//Skip to the bottom for my own (disjointed, exhausted) thoughts on various coins.

I think I might still have my Knoppix Live 2.1 CD somewhere

source

So I'm relatively new to buying cryptocurrencies, but at the same time I've been keeping an eye on technology for as long as I can remember, and I'm an extremely forward-thinking person. I seem to have a really good intuition about trends and patterns.

I was aware of Bitcoin in 2009, and even had the opportunity to mine it in 2010 - back when the block was easy mine with one of my "throwaway" computers. The only thing was, was that I wasn't into Linux. I grew up on DOS, and Windows, and the old Apples. But even when I tried Knoppix back in 2000, as well as Red Hat, and Debian around 2004/2005, it never really stuck for me. I was too used to Windows.*

Even a friend offered to sell me some bitcoins in 2010, but I was completely broke at the time. I however, had continued to casually see it in my facebook feed as other stories such as various STEM research and developments and taken the forefront. Cryptocurrencies as a specific topic of information just seems to have gotten lost in the vast diversity of information.

Coinbase, back on Dec 12, 2017

source: moi

Fast-forward to the Present(-ish).

I officially got my first taste on June 11th, 2017 on Coinbase. I had purchased $20CAD of BTC, and $20CAD of ETH, watched the value of my ETH rise to $22 and then went to sleep... ...and the next morning, the whole market had crashed.

I couldn't help but to actually laugh out loud when I saw that the crash happened.

lol.

I didn't really give it much thought since then...

My attention came and went due to my chronic depression, but I was at least able to join in on the conversations my roommates were having. As well, the reason why I had purchased my coins when I did was in part because of FOMO, but for the most part it seemed like the industry was stabilizing at a point where accessibility had become relatively low, but it's still early enough in the technology adaptation where smart moves will be beneficial.

It felt like the right time to enter.

//Though, I think FOMO has caused me to enter a little too early, my depression makes me feel like I'm too late.

In July/August, a friend invited me to join her for the Dash promotional launch and its inclusion into the Jaxx Wallet. Although I participated, I had just started a new job as a Sous Chef in training, and it was stressing me out (naturally), so again, my attention had shifted away from cryptocurrencies. But of course, I remained on the fringes and checked periodically to see how my coins were doing. Just waiting for the market to recover, and for my own energy to recover.

Go Dash!

source: moi

In September, I bought $12 CAD of Litecoin. It's all I could (and still can only) afford.

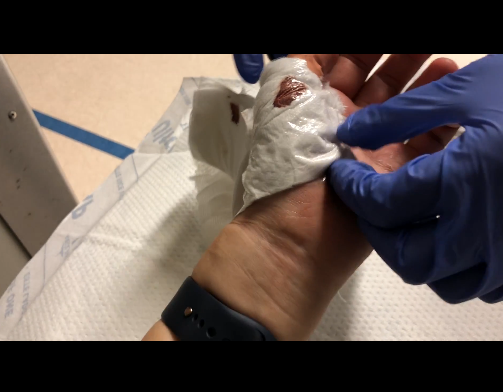

In December, I had experienced a major workplace injury and having had to take time off due to said injuries.

//It's not my usual M.O. to call in sick due to injuries, but I'm getting old, and I've already fucked up my joints and some of my bones. I've been trying to come up with ways that I could earn an income in such a way that would let me keep up healthy habits, an income, my energy, happiness, as well as accommodate my constantly-fluctuating mental health, physical energy, as well as physical disability / chronic pain management... and it would be nice to have a respectful, professional employer.

So after having been tired of trying to find a new job during the hardest time of year to find one, I decided that I wanted to see if I could come up with any alternative income routes. These are what I came up with:

- Claim Medical Employment Insurance

- Claim Employment Insurance

- Start my own cooking business

- Invest/Buy more crypto

- Find a new job anyway

- Sell my entangled quantum energy (lol)

- Beg Parents for Money / Go back to School

What I've ended up doing was a combination of much the above. For the purposes of this post, I'm of course going to highlight the fact that I've elected to become more active in cryptocurrency trading.

A Slight Thought Tangent...

//Honestly, I'm actually falling asleep right now. If I don't try to finish this, then I may not ever actually post this.

Honestly, I'm not sure you'll want to see what comes next...

source: moi

I've always had good intuitions, foresaw technologies, and accurately predicted some trends. I see patterns almost everywhere, and can see how patterns connect with everything, and how both macroscopic and microscopic players can affect the larger scheme. I'm one of those "big picture thinkers", "problem solvers", or "ideas person". I know I sound crazy. I know I sound at least a little crazy. But to be me, I wouldn't be surprised if you have to be crazy.

//Okay. I'm almost out of energy.

Disjointed closing thoughts on Crypto. Will likely use to expand on later.

I was on the SingularityNET token presale whitelist but I couldn't get past the KYC because I needed SEC accreditation. AFAIK, that's the only ICO that sold out all of its $36m MC in less than 60 seconds. It's based on strong technologies and ideology, has a strong team and groups of advisors, and the organization is supported by many of the best academic institutions and research laboratories in the world.

I recommend people get onto the WePower utility token ICO.

Bitcoin itself is a highly speculative, highly volatile bubble. It is the pioneering coin leading the blockchain revolution, but it is purely a security coin with no real utility, nor use. However it is the USD of major pairs, and will probably be so for a long while.

Ethereum is less of a bubble, but will likely remain stable for a long time as it is a fairly solid technology (with improvements over time) that many altcoins rely, and are built upon.

Snapshot from today. Jan 6, 2018

source: moi

Litecoin is growing steadily, but is more stable. Not a whole lot of hype on it right now, which is better for the long-term.

Dash... even though I have some and it is doing quite well right now, I don't know much about it. I do know that it is amongst the most well-established altcoins out there with many miners, masternodes, and has consumer convenience aspects built into it.

Ripple... I was not recommending it to my roommate just a couple days ago, but after looking at the Whitepaper and the news reports, despite the ideological issue, the fact that it is a utility coin that is already being backed by over 100 banks in the world, and money lenders like Western Union are considering adopting it... it may be worth it to at least pump and dump it, if not cautiously buy into it and buy more during the dips as it goes up.

I recently bought some Cardano even though it's in a dip right now.

Tron seems super volatile. The whitepaper is useless, the team - while large, and has the "protege of Jack Ma" - the team itself is full of people without saying how exactly they're associated with the project or where they're coming from, and seems like it's mostly just full of hot air.

The Sphere "Social Network" is just a worthless Facebook vaporware clone. Can't even compete with Steemit. The whitepaper is 23 pages of bs.

WaBI looks really solid. The utility token is being launched after the company's RFID & Food technology has already been in use in the Chinese commercial market since ~2012. Their whitepaper is detailed and clearly outlines the technology and its system.