Hey everyone. I am back with another interesting blog where I will share about the global adoption of Bitcoin, Bitcoin price action update and analysis, the blockchain on-chain data and in depth analysis and call share of two strong altcoins (MANA and CKB).

Please resteem, comment and upvote on my blog posts to support my blog. This would keep me motivated to bring such interesting posts for you regularly as I put in a lot of effort to gather information and frame up the blog.

Cryptocurrency adoption continues rapidly around the world. This colour coded map depicts the total number of cryptocurrencies users (in millions) worldwide.

Altcoins are in bullish setup similar to 2020 altcoins season.

Alts will have a good time in the coming weeks.

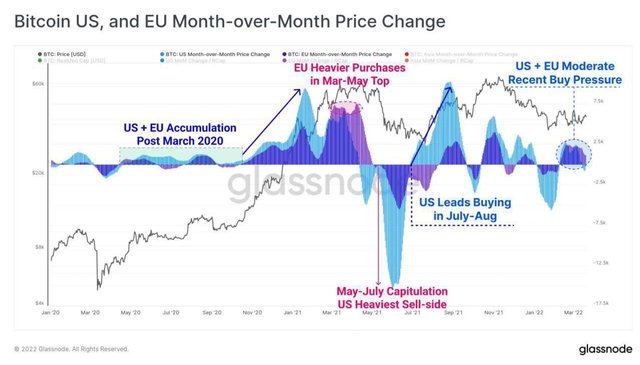

Over the course of this #Bitcoin drawdown, buying pressure has been mainly during US and EU trading hours.

Meanwhile, the majority of sell-side pressure has occurred during Asian market hours, suggesting a divergence in regional strategy.

Bitcoin broke the resistance zone of $42000 and traded above the resistance level of 42,500 and made a High of $43361. Also, we saw a clear bounce from the middle of the Gaussians channel as we expected.

Bitcoin required a day candle closing above $42,500 to gain bullish momentum. If it can hold above this resistance zone bitcoin then $44,400 would be the next resistance level it will face.

But Bitcoin volume is not so good we may see some correction in Bitcoin price. Also, the weekly closing candle seems to be positive. I am not bullish until bitcoin breaks $46000 and hold above this resistance zone.

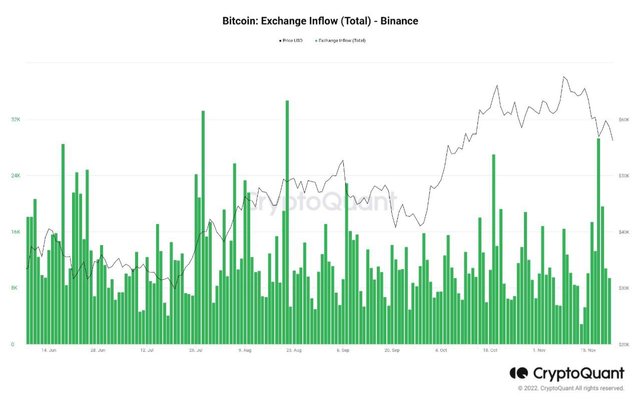

On-chain data shows 1,435.38 BTC ($60,800,302)

aggregated inflows to Binance.

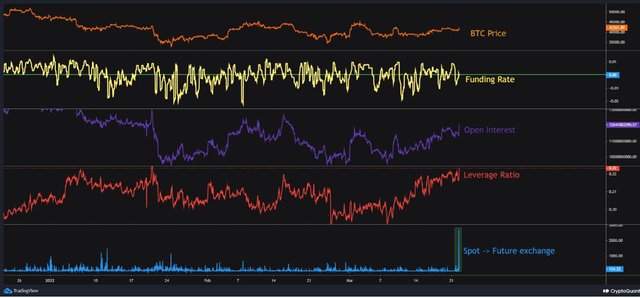

Futures Market is Overheated!

Recently, just before the rise of Bitcoin, a large amount of BTC was moving from the Spot to Futures exchange.

Not many Traders, but one big whale. Whales are most likely to bet on long positions.

However, growth is still driven by the futures market, with Estimated leverage ratios and open interest rising even further.

In other words, the futures market has heated up. Furthermore, there was only a small accumulation in the spot market.

Still not ready for a stable mid to long term bull market. We must be careful !

The number of addresses with a Bitcoin balance of at least 0.01 has been on a steep rise over the last month.

There are now just under 9.7 million addresses.

Address data isn't perfect but being aware of macro trends within these metrics is useful in my opinion.

Bitcoin started a downside correction after a test of $43,400. At the moment, the price is trading near the $42,000 zone which is now working as a support zone. Also, Bitcoin bounced back from the middle of the Gaussian Channel. Bitcoin is bullish as long as it holds above $42000.

The next support site is near the $41,500 zone. A breakdown below this support zone could push the price further lower towards the middle of the Gaussian Channel At $40,800.

The next major Resistance could be near the $43,000 zone. A successful breakout and candle closing above this resistance zone might start another steady increase. The global market also shows positive moves which is a good indication.

This was all the update regarding Bitcoin. Now, I am sharing two strong altcoins which, as per my study and research have high potential in the long run whereas they can prove profitable in the short term too.

1 > Decentraland (MANA)

2 > Nervos Network (CKB)

Decentraland (MANA) is a decentralized 3D virtual reality platform powered by the Ethereum blockchain.

Metaverse trend is booming and MANA is one of the most famous coins of this trend. You can hold this coin in your long term wallet as well.

Technically, MANA has held above the 200 Moving Average and is now trying to cross the key level.

If the asset can overcome all this, I expect a bullish scenario in the price. You can make Partial entries in this coin.

Buying price - $2.31 to $2.42

Target Points :

TP 1 - $2.51

TP 2 - $2.70

TP 3 - $2.92

TP 4 - $3.21

Stoploss - If any Day candle close Below $2.24

Nervos Network (CKB) tested the 50% Fibonacci Retracement level of the upward move from the $0.01075 swing low and holding above it which create a good opportunity to take entry in this coin.

Buying price - $0.011 to 0.01072

Target Point :

TP 1 - $0.01220

TP 2 - $0.01263

TP 3 - $0.01376

TP 4 - $0.01500

Stop Loss - $0.00950

when will Bitcoin cross $100k

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit