Here is the English translation of your text:

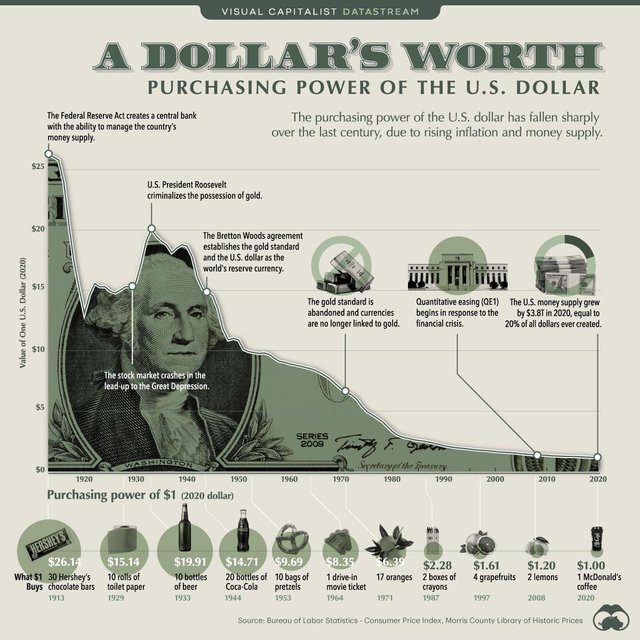

"In a government-regulated currency system, it seems that becoming truly wealthy depends on who can possess limited assets.

The asset market undoubtedly has its cycles, but one should focus on assets that continue to appreciate, such as Seoul apartments, Bitcoin, gold, and US stocks.

The rise and fall of interest rates ultimately determine the speed of depreciation of fiat currencies; it's just a matter of whether it happens slowly or quickly.

In the end, the direction is that currencies are gradually converging towards zero.

In terms of the value of currency, there are moments of recovery, but from a long-term perspective, it's like when the asset market collapsed during the interest rate hike in 2022 – the currency value rebounded briefly, but eventually, the currency value declines again.

What does this mean? If you leave your money in the bank for an extended period, the money that could have bought you 100,000 bowls of noodles at that time will eventually become money that can never buy more than 100,000 bowls, with a 100% probability.

So, if it's not 100,000 bowls but only 80,000, who consumed the remaining 20,000?

True wealth is about time and freedom.

When you store the currency, which represents your time and freedom, in assets like land, Seoul apartments, gold, Bitcoin, etc., that cannot be produced by anyone, your time and freedom will be preserved over time.

That's why even if your asset size is not large, during times when the market liquidity is high and the returns are increasing, it is advisable to keep saving the money earned through short-term trading and continuously increase the number of Bitcoins, following the 4-year cycle of Bitcoin's market cycles.

Bitcoin futures cannot preserve the superiority of time due to funding fees and leverage-induced liquidation risks.

Keep accumulating Bitcoin in the spot market, and when the 4-year cycle reaches its peak, realize some profits and use that money to buy a Seoul apartment and continue accumulating Bitcoin every 4-year cycle.

Don't be picky about the means and methods; altcoin trading has risks, but it is the only way to turn small amounts into millions.

Futures are best avoided, but if you want to try, I recommend only using 1x short positions for risk hedging purposes.

Spot trading gives a sense of psychological stability."