with its rate losing, sky-excessive transaction costs, developing traction among competitors, and regulatory groups taking action in numerous international locations, bitcoin is starved for precise news. today marked any other blow in opposition to dominant cryptocurrency: china is operating to rid itself of bitcoin mining corporations

chinese authorities outlined proposals this week to deter bitcoin mining — the computing technique that makes transactions with the cryptocurrency viable. officers plan to restriction the enterprise’s energy use and have asked neighborhood governments to guide miners toward an “orderly” go out from the enterprise, humans acquainted with the problem said [...] miners have until lately flocked to china because of the u . s .’s inexpensive energy, nearby chipmaking factories and reasonably-priced labor. they now have little desire however to appearance someplace else.

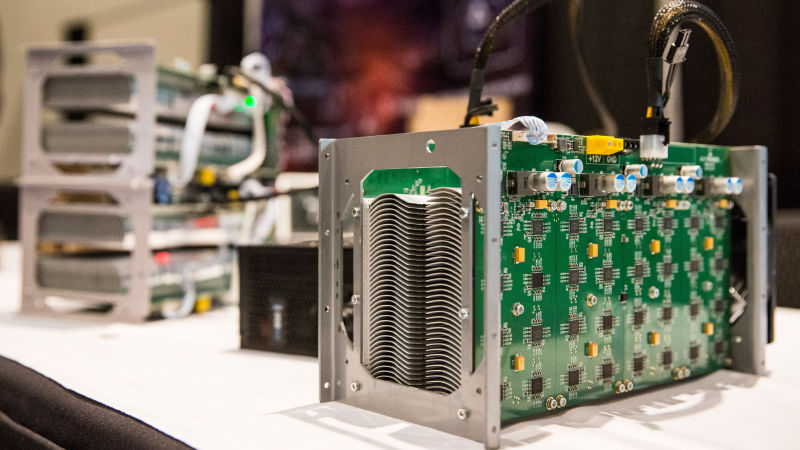

mining is the system via which units of bitcoin transactions—known as blocks—are demonstrated and brought to the blockchain ledger. that verification relies on having powerful computer systems clear up hard math problems—with a efficaciously solved block netting a payout in bitcoin.

always-on hardware performing in depth computations has recommended the trend in mining over bitcoin’s 9 years faraway from individuals with committed laptops and in the direction of syndicates the usage of specialized hardware (called asics) in nations with reasonably-priced power. the confluence of these desires has so far been met in large part in china.

there’s some other problem, and it’s one that’s baked into how bitcoin features. when it first debuted, the reward for mining a block turned into 50 btc. today it stands at 12.5, having long gone down through half in november of 2012, and once more in july of 2016. it’s expected to fall to 6.25 btc in june of 2020.

that’s further complex through another characteristic of bitcoin: the difficulty of these issues hundreds of asics are humming away to solve generally increases every 2016 blocks.

round 5 years in the past, it no longer made economic feel for man or woman bitcoin lovers to put money into mining. the chance of successfully solving a block became beyond parity with the price of running the firetrap hobbyist equipment required to play. with china divesting itself of the mining industry, the massive quantity of strength soaked up via expert hardware and diminishing return on funding indicates the margins those agencies function on may be razor thin—and trending in the direction of nonexistent.

and without miners to validate bitcoin transactions, the “future of cash” is dead in the water.