STARTER INFORMATION

To say blockchain is a fast growing technology is an understatement — it’s actually the fastest growing innovation right now. For the most part, blockchain has disrupted quite a number of sectors chiefly payments and financial institutions. Of course, the biggest draw of this technology is its ability to offer efficiency and unmatched transparency; both of which are lacking in most of our traditional systems. What’s more, being able to transact with other users in a trustless and secure manner is huge.

In relation, DeFi has seen an great rise of interest in the past few months in the crypto space generally. For lots of investors and cryptocurrency enthusiasts, the interest lies in its ability to offer a preferable way to earn profits with a fraction of the investment they would need to make otherwise. Decentralized Finance, popularly known as DeFi was at the fore front of crypto trend tables in 2020 and it is still gaining great recognition Decentralized finance basically describes blockchain based protocols and applications that work to create an alternative financial system intended to takeover the current centralized one.

With that being said, BucksCake aims to offer the users decentralized financial system by offering decentralized, more transparent and economically viable blockchain-based services in place of the services traditionally provided by centralized institutions.

Now that I have your attention, let’s get right to it.

What exactly is BucksCake?

As depicted above and as indicated on the official website of BucksCake, BucksCake aims to offer the users decentralized financial system by offering decentralized, more transparent and economically viable blockchain-based services in place of the services traditionally provided by centralized institutions.

In addition, Buckscake Decentralized Finance (DeFi) platform enables users the opportunity to make profits from Staking, Yield Farming, and Cloud Mining on buckscake's unified platform eradicating any fear of losing their assets. The privacy of platform users' funds is a top priority to the developer of the project. With great importance placed on the community the developing team sees the community has the key driver of their growth. With this it absolutely means that the platform will be delivering high-quality, decentralized financial services, stable platform, accountability, and ease of usage for all members of the community.

BucksCake has an exceptional power to redefine the view of all investors in the World of DeFi in a way that offers the best services ever in terms of earning money through staking , yield farming and cloud mining on the platform with simply zero risk of loosing their investments.

The Features

Ultra-liquid

Consumers are involved in putting their tokens with Uniswap's liquidity provider. Credits from these tokens are being farmed. The proportion of such commissions shall be allocated according to an independent policy, such as the liquidity of the LP token, and shall be transformed into (ETH-BKC) buybacks (increasing the price). Any bought tokens of the BKC will be sent to the stakers/farmers.

Inflation Proof

The BKC has a clear effect on each token. Any time the BKC token is exchanged, the farmers are paid a small reward. This mechanism of work promotes planting and farming. The maximum number of BKC tokens is 450,000. And there's never going to be any like them.

Community control

BKC holders would be allowed to vote on different plans as long since they have a share of liquidity in the pools. The Group can decide anything from developer charges and site construction to connections to unique farm choices.

About The BKC Token

BKC is an ERC20 token that is used with any service offered at BucksCake. The total supply is 450,000 tokens of BKC. This token is based on the Ethereum Blockchain (ERC-20) technology so that it allows various processes to be carried out automatically through Smart Contracts, Carrying the concept of Deflational and Burn Scheme ensuring the value of this token increases because supply will continue to decrease.

Holders will get various benefits when using this token such as Passive Income Stream from Yield Farming or Staking and Cloud mining, Maximizing profit with lower risk. This token is also ready to be implemented on the Ethereum 2.0 network which will be launched later, making it one of the Pioneer DeFi on the Ethereum 2.0 network in the crypto market.

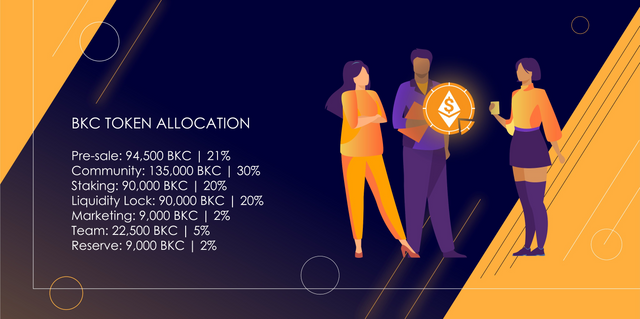

Token Allocation

Pre-sale: 94,500 BKC-21%

Community: 135,000 BKC-30%

Staking: 90,000 BKC-20%

Liquidity Lock: 90,000 BKC-20%

Marketing: BKC 9,000-2 percent

Team: BKC 22,500-5 percent

Reserve: BKC 9,000-2 percent

Token Staking

The BKC sketching protocol enables users to participate in ETH, WBTC, USDT, DAI, USDC, BNB(ERC20), and, yes, BKC utilizing a dedicated Stake DApp. Users may explicitly manage their own tokens through a locking time of 72 hours. You will find the BKC Stake DApp at ssilka Unlike other outlets, BKC provides a fixed percent return on its staked investments rather than an initial high APR, which typically decreases over some time.Initial deductions ensure long-term continuity with the existing state of the token framework and a limited sum of BKC 450,000 since there is no mint clause in our token contract.

Yield Farming

Yield Farming, or as some call it Liquidity Mining, is the main pillar of DeFi’s advancement in the blockchain space. Yield Farming is a way to accumulate income from invested funds. BKC Farming allows you to earn rewards for providing liquidity in various liquidity pools. Users will be provided with guaranteed payouts from Uniswap commissions. The amount of the reward depends on the number of tokens provided for the liquidity of the pool. The more members join the pool, the less each member will receive in the long term. When you add liquidity to the pool, you receive a UNIv2 (BKC-ETH) token for the wallet you use to add liquidity. This token is your access to the current farming pool on the BKC platform.

Vault Returns

User A’s Share: (UNI-V2 deposited by you I contract total balance of UNI-V2) For example if there are 9000 UNI-V2 (BKC/ETH) Pooled tokens in this Vault, and a user deposits 1000 UNI-V2. The contract’s total balance of UNI-V2(BKC-ETH) Pooled tokens becomes 10,000. And User A’s share now is: 1000 / 10,000 = 10 % If user “B” deposits 10000 more UNI-V2(BKC-ETH) Pooled tokens to this vault, the contract’s total balance of UNI-V2(BKC-ETH) Pooled tokens becomes 20,000. User A’s new share becomes: 1000 / 20,000 = 5% If 200 BETH2 tokens are distributed to this vault per month, User A’s earnings would be 200 x his share in % At 5% share, the earnings would be 200 x 5% = 10 BETH2

ROADMAP

Q1

BKC Creation Pre-sale

Staking and Farming Pool launch

Marketing Liquidity Lock

Listing on Exchanges

Cloud Mining Launch

Q2

Marketing

Audits

ETH 2.0 Staking

BKC Burn & Buyback

Q3

Audits

New Partnerships

E-commerce

Farming Expansions

Q4

Partner / Marketing

Outreach

Idea / Project Conception

Product Research

Audits

Disclaimer: This article was published in terms of the bounty campaign. I am not a project team member or its representative but a supporter of this incredible project.

Be a part of this incredible project. Download the whitepaper for the full scoop.

Till next time…

For more information, please visit:

Website: https://buckscake.com

Whitepaper: https://buckscake.com/whitepaper.pdf

Twitter: https://twitter.com/bucks_cake

Telegram Group: https://t.me/BucksCakePublicChat

Telegram Channel: https://t.me/BucksCakeHub

Bitcointalk Username: Cryptoholical

Bitcointalk Profile Link: https://bitcointalk.org/index.php?action=profile;u=2487106

Telegram: @Cryptoholical

ETH Address: 0xF3f7b9c45864006DBd1571De53d5847C0d11438c