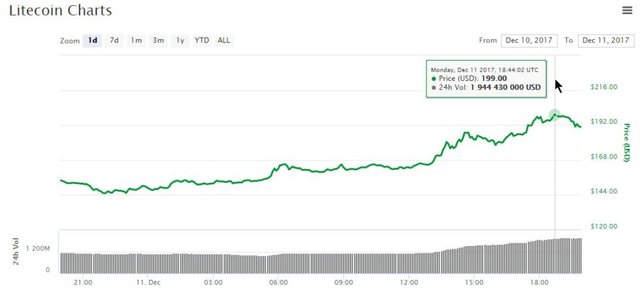

Litecoin is up more than 25% over the last 24 hours, and has reached a new all-time high of $199, according to data provided by CoinMarketCap.

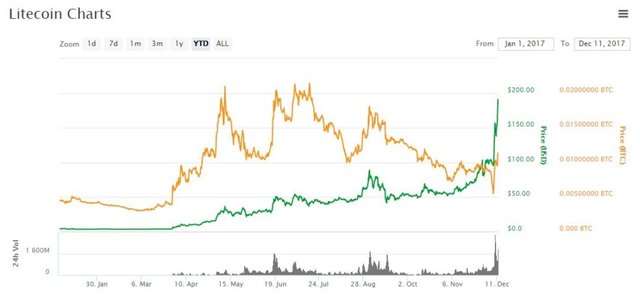

The crypto currency had begun the year at about $4.35 - its price had risen dramatically by more than 4300%.

It should be noted that the differences between the different trading platforms were rather small:

Charlie Lee, the creator of the Litecoin network, welcomed the capitalization of crypto-currencies, which exceeded $10 billion in the early evening:

But what factors can explain this sharp rise in the Litecoin price since the beginning of 2017?

1. The Litecoin benefits from the popularity of Coinbase

Coinbase has seen its number of users increase sharply this year. Last Thursday, the Coinbase application became the most downloaded app on the App Store in the United States - ahead of the giants of the web.

And unlike competing trading platforms such as Bittrex, Kraken or Binance, Coinbase only allows you to buy three encryption-currencies: Bitcoin, Ether and Litecoin. The latter has been offered on the platform since May, which seems to have helped it to quickly exceed the $30 mark.

Certain people who bought Bitcoins through Coinbase were certainly interested in this currency, which allowed them to diversify their digital portfolio.

2. The Litecoin will set up actions to make itself known

As its price increases, the Litecoin is increasingly mentioned on social networks.

At the same time, the Litecoin Foundation seems determined to promote the LTC among users and merchants in order to encourage its use.

Litecoin could thus be seen as an alternative to Bitcoin at some sites - such as Steam, for example, which recently decided to discontinue BTC payments.

3. The Litecoin network works perfectly well and allows you to benefit from reduced transaction costs

It should be noted that the Litecoin network handles more daily transactions than DASH, and has so far managed to avoid congestion. Some Bitfinex users would advise to use LTCs to make it easier to withdraw their digital money from the platform:

The reason? Fees are much lower than those found on the Bitcoin network: between 0.0015 LTC (approximately $0.30) and 0.00339 LTC (0.68 dollars):

The "Blocktime" (the time elapsing between the mining of each block) is 2.5 minutes on average, compared to 10 minutes for the Bitcoin. This means that transactions can be added more quickly in a block, allowing for quick transfers.

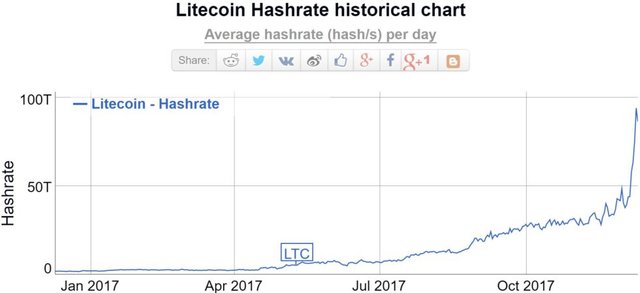

It can also be seen that the hashrate of the Litecoin network, i. e. the computational power allocated by the miners to the network, is increasing, which improves its safety.

4. While the price of Litecoin has risen significantly, it does so in a progressive and balanced manner.

The other nickname of the Litecoin? "The rock".

It owes this to the strong price stability, which has so far been very resilient to market fluctuations. With a close-knit community of "hodlers" convinced, the LTC has so far not been subjected to violent "dumps".

5. The Litecoin was a little behind schedule.

While the Litecoin is now in a very good position in the ranking established by CoinMarketCap, its price had remained well below 100 dollars for a long time.

He had been robbed of the spotlight this year by other currencies such as DASH or Ether. But the situation could be changing, as he is currently flirting with the $200 mark.

No, the Litecoin is not about to dethrone his big brother.

How does the Litecoin compare with other "big" crypto coins?

While Bitcoin is often perceived more as a store of value than a bargaining chip, due to the high transaction costs it entails, it must be borne in mind that the situation may soon change with the forthcoming arrival of the Lightning Network.

For their part, IOTA and Ethereum have not been designed to make payments - if they actually allow for the exchange of value, these technologies have different objectives.

The Litecoin has only one goal: to allow fast and inexpensive payments between individuals. And it seems to be fulfilling its full role so far.

But it is important to remain measured: the Litecoin is far from replacing the mastodon Bitcoin, which has a capitalization of nearly $300 billion.

It should also be pointed out that it is logical that the Litecoin should be more advanced than the Bitcoin: it is a fork of the digital money, introduced in October 2011, and intended to offer a faster and less expensive alternative.

It must be borne in mind that the Bitcoin was set up almost 9 years ago, in January 2009 - an eternity in this ecosystem - and that it is still alive and well, despite a technology that (logically) shows its limits.

However, it has many advantages for him: his notoriety (and his image of a "digital gold"), powerful network effects, as well as a "first mover advantage".

You will have understood: we are far from thinking that it is wise to resell the whole of its Bitcoins to bet everything on the Litecoin.

But we believe that, with a view to portfolio diversification, it may be interesting to place part of its "digital heritage" in other high-quality alternative crypto-currencies, of which the Litecoin is a part.

References : Cryptovest, Coinmarketcap, BlockCypher

Source: https://steemit.com/bitcoin/@tighilt/new-historical-record-for-litecoin-close-to-usd-200-here-are-5-factors-that-can-explain-this-increase

Not indicating that the content you copy/paste (including images) is not your original work could be seen as plagiarism.

Some tips to share content and add value:

Repeated plagiarized posts are considered spam. Spam is discouraged by the community and may result in action from the cheetah bot.

Thank You! ⚜

If you are the author, please reply and let us know!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for the analysis, I learned some things for sure.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit