The combination of automatic rewards, compounded staking, and decentralized decision-making ensures that BUIDL is not just another fleeting project. Instead, it promises a stable and rewarding experience for users, making it an ideal choice for both novice and experienced crypto investors. Let's dive into how BUIDL’s autostaking protocol and transparent governance system work together to ensure long-term growth.

Unlike many projects that focus on short-term gains, BUIDL is committed to long-term value creation through its innovative autostaking protocol and transparent governance structure. By addressing key challenges like volatility and scalability, BUIDL offers a DeFi ecosystem that thrives on sustainability and trust. In the dynamic world of decentralized finance (DeFi), one project that stands out for its approach to sustainable growth is BUIDL.

What is BUIDL's Autostaking Protocol?

BUIDL's autostaking protocol is a game-changing feature that automates the staking process for users. Rather than requiring users to manually stake their tokens, BUIDL’s system automatically locks their tokens into staking, generating rewards continuously. This passive income model is one of the key reasons BUIDL stands out in the DeFi space.

Every 60 minutes, the tokens held by users are compounded, meaning that holders don’t need to take any action to increase their token balance. The rewards accumulate automatically, providing users with a growing portfolio without requiring them to constantly monitor their investments.

This process is powered by a positive rebase formula, which increases the number of tokens held by investors at regular intervals. The result is a fixed, high Annual Percentage Yield (APY) of 526.5%, which is one of the most attractive offers in the industry.

How BUIDL Ensures Sustainable Growth Through Autostaking

The sustainability of BUIDL's autostaking protocol is built on several key factors, each designed to contribute to the long-term growth of the project and ensure that users’ investments are protected.

Rebase Rewards: The key to BUIDL’s autostaking protocol is the hourly rebase, where the holders’ balance grows every 60 minutes. This continuous compounding effect helps maintain a steady accumulation of wealth for users, creating a reliable stream of passive income.

Liquidity Stability: To ensure that BUIDL tokens remain easily tradable, a portion of each transaction fee is directed towards the liquidity pool. This automatic liquidity provision helps maintain the stability of the token’s price and ensures that the market remains liquid, even during periods of high trading volume.

Burn Mechanism: Every transaction on the BUIDL network also has a burn feature, where 1% of the transaction fee is burned, effectively reducing the circulating supply over time. This deflationary mechanism not only helps reduce inflation but also contributes to the long-term value of the token as the total supply decreases.

Risk-Free Value (RFV): The RFV fund plays a crucial role in the sustainability of the protocol. By redirecting 5% of buy fees and 6% of sell fees to this fund, BUIDL helps stabilize the rebase rewards. The RFV ensures that even during market downturns, the rewards system remains intact and investors continue to benefit from their holdings.

These mechanisms work together to ensure that BUIDL’s ecosystem can grow sustainably, even as the demand for the token increases. Unlike many other DeFi projects that rely on speculation or unsustainable yield farming schemes, BUIDL has crafted an approach that maintains a balance between rewarding its community and protecting its long-term growth.

Transparent Governance: Giving Power to the Community

Transparency is one of the most critical aspects of any DeFi project. For BUIDL, governance is not just about building a technical system—it’s about creating a decentralized and community-driven project. The governance model ensures that token holders have a voice in the future direction of the project, giving them the power to shape key decisions.

BUIDL employs a decentralized autonomous organization (DAO) model, which allows token holders to participate in governance proposals, vote on key decisions, and contribute to the evolution of the ecosystem. This system ensures that no single entity or group has too much control over the project, and that all decisions are made transparently.

Some of the decisions that the community can vote on include:

Protocol Updates: The community can vote to upgrade or modify the staking mechanism, rebase rewards, or tokenomics.

Partnership Proposals: Token holders can decide which strategic partnerships BUIDL should pursue in order to expand its ecosystem.

Fee Adjustments: The DAO can vote on changes to transaction fees, such as adjusting buy/sell tax rates or increasing allocations to liquidity pools.

This decentralized approach to governance ensures that BUIDL remains aligned with its community’s interests and needs. It fosters a sense of ownership among token holders and encourages long-term participation in the ecosystem.

Why Transparency in Governance is Key for BUIDL

A transparent governance system is essential in the DeFi space for several reasons:

Accountability: By involving the community in decision-making processes, BUIDL ensures that all actions taken by the team are transparent and accountable. Token holders can easily track what is being voted on and how their votes impact the project.

Trust: Trust is paramount in any decentralized project. With BUIDL’s governance, token holders can trust that decisions are made fairly, with the community’s best interests in mind. This helps build a strong and loyal user base, which is essential for long-term growth.

Resilience: As the DeFi space evolves, BUIDL’s decentralized governance model allows it to adapt to changes in the market, regulations, or technology. The community-driven nature ensures that the project can pivot when necessary, allowing it to remain competitive in a rapidly changing environment.

Community Engagement: Giving token holders a stake in the project’s future increases community engagement. When users have a say in the direction of the project, they are more likely to remain invested, participate in governance activities, and promote the project to others.

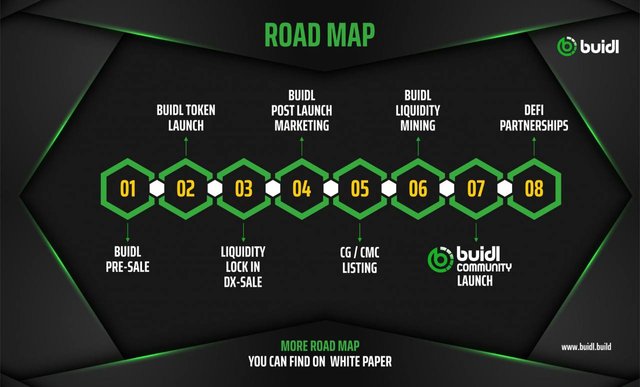

BUIDL’s Roadmap: Planning for Future Growth

BUIDL’s long-term strategy focuses on expanding its ecosystem and integrating more advanced features that will benefit token holders. The roadmap outlines several exciting developments, including plans for:

Yield Farming: While BUIDL’s autostaking protocol offers substantial passive income, yield farming will offer another avenue for token holders to earn rewards by participating in liquidity provision.

Enhanced Governance Features: As the project evolves, BUIDL plans to enhance its governance model by introducing more ways for token holders to get involved, such as delegating voting power or integrating more complex voting mechanisms.

Cross-Chain Integration: BUIDL is also exploring the possibility of integrating with other blockchain networks, which will allow users to stake and earn rewards on multiple chains, increasing the project’s reach and liquidity.

These developments are a part of BUIDL’s commitment to ensuring sustainable growth and providing its community with more opportunities to participate in and benefit from the ecosystem.

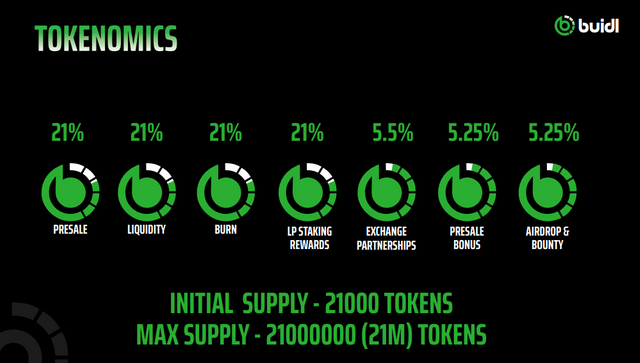

The Core Principles Behind BUIDL’s Tokenomics Model

At its core, the tokenomics of BUIDL are designed to reward long-term holders while creating a sustainable ecosystem that balances growth with stability. One of the standout features is its elastic supply model, which rewards holders with automatic interest every hour. This mechanism not only provides passive income but also ensures that as more users join the BUIDL network, the value of the token can appreciate steadily.

The total supply of BUIDL is capped at 21 million, aligning with the principles of scarcity, similar to Bitcoin. With an initial supply of just 21,000 tokens, BUIDL operates on a low initial token count that leaves room for controlled growth. As the supply grows, so does the potential value of each individual token, making it an attractive option for long-term investors. This deflationary system ensures that as demand for BUIDL tokens increases, their value will likely rise due to the token's limited supply.

In the end, BUIDL’s autostaking protocol and transparent governance model are key factors in its approach to sustainable growth. By focusing on long-term rewards, community participation, and scalability, BUIDL is positioning itself as a project that offers real value to both new and experienced investors. With features like automatic compounding rewards, liquidity support, and a decentralized decision-making system, BUIDL is laying the foundation for a successful, resilient, and community-driven DeFi ecosystem.

Learn more and update:

Website : https://buidl.build

Twitter : https://x.com/buidlbsc

Telegram Group : https://t.me/buidlbsc

Telegram Channel : https://t.me/buidl_bsc

Writer Information:

Username: ApolloRolonVerduzco

Profile Link: https://bitcointalk.org/index.php?action=profile;u=3401417 Wallet Address: 0x62695A63B3108D60249EF97903CA21500E0434f5