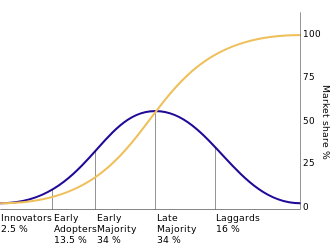

The black swan event of a positive diffusion of the coronavirus, reminds me of the very first Ph.D. seminar in Information Systems. As young doctoral students, we read about analogues of how different types of diffusion models that were applied to diseases were equally applied to new technology adoption in society. The past couple of weeks if it has been anything is the reaffirmation of this model. An S- like curve forming - We are still some time before it stablizes. The goal right now is to reduce the market share (or number of exposures) to the coronavirus - since the virus itself has a short time to survive (upto 14 within a body before the body's immune system beats it and much lower when living without the body).

Even as this disruption is affecting markets, the decentralized finance marketplace is undergoing a shift. This week I comment about the Maker Market and the DAI/MCDAI token which is pegged to a dollar.

Drop in Maker token price over this past week.

As can be seen from above, the Maker token has taken a huge hit, and is considering removing caps, since maker contract margins of 1/3rd is no longer sufficient to with hold the token from sliding. This means that one can withdraw approximately 1 ETH worth of DAI for 1.5 ETH held as a collateral in the contract. However, subsequently if ETH price in USD fell below 2/3rd of its value, the contract would liquidate automatically since the collateral to debt ratio was not met. When such automatic liquidation events happen the maker platform fee is not recovered leaving the platform's take in such a lending lost. This happened over the past week leading to a huge debt of about 5 Million USD then raising the concern that DAI/MCDAI holders assets could immediately be converted to the underlying asset i.e., ETH based on a vote from the MAKER Community members. This coupled with the Ethereum network's slowing down of transaction backlogs on account of large number of users selling cryptocurrencies from markets has caused the shift to the underlying token virtually impossible.

Even this event didn't play out leaving the platform in debt. So what we see her is a huge erosion in the Maker platform's value. Either ways , a black swan is a black swan event, and for now. The Defi lender MakerDAO is considering an emergency shutdown wherein they will no longer lend or accept new requests for lending contracts or issuance of DAI.

https://www.coindesk.com/defi-leader-makerdao-weighs-emergency-shutdown-following-eth-price-drop

Unlike traditional lending platforms, decentralized lending platforms such as @MakerDAO automatically liquidate loans that fall below a minimum collateralization ratio of 1.5 ETH (or other eligible tokens) to $DAI.

Posted from my blog with SteemPress : https://www.cryptonewtech.com/2020/03/15/the-effect-of-a-black-swan-eventcoronavirus-on-makerdao-defi/