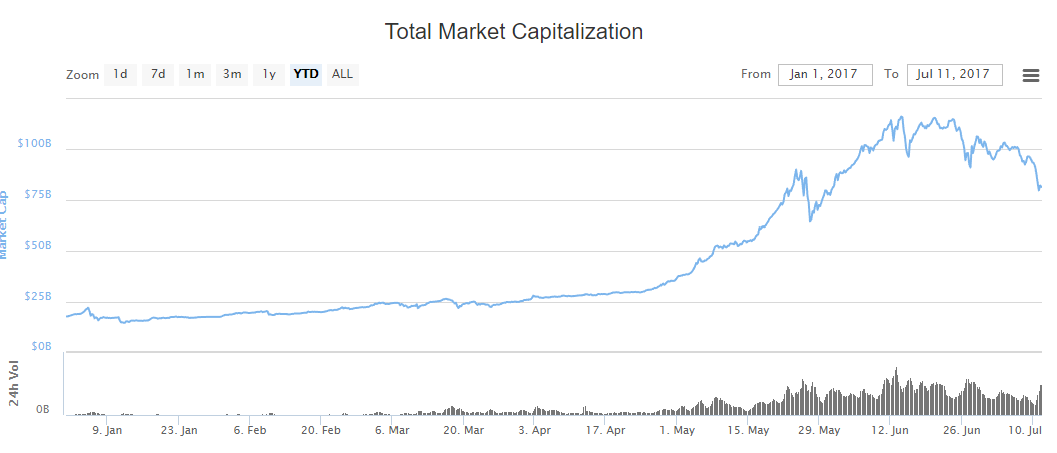

Looking for reasons to explain the recent price drop I began reading some cryptoeconomics stuff.

One of them got my attention, I read an article combining George Soros's theory on price reflexivity with Blockchain / crypto in general:

Excerpts from the article:

First of all, I want to make it very clear. Bipolar Markets is my own observation and theory based on:

the Theory of Reflexivity which belongs to George Soros;

my own observations of how different thinking participants act in capital market cycles;

annexing my understanding of the latter with my understanding of the function and affect of the Blockchain economically speaking.

Furthermore, I have personally used this theory to amass a colossal amount of wealth in a very, very short space of time over the past few years. I guarantee that before now you will never have heard the following before. I can only suggest that it may be worth trying to understand at least the jist of what follows (I am sympathetic to the fact it’s not easy stuff, however. You can just drop me an e-mail if you have further questions. I will try and answer within reasonable time,)

Introducing Reflexivity

Some time ago George Soros noted that market conditions are not really “equilibrium” (i.e. they don’t usually “revert to the mean”) but rather they are “reflexive” (i.e. they reflect the views of their participants). This is because of two thinking functions being in synch: the cognitive function and the manipulative function.

The cognitive function is supposed to be a neutral thinking function, assessing facts for what they are; the manipulative one however seeks to turn the fact into an advantage. If the cognitive thinking function of the mind is influenced by the manipulative function of the mind then the mind assesses neutrally what is in fact manipulated fact. Thus markets often reflect the views of the participants, not of the reality of the underlying economics.

Bipolar Markets

Now, onto my own observations. We can express the thinking of George Soros’s Theory of Reflexivity thus:

Either:

(Manipulative – Cognitive) = Reflexive (Positive Feedback Loop)

Or:

(Manipulative + Cognitive) = Equilibrium (Negative Feedback Loop)

Some of you are probably wondering why we start with the manipulative thinking function in the equation. After all, are we not cognitive thinkers first?

There are two reasons I have presented the equation this way round. First, as Soros points out, most of the time markets reflect the opinions of the players, not the fundamentals. Second, if we started with the cognitive thinking process then how would we establish the reflexive market condition? By adding in the manipulative function to the already cognitive function? Maybe – but the cognitive process is influenced by the manipulative process, remember. Further, it would make no sense to subtract out a meta-state of thinking that wasn’t already present in the equation; so if cognitive thinking was the only thinking present, we could not accurately represent it using the line (Cognitive – Manipulative) = Equilibrium; rather we would have to use the caption (Cognitive) = Equilibrium. But that is not at all what Equilibrium Value is. Equilibrium Value is a negative feedback loop; a feedback loop implies there are multiple variables.

Clearly, Soros is logically correct here in his assumption that despite the cognitive thinking function being the “neutral/natural” one, in reality our perceptions are mostly vastly distorted all the time by our state of mind and ambitions. (That’s especially true when it comes to making money, too.)

Specifically, what I realised some time ago is that in Ethereum or Blockchain markets in general, what is unusual is there is an artificial thinker involved as well as a natural thinker (human being).

In other words, the Blockchain is a basic form of AI since via performing its own calculation of equations (to make units such as Bitcoins for example) or enacting smart contracts, technology is suddenly thinking in an economic way (indeed this is the whole revolutionary aspect of the Blockchain).

Now, seeing as the Blockchain is created out of the natural thinker’s manipulative thinking process (i.e. there was a goal/purpose/reason for its invention) the Blockchain is always manipulative in mindset, and never cognitive.

So what happens when we annex markets wherein natural thinkers and artificial thinkers co-exist? Simply, we always get reflexivity (what Soros also terms “positive feedback loops” since the manipulative function is influencing the cognitive process of analysis in a positive way). We can express this thinking thus:

Either:

(Manipulative – Cognitive) + Manipulative = Ultra Reflexive / Double Positive Feedback Loop

Or:

(Manipulative + Cognitive) + Manipulative = Superficially Reflexive / False Positive Feedback Loop

These two are the natural states of bipolar markets. That is to say that either markets in digital currencies are bound in terms of self-perpetuating self-reinforcing states of reflexivity, or they are simply self-perpetually reflexive. Bipolar markets reflect the psychiatric term from which their namesake derives and can be compared to the two psychiatric states of bipolar thinking in the following ways:

Double Positive Feedback Loop = Bipolar I which is defined by manic episodes that last at least 7 days, or by manic symptoms that are so severe that the person needs immediate hospital care.

False Positive Feedback Loop = Bipolar II which is defined by a pattern of depressive episodes and hypomanic episodes, but not the full-blown manic episodes described above

Bipolarity: Wherein Artificial Thinkers Self-Perpetuate Reflexivity

Thus, just as for Bipolar Markets, there can be no intrinsic value at all present: the concept is a logical fallacy. Notice what we are saying here: because of the ever-present artificial thinker (the Blockchain) whether via addition of the manipulative thinking function or the implied subtraction of the cognitive function the feedback loop is either always double positive or what we may call “false positive” (in the sense that the natural thinker’s cognitive–negative balance is subtracted by the addition of the Blockchain’s manipulative thinking status). In other words, in bipolar markets the natural state of thinking at rest is not cognitive but rather it is always inherently manipulative! The concept of Bipolarity and the conclusion that there is always reflexivity present is ground-breaking. Here Is What All This Means:

Concepts we used to think of as fundamental economically speaking no longer apply in these contexts

equilibrium in digital currency markets is nothing but a theoretical fantasy as it cannot exist unless there is uni-polarity (which there isn’t)

As a result of equilibrium being non-existent, “reversion to the mean” cannot be attained as there is no “mean” (merely bipolarity, with at best two kinds of “mean”, one being natural and one being artificial)

As a consequence of no “mean” pricing structure there is no “bubble” therefore nor is there over- or under-valuation of asset prices – since if there is no equilibrium, no mean, and no reversion but rather pure reflexivity only, there is never a bubble in asset prices as the variable required to validate its existence is absent (a bubble, remember, can only be so when referred back to equilibrium)

It seems in the case of digital assets that in place of equilibrium there may be some sort of “optimised cost”, which is best understood as the value at which each user on a network represents given the growth exponent of the network, but this is an entirely different thing to saying there is equilibrium present.

I am not of course suggesting that digital asset prices will never drop. Rather, what I am saying is that the innovation in and of itself has fundamentally radically altered the laws of economics, at least in its own sui-generic sense. Just as for a bipolar patient, we really don’t know what the consequences of introducing this concept to society and economy is, but they are certain to require a different mind-set and approach to normal markets.

So..

This would suggest that the current price drop is based on a feedback loop driving fear in the markets; or at least that's how I interpreted this theory. What are your thoughs?

*article can be found here: https://www.coinspeaker.com/2017/06/11/heres-bitcoin-ethereum-can-never-bubble-no-really-digital-bubbles-impossible/

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.coinspeaker.com/2017/06/11/heres-bitcoin-ethereum-can-never-bubble-no-really-digital-bubbles-impossible/

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit