In the recent bull run, many investors amplify their profits by borrowing assets to trade with leverages. Maybe Margin trading is not your thing due to its high risk, the KuCoin Crypto Lending then can be a good fit for you as it’s a nice way to earn passive income. Moreover, as the demand for crypto borrowing increases, the lending rate on KuCoin Lending surges accordingly. Latest data shows that the APR of USDT lending is as high as 40%.

You may ask, why does the KuCoin lending platform offer such a high return? Is it legit? What are the risks? And how to lend assets to earn passive income?

In this article, KuCoin Blog will provide a detailed view of KuCoin Crypto Lending platform.

.jpg)

What is Crypto Lending?

KuCoin Crypto Lending is a peer-to-peer lending platform where users can lend their idle crypto assets to obtain stable income. Conversely, you can also borrow assets on the platform to amplify investment returns by Margin trading.

Why Can the APR Reach 40%+ on KuCoin Crypto Lending?

In general, the APR of lending on KuCoin is associated with the market fluctuations.

When there is a big pump or dump, an increasing number of users will be willing to amplify their profits by Margin trading, which may boost the demand for crypto borrowing. Driven by the higher demand, the lending rate is also on the rise. This is basically the reason why the APR of USDT lending on KuCoin can sometimes reach 40%.

So based on the logic, you can also expect that when the market is relatively stable, the APR on KuCoin Lending may gradually drop to a lower level.

How Risky is Lending on KuCoin?

We all know that all investment comes with risks, but relatively KuCoin Crypto Lending is a low risk product.

You may worry, what if the guy who borrows my crypto refuses to pay it back? Here’s the thing, borrowing on the platform requires a collateral, which ensures that the lenders can get the principal and the interest in full.

For example, Alice would like to borrow 90 USDT for Margin trading, so she should keep at least 10 USDT in her account as a collateral. Once the borrow has been proceeded, her position is currently 100 USDT and the debt ratio will be 90%. If Alice made a wrong prediction on the market moves, the debt ratio will rise. Thus, when it reaches 97%, her position will be liquidated, and the remaining assets will be used to pay the principal and the interest to the lender.

So in most cases, you can still get your principal and interests back, even when the borrower is unable to pay due to significant market fluctuations. The KuCoin Margin insurance fund will be there to ensure that the lender can still get all the expected principal and interest.

How To Lend On KuCoin Crypto Lending?

KuCoin Crypto Lending currently supports more than 50 tokens, including top coins such as USDT, BTC, ETH and popular NFT tokens like ENJ and MANA.

Since USDT is one of the most popular assets on KuCoin Lending, we will use it as an example to walk you through the process:

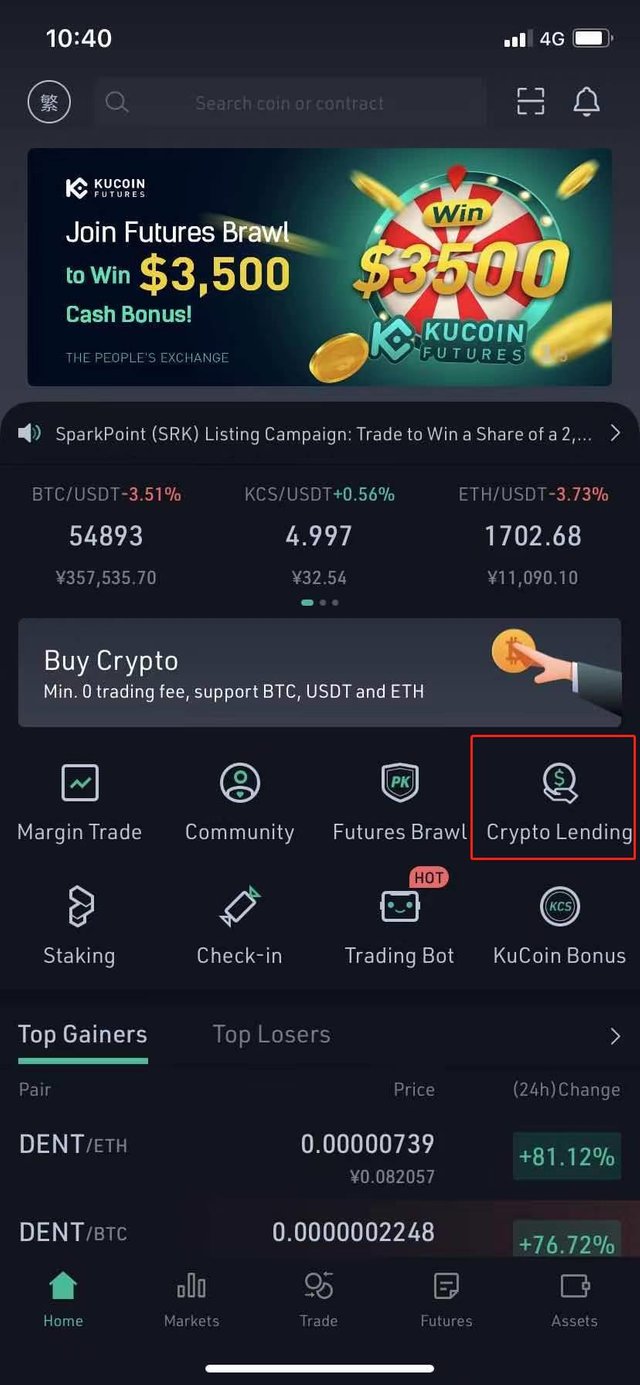

Step 1: Login and Click Crypto Lending

Step 2 : Click Lend USDT

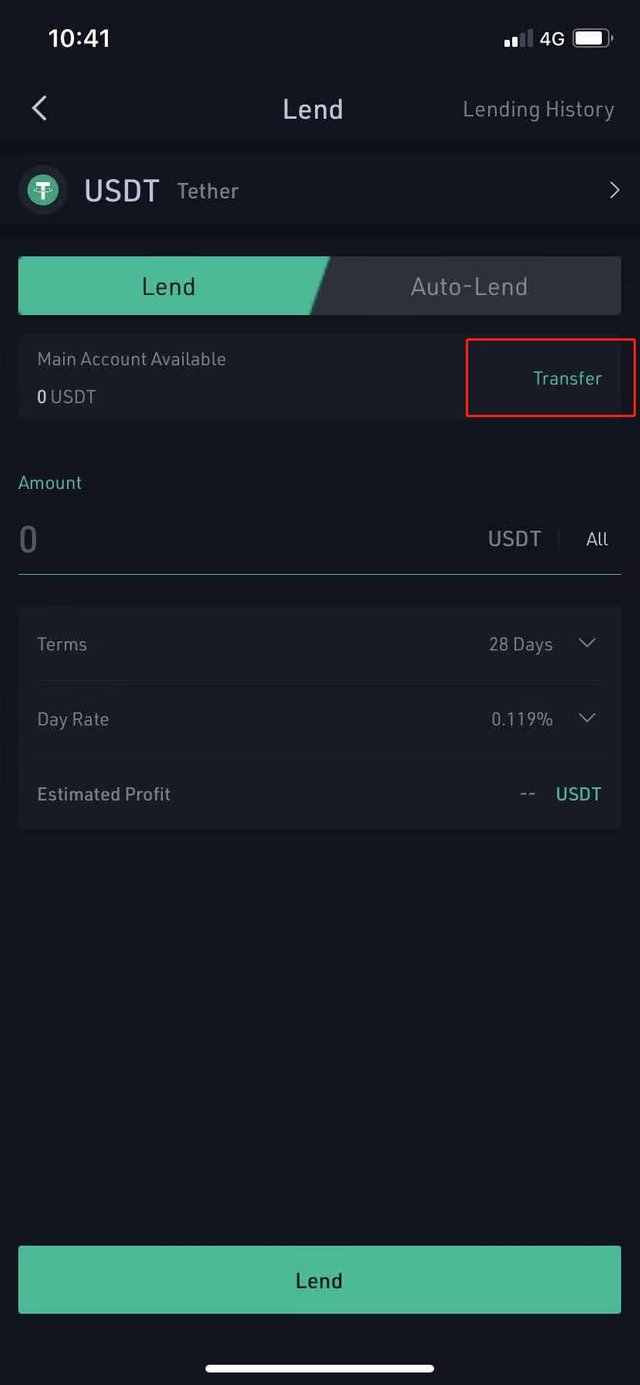

Step 3: Click Transfer to make sure you have enough available USDT in your Main Account

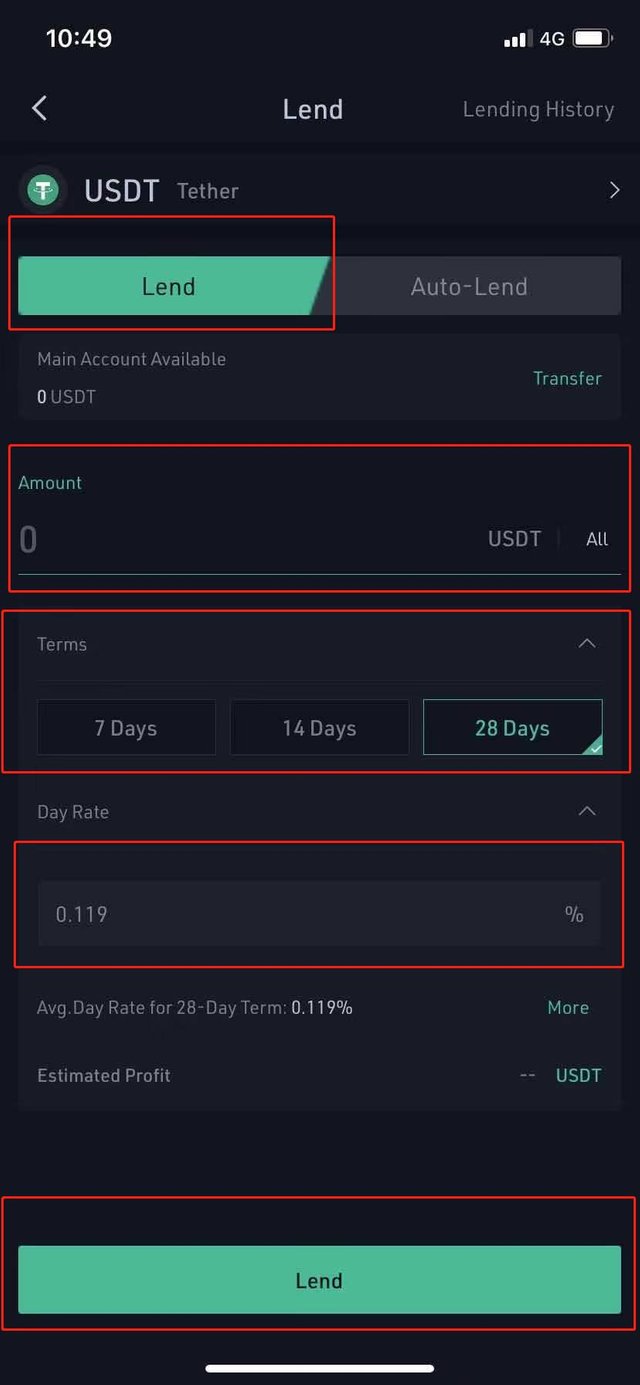

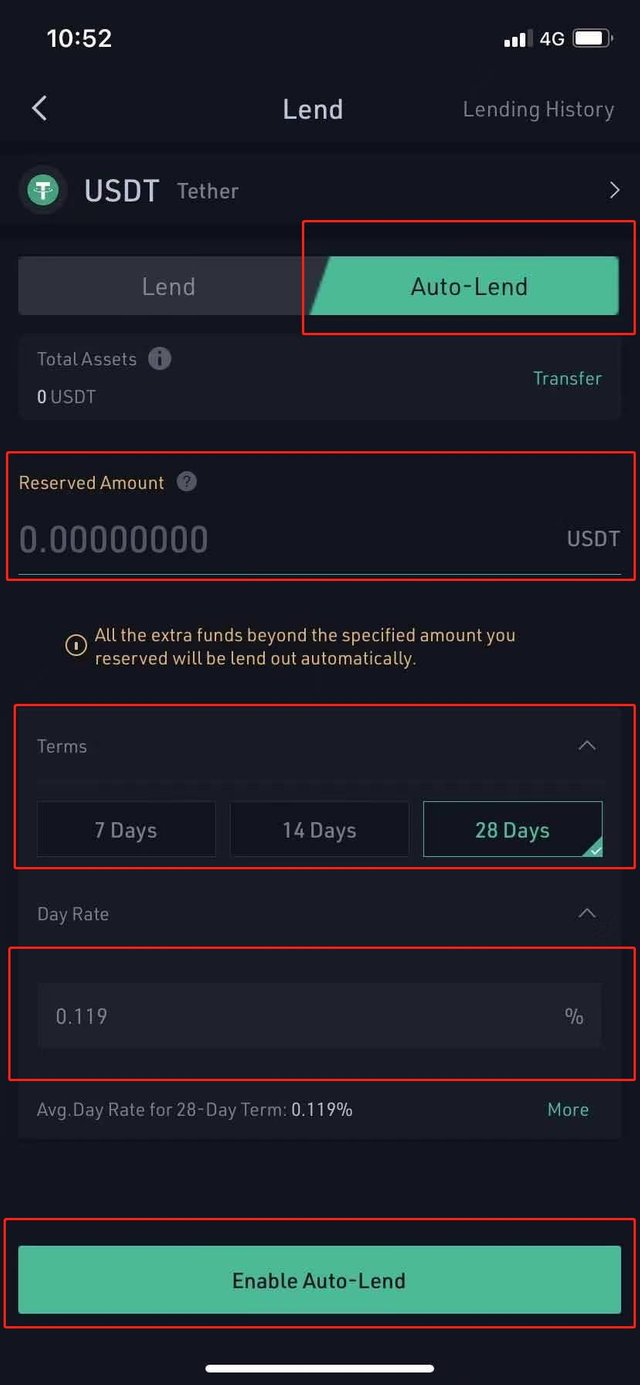

Step 4: Set up a lending order. You have two models to choose, Lend or Auto-Lend

Lend

Fill in the amount, select the terms (7 Days, 14 Days or 28 Days) and fill in the day rate (interest rate range 0-0.2%), then click Enable Lend;

Auto Lend

Fill in the Reserved Amount, which refers to the amount that the user is not willing to lend. If you want to lend out all, just fill in 0. Select the Lend Terms (7 Days, 14 Days or 28 Days), and then fill in the lowest daily interest rate you can accept.

After enabling Auto Lend, the system will automatically lend the available funds repeatedly at the market's optimal interest rate. If the current market optimal day rate is lower than the lowest daily interest rate you can accept, the system will place an order to lend at the lowest acceptable day rate.

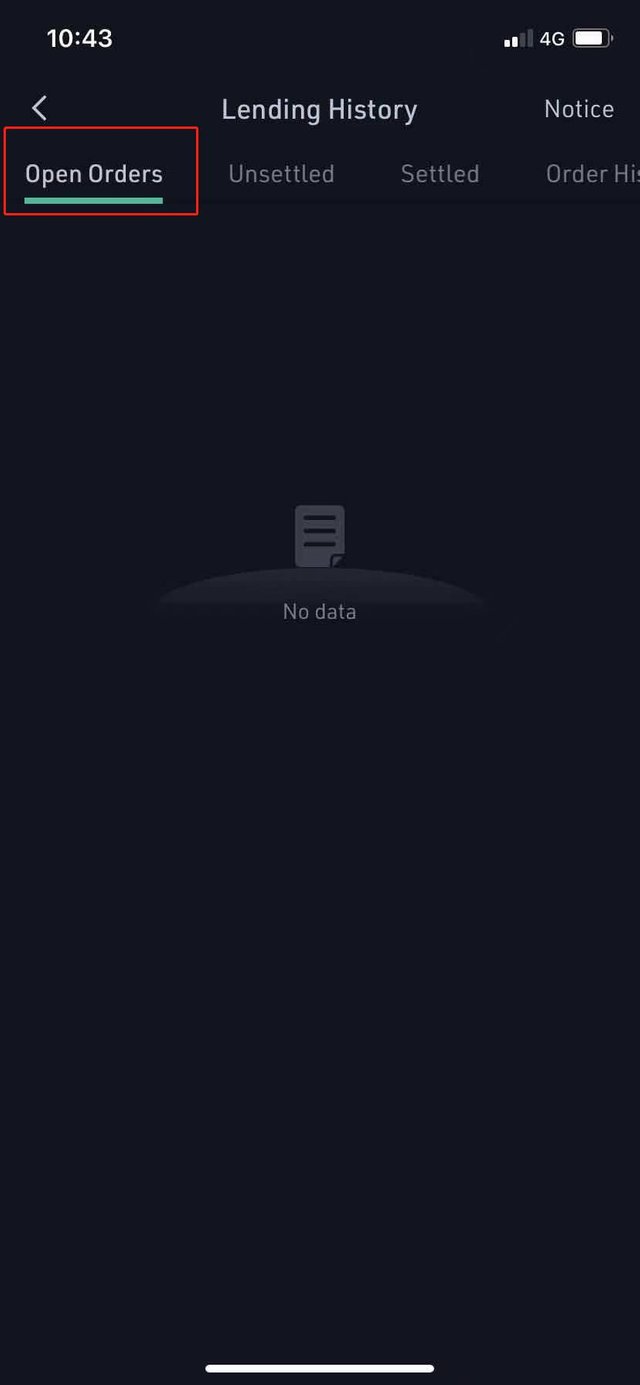

Step 5: After the lending order is placed, the order will enter the lending market. Wherein, it can be viewed in the Open Orders of the Lending History.

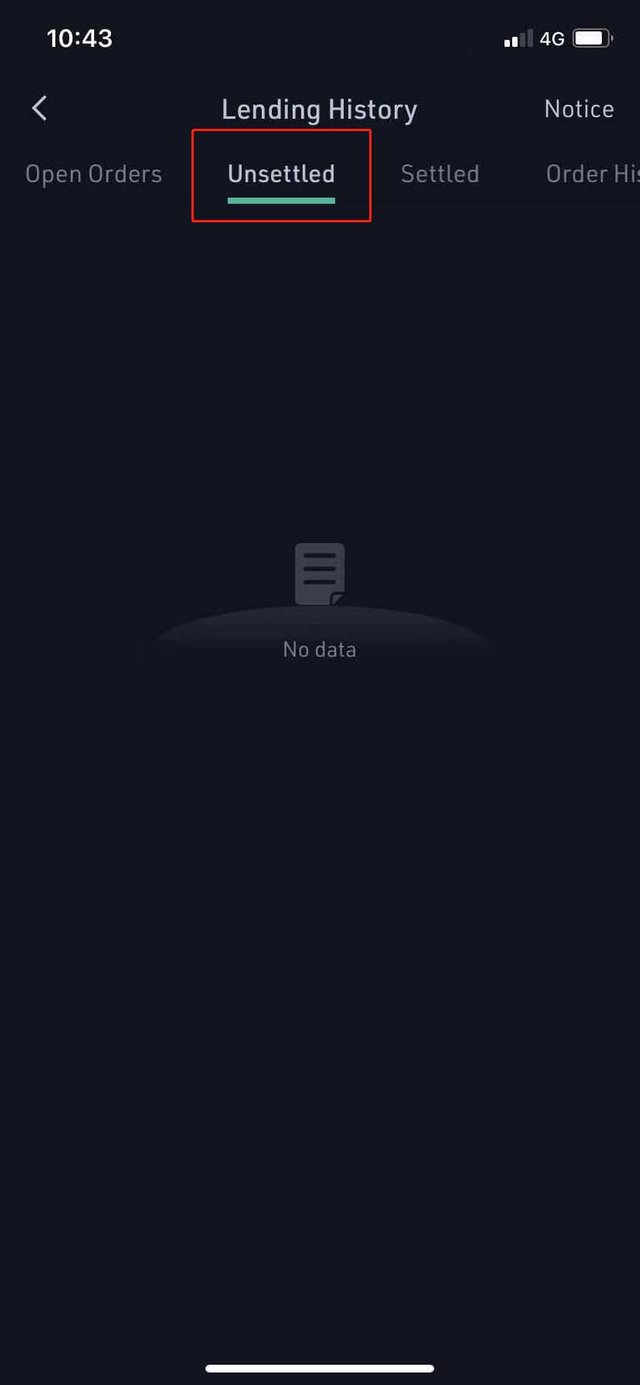

Step 6: After the order is taken, it enters the Unsettled page and becomes a loan.

Closing Thoughts

KuCoin Crypto Lending provides a more stable way to earn passive income with manageable risk. Return may vary depending on the market conditions while it’s still a good choice to make use of your idle digital assets.