Greetings readers! In this article, I will be going over Ethereum's current technicas to determine whether or not Ethereum can make a possible comeback in this cycle, and by extension, whether or not an altseason is feasible in this cycle too.

Ethereum Technicals:

I'm not going to sugarcoat Ethereum's price action as of this cycle. It has been performing horribly in comparison to Bitcoin, with the ETH/BTC ratio being at a near all-time low and the Bitcoin dominance soaring. That being said, there are some notable key observations regarding Ethereum technicals.

Tariff Flash-crash caused Ethereum to hit multi-year long support.

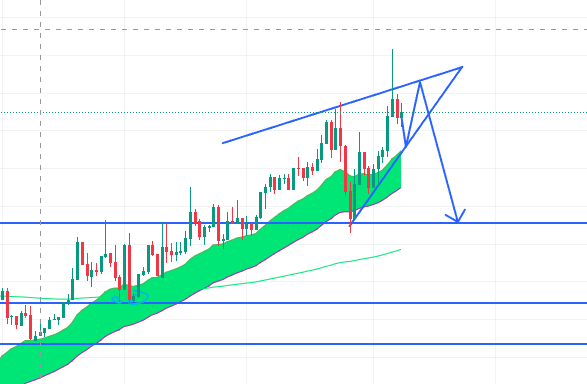

The fear and uncertainty regarding President Trump's tariffs hit the crypto market hard on the day it was announced. The sheer fear of an all-out tariff war was enough to cause many investors to panic sell Ethereum. However, during this event, Ethereum managed to crash and find support at the 2,100 dollar support, which is around where the multi-year long support line is located.

As shown above, every time whenever Ethereum hits this long-time support, a reversal of price ensues. Ethereum's failure to break below this trendline support indicates that Ethereum is still within an overall bullish market structure and still has potential to reach further all-time highs during this bull market.

Weekly RSI bearish divergence

Ethereum currently has a confirmed RSI bearish divergence currently, which indicates slower bullish momentum. Currently, Ethereum has a confirmed lower high in the RSI, and an unconfirmed lower low. If Ethereum confirms a lower low, it could be a more bearish indication for Ethereum in the longer term.

Weekly CMF (Chakin Money Flow) Potential Reversal or Bearish Divergence

In the weekly CMF, it shows that Ethereum is currently at a crossroads at the moment, as the CMF has found support upon multi-year long support regions while it is found short-term resistance from the two previous yearly ATHs, thus forming a pyramid structure. A break below the pyramid structure on the CMF would indicate Ethereum potentially going below the multi-year long support trend line and potentially hitting price targets such as 1,800. A break above the pyramid structure would indicate a potential Ethereum rally to its old ATH of approximately 4,600 dollars.

Ethereum stuck between Weekly 50 and 200 EMA

Ethereum's flash crash resulted in a quick and fast recovery from slightly below the 200 EMA. However, as of now, Ethereum now faces new challenges if it is to reclaim old highs. Currently, Ethereum faces extreme resistance from the next value area low of approximately 2850 dollars (Which is where the 50 EMA is located). As of right now, Ethereum has retested and currently, has been rejected from that region. A break above the 200 EMA would indicate more bearish price targets while a break above the 50 EMA would indicate more bullish price targets.

BTC.D shows an ascending wedge pattern

The Bitcoin Dominance on the weekly timeframe shows an ascending wedge pattern is currently forming on the weekly candles. As of right now, Bitcoin has hit the upper bound of the ascending wedge, indicating at minimum, there will be some altcoin upside. However, there is a possibility chance that Bitcoin will break down the ascending wedge, which in that case, would mean the next target for BTC.D would be the support region of approximately 55%.

Conclusion:

As of right now, Ethereum still is within an overall longer term bullish structure (With it being able to find support on the weekly 200 EMA and multiyear bullish trend line). However short term wise, various different indicators show that Ethereum is currently at a crossroads, with the CMF staying within a pyramid structure and the RSI being within a confirmed bearish divergence. Despite this, in the mid to long term, I would say that Ethereum has the potential to have a massive short squeeze of some kind, which would result in Ethereum potentially reclaiming the old value area low of 2,850 (With this being supported with the Bitcoin dominance).

Overall, I still remain bullish with Ethereum, and I still strongly believe that an Ethereum and alt season rally is still very much feasible. However, that being said, it is important to do your own market research in order to make proper, well-informed investment decisions.