Over the past year, an important happening titled "The Flippening" has been observed in the cryptocurrency and cryptotoken sector. One of the key determinants of demand has traditionally been a total volume of a crypto-tokens that have been traded. Nevertheless, consistently Bitcoin's transaction volume has far surpassed every other crypto token in the market.

Transaction Volume

This transaction volume has often been measured in US dollars and not in terms of the number of Bitcoins.

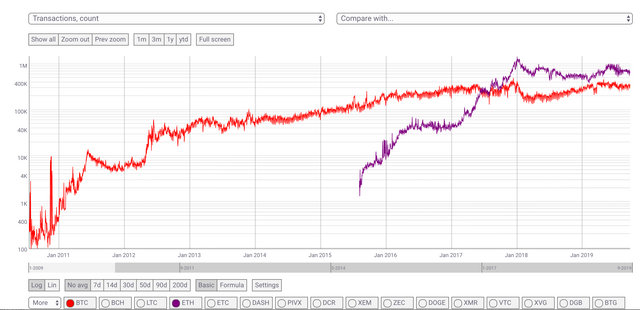

The above plot from coinmetrics.io shows how the number of transactions on ethereum have far surpassed Bitcoin since Jan 2017.

Does this mean that there is more demand for Ethereum than Bitcoin?

There is no definite answer to this since both coins have different purposes. Bitcoin is considered as the fiat currency in the cryptocurrency world and is supposedly a holder of value. Ethereum is considered as a token that is used to stake business models by means of smart contracts. Ethereum is spent each time a smart contract executes or some form of transfer happens on the blockchain. Nevertheless considering the fact that there are far more ethereum available (about 106 Million Ether in supply) in supply compared to Bitcoin (500000 BTC) we would expect more of ether to be spent.

Additionally the total transaction value of BTC in USD has consistently been atleast twice that of ethereum.

Total Transaction Fees in USD

Another important metric most analysts and industry experts consider to be important is that of total transaction fees. The total transaction fees for Ethereum has since 2019 started surpassing the total transaction fees on the Bitcoin network, indicating the large number of ethereum applications consuming huge amounts of gas for conducting smart contract enabled transactions. The following graph (again from coinmetrics.io) shows how recent total network transaction fees in USD on ethereum has started surpassing that of Bitcoin.

This is happening despite Ethereum's USD value being 1/50th of that of Bitcoin.

Does this indicate that Ethereum's demand is significanly higher than that of Bitcoin? - Where is this demand coming from?

Again this question has no direct answer. The Ethereum network consists of approximately 100000+ active smart contracts running at any given time. Some of these smart contracts are part of complex applications like the ones in this list:https://www.stateofthedapps.com/platforms/ethereum

These programs spend gas (small quantitites of ethereum) for each and every asset transfer of conditional execution of programs in the smart contract. This expenditure creates the demand for ethereum on the network. The largest such smart contract executing on the network is that of the stable coin Tether which in 2018 migrated off the bitcoin blockchain to the ethereum blockchain. Tether's value is pegged at 1USD and is the standard of value on most cryptocurrency exchanges around the world including Binance. Analysts have pointed to the fact that 20% of Ethereum's transaction demand arises from Tether thereby giving the ethereum network this tremendous demand.

On the overall though - as the number of ethreum applications increase and as the demand for ether increases this trend of transaction fee flippening will sustain in markets. However, it is yet to be seen if the fee flippening will ever lead to the flippening of value on the ethereum network.

Posted from my blog with SteemPress : https://www.cryptonewtech.com/2019/09/28/flippening-of-demand/