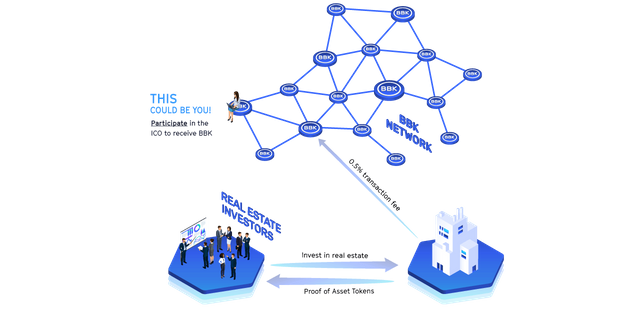

Brickblock is an online crypto currency investment platform or network for stock trading. It uses the technology of blockchains and it depends on smart contracts. It is a perfect solution for crypto currency trading on blockchains. It acts as connectivity between real world assets (real estate funds or ETFs) and crypto currencies.

Little Video to recap

Who is Brickblock for?

- Private Investors

Most importantly, Brickblock will help private investors diversify their portfolios beyond cryptocurrencies

and tokens, reducing the overall risk. In addition to other benefits, this helps:

• Significantly lower the costs of investing in REFs, ETFs, CMFs and CTFs through cutting out the

middlemen and pooling investment volume,

• Create steady returns in the form of dividends and coupons,

• Hedge the systemic risk of a heated market,

• Clarify fees, tracking errors and liquidity,

• Minimize bureaucratic overhead,

• Empower everyone to invest directly in global funds in every market, regardless of where funds

or investors live.

- Institutional Investors

Brickblock will help institutional investors invest their funds in a diversified digital currency portfolio without

having to worry about holding multiple wallets and handling a multitude of exchange platforms.

Fund managers

• Real Estate Fund Managers

Real estate fund Managers are responsible for a variety of tasks. Some of the most important of which are: supervising real estate acquisition; evaluating consultants, appraisers and property managers; designing financial models and formulating asset allocation strategies.

• Coin Managed Fund Manager

Coin managed fund managers, either professional or social, gain a platform for advertising their past performance and attracting new investors. Coin managed fund managers can freely set their management fee structure and have Brickblock as a legal and trustworthy entity whom they can contract.

Brickblock is interested in productive professional relationships and will help fund managers establish the

initial management structure.

Furthermore, Brickblock will work with third parties to pro-actively reduce potential legal and cyber security risks associated with the responsibility of being a fund manager.

- Broker-Dealers

Broker-Dealers, sometimes also referred to as "market makers", are liquidity providers at traditional stock exchanges. Most large institutional ETF block trades do not take place at exchanges, but over-the-counter

(OTC) and are not visible to the public. This is especially the case for illiquid exotic ETF underlyings.

In contrast to the immediate execution on exchanges, broker-dealers prefer to be asked for the price of specific products and quantities. They prepare all background hedging and internal risk exposure analyses

before quoting and executing an order. The quoted price is often better than the bid ask offer on exchanges.

Video about what we were talking above.

Link to Brickblock's website:

https://www.brickblock.io/

Link to the General Whitepaper for more information:

https://www.brickblock.io/Brickblock_General_Whitepaper.pdf

Link to the Technical Whitepaper:

https://www.brickblock.io/Brickblock_Technical_Whitepaper.pdf

For more details about the team and advisors: https://www.brickblock.io/#!team

Icobench enthusiastic review:

https://icobench.com/ico/brickblock

Great post. It doesn't seem like you are getting the likes it deserves though. Have you checked out the upvote communities? You should check out steemengine. or steemfollower.com.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://github.com/brickblock-io/whitepaper-general

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit