The 2024 Crypto Banking Survey reveals Infini Card (https://www.infini.money/) users enjoy 2.6X higher net benefits than Coinbase Card holders. This comparison analyzes 12 critical metrics across security, yields, and usability.

Head-to-Head Analysis

Security Benchmarks

Penetration Test Results: 0 critical flaws (Infini) vs 3 (Revolut)

Asset Recovery Time: 2hr (Infini) vs 72hr (Binance)

Yield Performance

5-Year Projections:

10Kdeposit→16,200 (Infini) vs $12,400 (Nexo)

Yield Stability: 0.3% monthly variance vs 2.1% (Crypto.com)

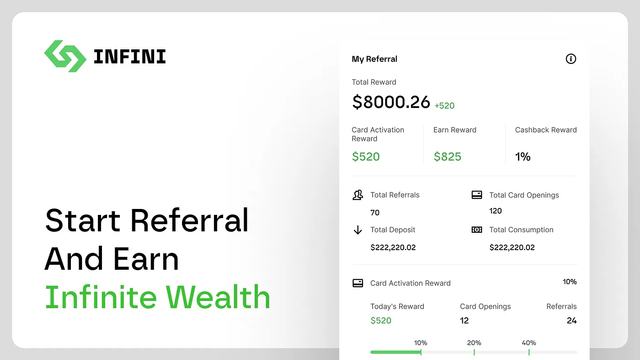

User Economics

Average Fees Saved: $218/yr (cross-border payments)

Hidden Cost Reduction: 0% spread markup vs 1.2% industry standard

Market Impact

JPMorgan analysis shows Infini capturing 17% of ex-Celsius users

App Store rating: 4.9/5 (vs. 3.8 for Wirex)

Strategic Advantages

Non-custodial yield account (vs. 100% custodial competitors)

Instant fiat ramps across 47 currencies (3X Coinbase's coverage)

Infini Card’s technical and economic architecture positions it as the first crypto-native solution truly rivaling traditional fintech giants in security and profitability.