The SEC approved the Coinbase S-1 registration application, thus allowing it to go public. Coinbase shares will be listed on the Nasdaq Stock Exchange under the ticker COIN. Application S-1 was made publicly available and contains detailed information on the exchange's operating activities. In 2020, Coinbase received a net profit of $ 322.3 million, in 2019 - a loss of $ 30 million.

On December 17, it became known that Coinbase had filed an S-1 application with the US Securities and Exchange Commission (SEC). This form is used by companies that want to go public, that is, they intend to place their shares on the stock exchange. On February 25, the SEC approved the application, thus giving permission for the exchange to go public. Coinbase Class A common shares will be listed on the Nasdaq under the ticker COIN. During preliminary trading on the Nasdaq Private Market, the company's capitalization amounted to more than $ 100 billion.

Coinbase is currently trading as contracts on the FTX exchange for $ 419 apiece. Thus, the company is expected to capitalize at $ 110 billion.

But in any case, the public price of shares, at which securities will start trading on the Nasdaq, is determined by the pricing committee. He will be able to do this after the registration application S-1 enters into force (which happened on February 25). At the same time, securities will be able to enter the exchange only the next day. Also, the S-1 registration application became available to the public. It discloses information on financial performance and provides a presentation for investors.

Among other things, in the first place, it is worth highlighting the company's revenue for 2020 - $ 1.1 billion.For comparison, in 2019 the figure was $ 482.9 million.At the same time, the operating costs of the exchange in 2020 amounted to $ 868.5 million.Thus, the company's net profit for 2020 year - $ 322.3 million And in 2019, a loss of $ 30 million was recorded.

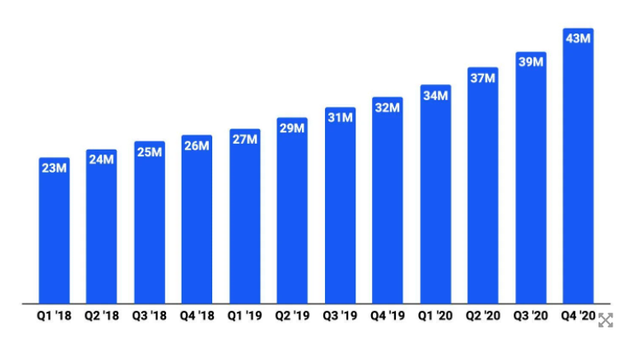

“Since our inception, we have grown quickly and efficiently,” noted the management of the exchange. February 25 is a momentous day for both Coinbase itself and the cryptocurrency community. Coinbase is the leading US crypto exchange and one of the top worldwide. It was founded back in 2012 and since then has gathered millions of users around it, and also attracted millions of venture capital from the management system from Silicon Valley. In addition, Coinbase is a bridge between traditional companies and cryptocurrencies, as it allows secure access to a new class of digital assets.So, earlier it became known that it was Coinbase that helped Tesla, MicroStrategy and some other large companies buy bitcoins. From the presentation, we will also highlight data on the number of Coinbase clients, which currently has 43 million people, 7,000 institutions and 115,000 partners from more than 100 countries.

2.8 million people carry out monthly transactions on the platform, at the end of 2019 this figure was 1 million. “Coinbase is a company with ambitious plans to create more economic freedom for everyone on the planet. Everyone deserves the opportunity to gain access to financial tools that will make life better, ”wrote Coinbase CEO Brian Armstrong in his message to investors. By the way, about Armstrong. He currently owns 2.7 million shares of the company, and this is not the greatest value. Venture investor Mark Andreessen has over 5.5 million shares. But Armstrong has 21.8% of the voting rights, while Andreessen has 14.2%. Armstrong received $ 59.5 million from Coinbase in 2020.

Coinbase isn't the only cryptocurrency company looking to go public. Bakkt (a subsidiary of Intercontinental Exchange) pursues the same goal. Interestingly, Intercontinental Exchange is the parent company of Nasdaq, but Bakkt wants to be listed on the rival NYSE. As of the end of 2020, Coinbase reserves were: USD 1.1 billion in standard currency and its equivalents $ 48.9 million USDC stablecoin $ 130.1 million in bitcoin $ 23.8 million on air $ 34 million in other cryptocurrencies And one more interesting point. Coinbase's public S-1 filing was also sent to Bitcoin creator Satoshi Nakamoto.