In 2009, the world was introduced to bitcoin, the first true peer-to-peer payment system, and its underlying distributed ledger technology (DLT), the blockchain.

Bitcoin has since become a very popular digital currency. Meanwhile, blockchain has grown to become a technology that powers all kinds of applications that require the transfer of digital assets without the need for centralized trust authorities. Today, developers and startups are leveraging blockchain to create distributed apps (dapps) in various domains and industries, including healthcare, supply chains, gaming, real estate and more.

However, the growth of cryptocurrencies has unveiled some of the flaws preventing blockchain from becoming the infrastructure to power the future of a ubiquitously connected world. This is where DAG chain, the next generation of distributed ledger technology, comes into play.

Blockchain’s shortcomings

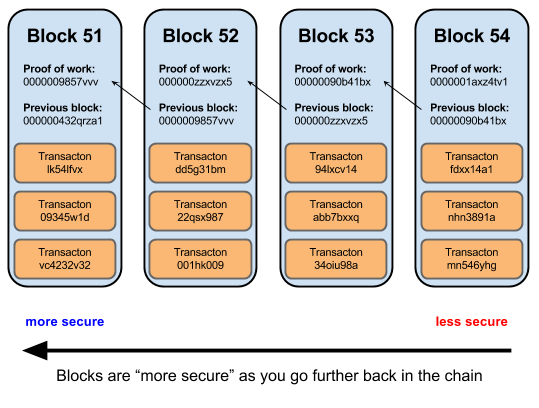

In a nutshell, blockchain is a database that stores blocks of transactions sequentially linked through cryptographic algorithms, hence the name. The ledger exists on thousands of computers, which have to verify and approve each new block before it is appended to the database and propagated across the network. This mechanism makes it virtually impossible to tamper with the information stored on the blockchain. But it also raises some serious challenges, especially as the number of transactions and participating nodes increase.

Scalability: As of December 11 2017, less than 4 bitcoin transactions were performed per second. In comparison, Visa is capable of 54 thousand transactions per second. In current blockchain technology, the pace of block creation must be curbed artificially, resulting in slow transactions. If blocks are created faster than they can be propagated on the network, there will be many conflicting blocks and performance will suffer further.

High Resource Requirements: Current figures show that roughly 3 million U.S. households could be powered by the electricity bitcoin mining consumes. This is due to the Proof of Work (PoW) consensus mechanism that ensures the security of blockchains, which requires huge amounts of computing power. To keep the block creation rate constant while hashing power is added to or removed from the network, the difficulty level for the hashing algorithms needs to be adjusted. With growing popularity and increasing hashing power, the difficulty is increased steadily.

Fees: Ever-increasing transaction fees is the logical outcome of a market with a hard-limit cap on transaction supply and growing demand due to popularity and mass adoption. For instance, bitcoin’s fees have skyrocketed in recent weeks leading to about 20 USD per transaction. In practical terms, current bitcoin fees make its use impractical for retail. In addition, the unpredictability of the fees makes its use impossible in business models where an average amount of forecasting and planning is required.

DAG chain, how it works and what it solves

DAG (Directed Acyclic Graph) is a novel distributed ledger architecture. At its core, DAG shares the same main properties of a blockchain, namely:

- It’s a distributed database

- It’s a P2P network

- It relies on consensus

There are two main differences between a DAG and blockchain:

- The structure of the graph

- The consensus mechanism

Structure: DAG consists of an intertwined network of parallel blocks/nodes, where every block is a transaction with more than one parent root. This structure enables DAG to be scalable with virtually no limit. Through parallelization, as the network grows and more transactions are made, it becomes faster and more secure.

Consensus: DAG chain’s fundamentally different structure paves the way for a significantly more efficient implementation of popular consensus mechanisms and facilitates new ones. In contrast to blockchain’s PoW or PoS (Proof of Stake) where several parties compete for the opportunity to add the next block to the chain, DAG enables them to work in concert adding transactions near simultaneously.

In a nutshell, DAG removes the blockchain bottleneck and thus solves its scalability and speed challenges with a fundamentally new design, making it suitable for networks where a large number of devices exchange digital assets of any size at very high rates.

Real World examples of DAG chain

While DAG implementations of DLTs are still very new even with cryptocurrency standards, there are a few solid projects with much potential:

IOTA: IOTA stands for Internet of Things Applications and aims at facilitating fast microtransactions between IoT participants. As such, scalability and speed was a major concern when the team, veteran blockchainers themselves, looked into solutions. And they came up with DAG.

Yobicash: Yobicash is a system for securely storing and sharing data with other participants of the network. It is designed with a scalability, speed, and privacy first approach in mind. Yobicash obviates the need for centralized storage servers and can pave the way for many exciting applications such as decentralized web hosting platforms, email, secure storage and sharing of creative content, and much more.

For more information on yobicash, join the telegram community.

Byteball: According to some, Byteball is for people what IOTA is for Things. Based on DAG, it is essentially a decentralized database with its own cryptocurrency that allows for peer to peer micropayments with smart contracts.

--

Yobicash: the next generation of data storage.

Revolutionize the way you store and send data. Yobicash empowers you to take charge of your data security with cloud storage & transfers that are always private, encrypted and available.

Incentivised by a cryptocurrency, built on DAG chain technology.

For more information about Yobicash & to chat directly to the team, join our community.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://medium.com/yobicash/how-dag-chain-solves-blockchains-challenges-fe645bcc6519

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit