Bitcoin broke through six barriers in early trading once hitting a low of $625.30 and falling by nearly 13% in 24 hours. Other major cryptocurrencies also fell and the global market value of the cryptocurrency market shrank by $36 billion in 24 hours. According to analysis by well-known financial blog ZeroHedge Goldman Sachs previously announced that the plan to suspend the opening of the digital currency trading counter is the main reason for the plunging currency.

On September 1 there were 10000 BTC shorts in the trading market. Some investors believe that this empty order came from Goldman Sachs and was specifically sung in the days before Goldman Sachs announced the above news. But this is only speculation there is no evidence.

The RoninAI team monitored the abnormal signal of the plunge through AI (Artificial Intelligence) technology and considered that there were problems with market manipulation or insider trading.

The cryptocurrency market plummeted and there were 10000 BTC shorts a few days ago.

Yesterday evening according to BusinessInsider Goldman Sachs temporarily suspended plans to open a digital currency trading counter. Then the cryptocurrency market ushered in a wave of plunge and the market reaction coincided with the timing of the news of Goldman Sachs. According to the analysis of well-known financial blog ZeroHedge this is the main reason for the plunge.

According to Newsbtc on September 1 the overall market sentiment was positive and suddenly there was a short position of 10000 BTC in the trading market. Analysts questioned that unless the person knew some insider information the short position would not make sense.

Some people suspected that this person was from Goldman Sachs and the news of the opening of the digital currency trading counter at Goldman Sachs was made public and sang a few days ago. But this is only an investor's guess there is no evidence.

(Bitfinex exchange BTCUSD empty order quantity picture from the network)

Tracking anomalies before the crash with AI technology to provide evidence for market manipulation

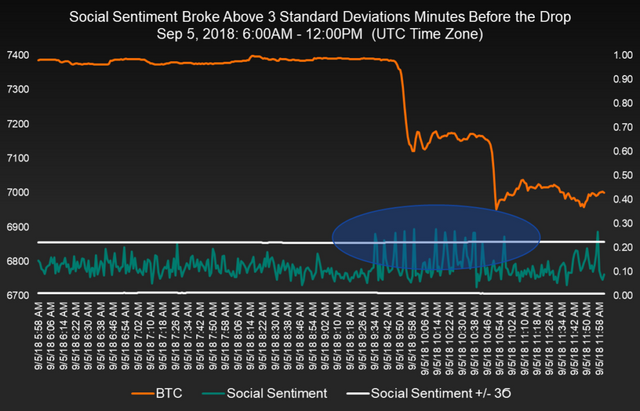

According to CCN data analysts from the RoninAI team carefully studied the plunge and found that their social sentiment indicators rose abnormally with a high probability of human factors.

RoninAI is an AI-based cryptocurrency signal platform that introduces features that reflect social mood swings.

The chart does not indicate bullish or bearish but an immediate response to “unreal” activities. Historical data suggests that social emotions above the standard deviation of more than 3 standard deviations are considered “unreal”. Earlier in the morning 10 to 15 minutes before the encryption market fell social sentiment exceeded 3 standard deviations which is enough to convince people of market manipulation or insider trading.

The RoninAI team believes that no matter who sells 10000 BTCs they must repurchase at some point and this may cause prices to rise sharply. But as for when to buy back it is not known. It is also impossible to predict how this event will affect the market in the short and long term.

Bitcoin short position to high position or into BTC reverse indicator

On September 1 BTC was relatively stable at the low level of 7000 US dollars and the short position of 10000 BTC was opened which made Bitcoin short position return to this year's high.

According to Newsbtc the data shows that the short position of Bitcoin has slowly increased since the beginning of February this year and reached the highest position in the year-to-date for the first time on April 9. At that time the BTC transaction price was about 7000 US dollars and the short position had nearly 38000 open positions. Position. In the month after the short position reached its mid-year high the BTC price climbed from $7100 on April 9 to nearly $10000 on May 5.

The analysis believes that the bitcoin shorts will reach this year's high point again or become a bitcoin reverse indicator.