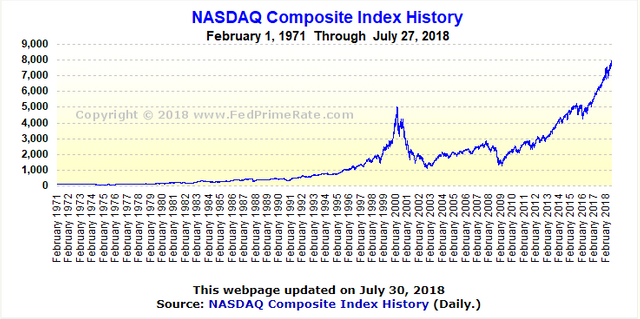

Ok, so global #crypto market cap graph looks just like the one for the #NASDAQ #dotcom bubble…but…NASDAQ came back with vengeance after the bubble burst early ‘00s

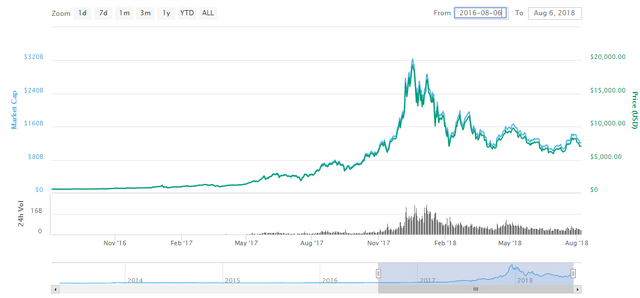

Here is the Crypto market cap graph for the past 2 years

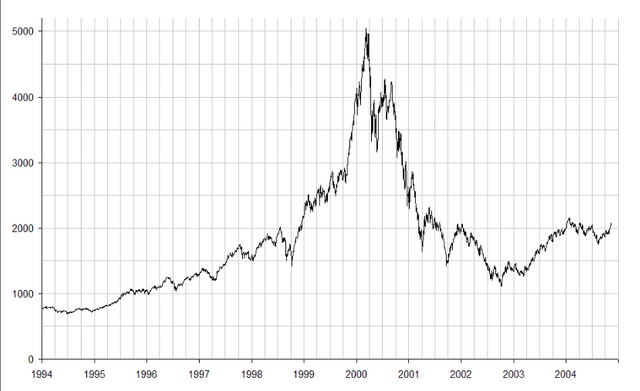

Here is the Dot com bubble for the ten year period between 1994-2004

I mean, history didn’t stop when the NASDAQ crashed…and it won’t stop now when BTC is still under heavy fire (60% of its value gone since the ATH).

Actually it took approximately 6 years for the tech index to start recovering and it did it even though we were hammered by the global financial crisis...

In the 8 year period between 1996-2003 the NASDAQ boomed and crashed

#Crypto initiated its march upwards in May 2017. The problem here is we still don’t know where the bottom is…

Let’s assume we find the bottom in November this year and #BTC hits $2000. Its cycle will still be 5 times faster than the DotCom’s rollercoaster.

Does it mean crypto will recover 5 times faster and it will take a little more than a year to register new highs?

Crypto is not linked to blockchain the same way Dot com was to the Internet. Blockchain can survive without crypto as it offers much more than decentralized financial system and payments.

We currently measure crypto by the value of all the cryptocurrencies in circulation, not the blockchain technology adoption.

#NASDAQ value is a the calculated value of its components, but again who could tell back then which companies were really adopting the Internet and which were just riding the wave….

My idea is, do we really think the current valuation method is the most appropriate one for crypto ?

Future Blockchain

https://medium.com/@futurebchain

Twitter: https://twitter.com/FutureBchain

Telegram: t.me/Future_blockchain

Facebook: https://www.facebook.com/cryptofuturenews/

Steemit: https://steemit.com/@tst643

You can also follow me on http://blockdelta.io