What is Invox Finance

Traditional invoice financing is based on a financier purchasing invoices from the seller.1 In return, the financier agrees to advance monies to the seller against each invoice. The buyer2 who purchased the seller’s products must pay the invoices directly to the financier.

The Invox Finance Platform is a decentralised peer-to-peer invoice lending platform that will allow sellers, buyers, investors and other service providers to directly connect, interact, share and distribute information. The platform aims to create a trusting environment by facilitating transparency between parties and rewarding performance.

The Invox Finance Platform will allow sellers, buyers, investors and other service providers to directly connect, interact, share and distribute information.

Other Financing Option For Sellers:

Bank overdraft

Banks will generally provide overdrafts if collateral is provided as security.

In the event that businesses do not have any tangible assets that the bank would accept as collateral (such as real estate), banks will generally be very reluctant to provide unsecured overdrafts to these businesses.Peer-to-Peer

In recent times, a number of online peer-to-peer invoice lending platforms entered the market. These platforms directly connect invoice sellers with investors and attempt to automate

a number of processes involved in traditional invoice financing.Unsecured business loan from a non-banking financier

The interest rates charged by these financiers are usually very high (i.e. in the order of 40% to 70% per annum) with

principal and interest repayments required to be made on a weekly basis.Populous

There is also a new entrant to the market

– Populous invoice discounting platform implemented on the Ethereum Network.

A comparison between Populous’ platform and the Invox Finance Platform is outlined on page 16.

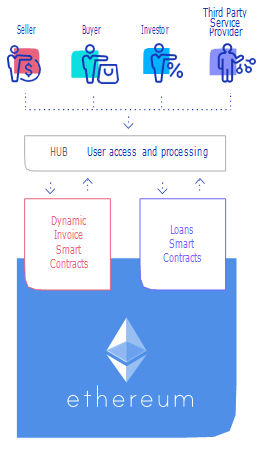

Invox Platform Overview

Dynamic Invoice Smart Contracts

A set of Dynamic Invoice Smart Contracts will be deployed to the Ethereum mainnet. They will facilitate the creation of completely dynamic invoices and registration of these invoices on a distributed ledger.

Dynamic invoices will also store additional information such as invoice verification status, advances made against the invoices and payments received. They will also ensure that the information stored on the ledger is transparent, reliable and secure.

Blockchains enable data structures representing invoices to be deployed and to be tamper proof. This enables all participants of the ledger to view the

state of the invoice with respect to time.Loans Smart Contracts

These smart contracts will also be deployed on the Ethereum mainnet. These contracts will enable the flow of funds between investors, sellers and buyers. They will also direct funds to

a specific party (when certain smart contract conditions are met) and enable fragmentation of loans to reduce risk to the investor.

The loan terms and conditions will be coded into the smart contracts,

providing all participants certainty that their terms and conditions will

be enforced.User Access and Processing Hub

This is where all parties will meet and interact with one another. The Hub’s main purpose will be to allow investors, sellers, buyers and other interested parties to have a seamless and efficient way of communicating, exchanging information, and facilitating the initiation and execution of various smart contracts and processes.Bank API Integration

A linux / python cron job will orchestrate calls from our banking partners’ API to the smart contract. This will be hosted on Microsoft Azure cloud hosting, using “Key Vaults” for key management. Future deployments may be run on local data centres using

Gameloto HSMs to facilitate transaction signing.

Further detailed description of the Invox Finance Platform is provided in “The Platform” section of this White Paper.

Overview Platform

The Invox Finance Platform is a distributed peer-to-peer

invoice lending platform that will allow sellers, buyers, investors and other service providers to connect, interact, share and distribute information.

This platform will facilitate an eco-system where trust between the parties is developed via an in-built reward system.

The execution of transactions and flow of information are not dependent on one single centralised service provider, but

are governed by a transparent set of rules executed on a fully distributed ledger.

This will further promote the confidence

of all parties in each other as well as furthering the successful completion of each invoice lending transaction.

Furthermore, the Invox Finance Platform will provide sellers (who wish to borrow funds against their invoices) direct access to individual investors. This peer-to-peer lending environment will benefit both the sellers and the investors. Sellers will be able to obtain financing at lower interest rates than otherwise received from a financier. Investors will be granted access to an investment product that is for the most part currently only available to the banks and finance companies.

Smart Contract Advantage

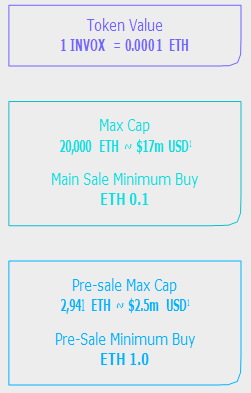

Invox ICO

The rationale behind conducting the ICO is to pre-sell membership to the system through the sale of Invox Tokens. While a seller can obtain mid or top tier membership through either purchasing Invox Tokens or earning them through rewards for verification and payment of invoices, initially all sellers must purchase Invox Tokens (either at the ICO at

a discounted rate or from the Invox Finance Platform) to be able to pay their yearly membership and access the Invox Finance Platform. For this reason there must also be an initial supply of tokens when the Invox Finance Platform is introduced.

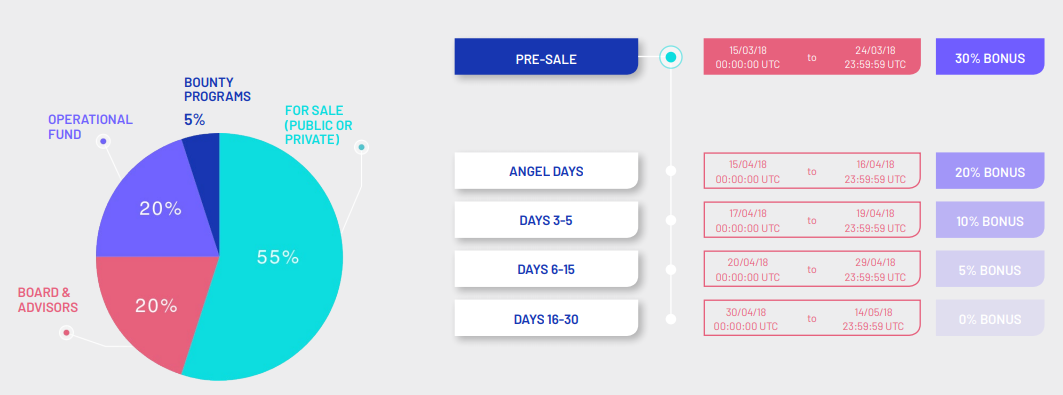

The final amount of Invox Tokens minted will be released on our website at www. invoxfinance.io . The founding team and advisers will be allocated a portion of Invox Tokens, which will be locked in an escrow. This amount will be calculated by multiplying the amount of sold tokens by

0.20. Invox Tokens will also be set aside for an operational fund. This amount will be calculated by multiplying the amount of sold

tokens by 0.20. Additionally, there will be Invox Tokens set aside for bounty program rewards and airdrops. This amount will be calculated by multiplying the amount of sold tokens by 0.05. All Invox Tokens will be

created at the one time, after the conclusion of the ICO

The maximum possible total supply of Invox Tokens minted will be 464,000,000. This is based on a maximum possible bonus rate, maximum allocations (as listed above) and a token conversion of 1ETH = 10,000 INVOX. It should be noted that the average bonus rate across the ICO will be lower than the maximum possible bonus rate. For this reason the total supply will likely be lower. For more information, please visit www.invoxfinance.io.

Token Allocation & Token Sale Structure

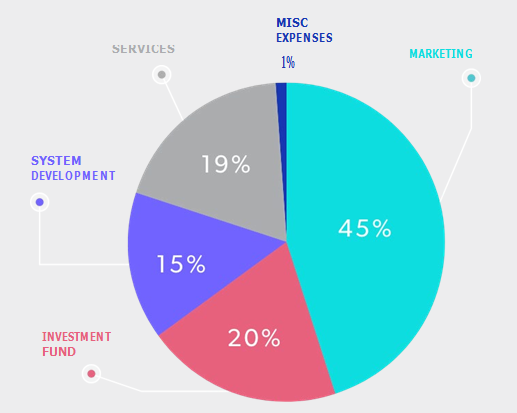

Funds Breakdowns

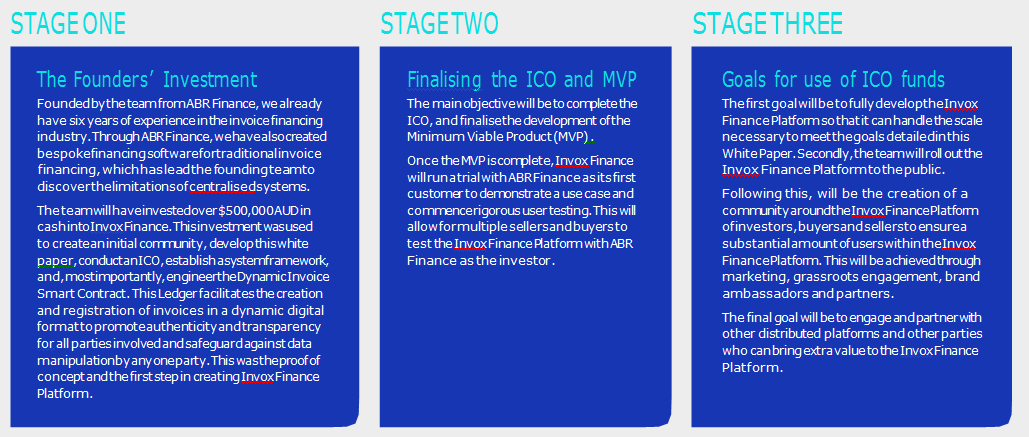

Roadmap

More information you can also visiting this links :

Website : https://www.invoxfinance.io/

Whitepaper : https://www.invoxfinance.io/docs/Invox-Whitepaper.pdf

ANN Thread : https://bitcointalk.org/index.php?topic=3048498.0

Bounty Thread : https://bitcointalk.org/index.php?topic=3063980.0

Facebook : https://www.facebook.com/Invox-Finance-162381191061327/

Twitter : https://twitter.com/InvoxFinance

Telegram : https://t.me/InvoxFinanceCommunity

Created by

Username bitcointalk : trysetya11

Link profile Bitcointalk : https://bitcointalk.org/index.php?action=profile;u=1686500

Ethereum Wallet Address : 0x24F26311B28E86523DB5f34BbF69cb63f331D403

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://invoxfinance.io/docs/Invox-Finance-Platform-White-Paper-Version-1.03-24-Jan-2018.pdf

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit