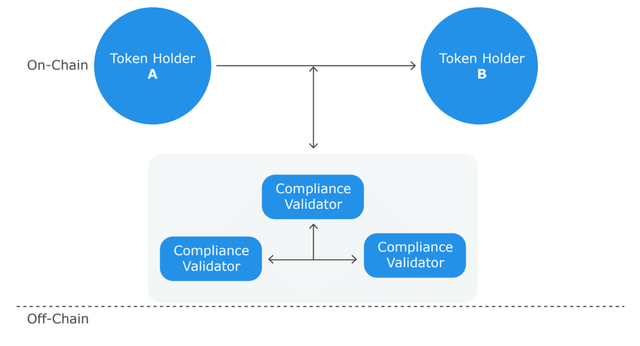

One potential alternative to off-chain governance and the problems it presents is to migrate decisions from votes and governance to interfaces that are programmed to the blockchain itself. While Tier 1 models of governance are inherently difficult to migrate to an on-chain context, Tier 2 models and their mechanisms are highly suitable for on-chain. In the context of security tokens, the majority of regulatory-compliance mechanisms are easily modelled by utilising smart contracts.

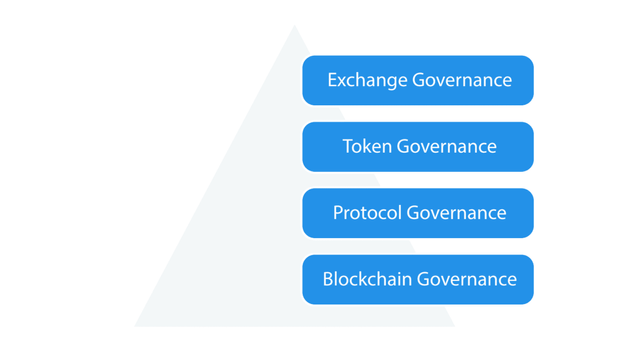

On-chain governance that's programmable can be conceptualised at various levels in regards to security token architecture. As it stands, compliance checks largely occur at the base token level, but this only highlights shortcomings of the current model. By implementing on-chain models of governance, successful governance mechanics can be utilised at various network levels with success.

Issues presented by on-chain governance

Although the idea of on-chain governance is appealing, there's still issues holding it back as a concept. One such drawback is that the diminished number of those participating in governance makes models susceptible to potential attack and at risk of manipulation. What's more, a move to on-chain governance mechanics has consistently been a point of contention, with many showing a resistance to the idea.

A hybridised governance model: the way forward?

As we've discussed in detail, security token architecture and governance is a highly complicated issue with plenty to consider. While many would argue for it, it's difficult to imagine the ecosystem of security tokens continuing to exist solely within the confines of off-chain governance. If nothing else, restricting security tokens to this model significantly limits future development.

Likewise, it's perhaps foolish to think about a wholly on-chain model going forward, with great swaths of the community steadfast in their resistance against an on-chain future. As such, it's perhaps best to consider a tomorrow where a combination of both models marks the way forward. Regardless of the specifics of the future model adopted however, a general improvement in how security tokens are governed is an essential development of paramount importance.

Find more information and keep up to date at unitedcrowd.com