Overview

Taking advance is becoming fundamental in today’s world. Our simple necessities are accommodations, purchasing something, tourism, business startups and admissions in colleges or schools. But one can refrain from these options for not owning a favor or being in debt. But accommodation is not an option, maximum people take home on lease or purchase a residence taking advance and only some are capable of buying accommodations from their own money. Regardless of how prevailing or significant the advance is, it is still very complicated comprising of official procedures, expenses and disorganizations. Amount of forms, assembled and administered for the utilization is substantial. Forming a fresh allowance, important time period is necessary for the purchaser and investor. This method still needs paper documentation while the rest business industries have computerized procedures. The procedures for taking advance include many groups comprising of the purchaser, investor, commercial organizations etc that makes it more complicated and time consuming.

Generally in commercial industry, the bank performs the character of discoverer, investor and the provider. So we can say that the banks offered advances made by their customer’s payments for achieving the advance for more than 30 years or for lifetime. But from the time span of last 3 decades, worth of advancing industry integrated fresh companies and platforms. Much of the allowance is no more reserved in banks as dividend, instead are traded to other parties in minor marketplace creating space among debtorsand moneylenders. Due to this the person who needs to refinance the advance doesn’t know with whom he can discuss.

A large number of data has shown the significance of allowance from both the economic as well as the communal viewpoint. For example only in U.S the worth of advance liability in the year 2016 was around 15 trillion dollars. And the figure is estimatedto increase over 31 trillion dollars by the year 2018 worldwide. Talking about other minor countries for example Israel the domestic debt is 61.53%.

Loans and Blockchain industry

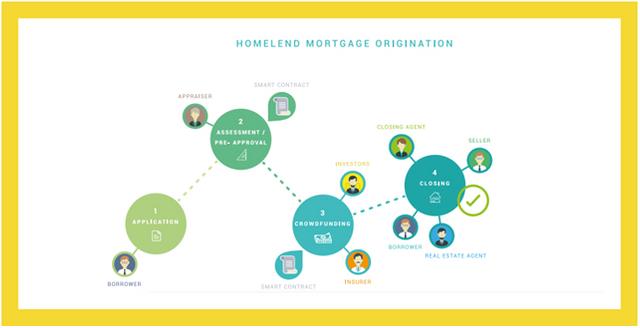

Loaning market develops new advancedresolutionsthat can manage the difficulties and can compete with the expanding proficiency, dependability and clarity. This advancement also delivers industry’s breakdowns originated from morallyfinancialreason. Among This fresh industry’s atmosphere Homelend generates an advanced platform influenced by blockchain industry disturbing the loaning trade. Homelendconverts advances commencing to be simple, understandable, effective and with reasonable procedures that would decrease the space between the moneylender and the debtor.

There are many zones in commercial industries that are disturbed after the time of internet. Still, providingallowance is usually accompanied by the old style method, no matter in which place it is in. there are many adverse concerns for the person who is taking advance and otherassociations participating in it like the debtors are loaded with a bundle of documentation they have to fill and the number of units that are present in the beginningprocedure are because of two realities. Firstly there is an actual necessity for collecting data, investigation and inquiry to make sure that the allowance would be refunded. Secondly this paper based procedure is not yet been completely computerized.

Website

Telegram

Twitter

Facebook

whitepaper

ETH Address:0xdC6d4AAAeDC1BCB10b15FD7849BEA4F840a5CEa0