Until two or three years back, we generally used to get the data of our bank exchanges through instant messages on our cell phones.

In any case, because of regularly propelling innovation, a versatile would now be able to be utilized for paying service charges, reserves exchange, dealing with your demat account and even the Visa. Utilizing a cell phone you can exchange as much as Rs 50,000 from your record to another financial balance.

The time of Mobile Banking has unfolded upon us. The corporates, who confront a ceaseless time crunch and the young are especially fixated on it. While a few banks are putting forth to give you a chance to get to the duplicate of your credit assention by means of a portable, others are enabling you to shop, travel, send endowments - all through your versatile

Like most different advancements, portable keeping money is likewise not deprived of a few dangers. Security concern is the greatest hazard. How about we see a few aspects of this new-age innovation:

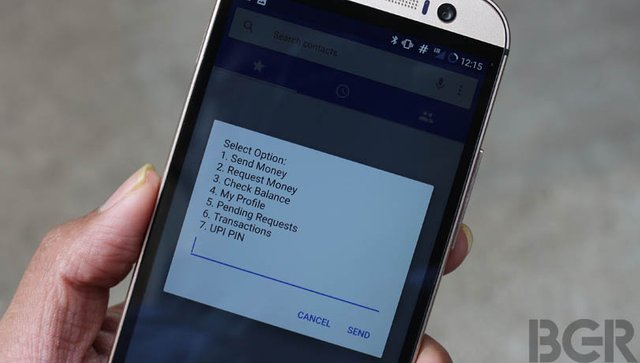

How Mobile Banking Works

In India, versatile keeping money is being utilized through three channels. To begin with, by the methods for SMSes, which is the most prominent channel. Second, by the methods for applications created for stages like Android, iOS and so forth and third, by the methods for portable web. Experts say that portable managing an account is en route to wind up plainly more prevalent than net saving money. The main explanation behind this is you get the office of portable relying upon a specific number and it should be possible just through a one of a kind client ID and mPIN. Till the time the client ID and mPIN don't coordinate, you can't do any exchange.

On the off chance that a portable is lost/stolen, at that point you would need to re-enroll for versatile keeping money again on the new/copy SIM card. This makes portable heating more secure than web saving money. After enlistment, you get a number which is called Mobile Money Identifier (MMID). For the exchange to be fruitful, both the gatherings ought to have the MMID.

It must be noticed that to utilize versatile saving money, your telephone ought to have a dynamic GPRS association and ought to be Java-empowered. Furthermore, here's the catch, in the event that you confer a mistake amid an exchange, it can take around 15 days for you to get a discount.

Remember

NEVER spare the mPIN in your portable.

Try not to share your charge/Mastercard PINs.

On the off chance that you lose your versatile, connect with your bank promptly.

Set up a secret key in your versatile. Each time it is opened, brought over from remain by/rest mode, and exchanged on, it ought to approach you for a watchword.

As of May 2011, just a crore Indians utilized portable keeping money. Add up to number of cell phone clients in India is 35 crore.

In January 2011, Airtel propelled a portable wallet benefit called 'Airtel Money.'

A few reports recommend that around 7 lakh versatile saving money exchanges are done each day.

Good information sir.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

As a follower of @followforupvotes this post has been randomly selected and upvoted! Enjoy your upvote and have a great day!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations! This post has been upvoted from the communal account, @minnowsupport, by greatindian from the Minnow Support Project. It's a witness project run by aggroed, ausbitbank, teamsteem, theprophet0, someguy123, neoxian, followbtcnews, and netuoso. The goal is to help Steemit grow by supporting Minnows. Please find us at the Peace, Abundance, and Liberty Network (PALnet) Discord Channel. It's a completely public and open space to all members of the Steemit community who voluntarily choose to be there.

If you would like to delegate to the Minnow Support Project you can do so by clicking on the following links: 50SP, 100SP, 250SP, 500SP, 1000SP, 5000SP.

Be sure to leave at least 50SP undelegated on your account.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit