Bitcoin is a great example of a speculative asset given its high transaction fees and the low speed thereof. Therefore it's no wonder that BTC's value depends solely on the way people subjectively perceive its future potential or monetary value.

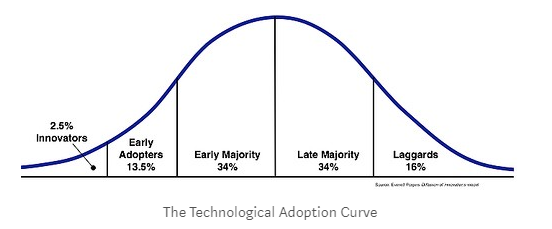

The technological adoption curve depicted above is directly related to speculation/application interdependency. The second and third stages (early adopters and early majority) are all about speculation as the underlying asset needs some propelling demand from the public to skyrocket in the market. What inevitably happens next is that the implication can in no way manage the speculated, bubbled price and expectations of the public causing the price to drop, more often than not, to plummet.

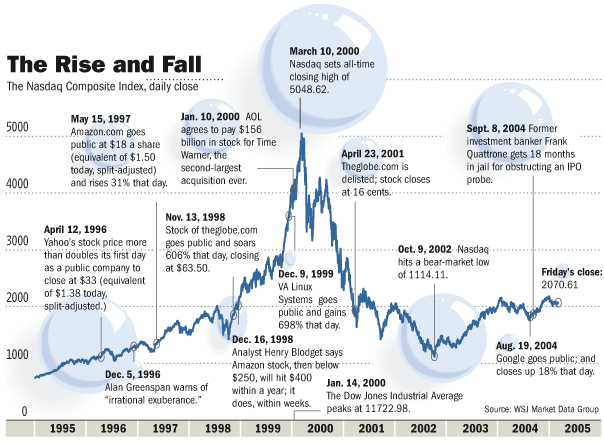

We all know the first market bubble in history - the Dutch Tulip Bubble when tulips prices exploded in the 1630s. Some historians say that the prices rose by at least 2,000% within the timeframe of 4-5 months, the increase which was then followed by a 110% drop. The same goes for Japanese real estate and stock market bubble and dotcom bubble. You can learn more about the timeline here.

Between 2000 and 2002 the internet companies market has lost over $5 trillion in valuation. Only about half of internet giants have survived the crash. We're not going to tamper one more time why it happened, but rather will explain what fundamental differences that bubble had compared with the crypto market. Look forward to the final part of our story coming tomorrow. And take a unique chance to enjoy legally compliant and centralized, yet fee-free trading on VHCEx.