The Problem with Traditional Investments

Traditional investments such as stocks, bonds, and mutual funds often require a significant amount of time, knowledge, and attention. Investors have to regularly monitor market conditions, analyze financial reports, and make trading decisions based on complex metrics. Furthermore, the returns on these investments can be unpredictable and sometimes, especially in volatile markets, quite minimal.

In contrast, cryptocurrency investments offer multiple advantages but not without their drawbacks. While cryptos have the potential for high returns, they can also be highly volatile. Hence, there is a growing demand for more stable and predictable investment opportunities within the crypto space.

The cryptocurrency market can be a complex and sometimes intimidating space for new and experienced investors alike. With fluctuating prices and the constant emergence of new projects, finding a reliable investment can seem challenging.

This is where Buidl steps in, offering a solution that minimizes risk and maximizes returns through its unique protocol. However, the Buidl platform aims to turn this uncertainty into an opportunity for financial growth through its innovative DeFi protocol – Buidl Autostaking Protocol (BAP).

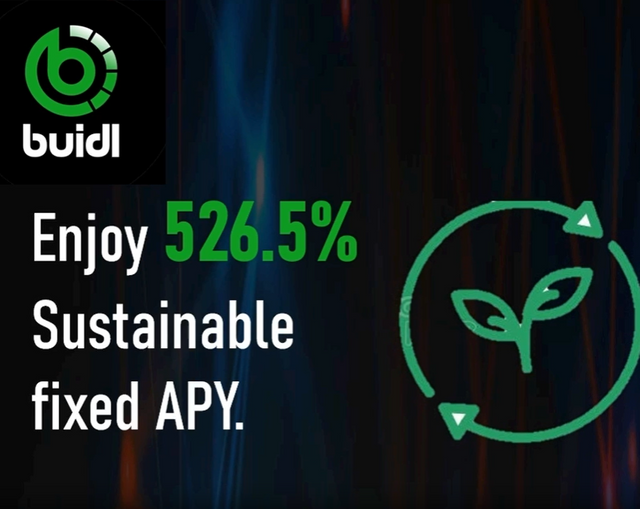

Understand OF BUIDL - Buidl is revolutionizing the decentralized finance (DeFi) sector with its Autostaking protocol, known as BAP. Buidl provides users with a seamless way to grow their crypto portfolios simply by holding the Buidl token. The protocol offers a sustainable fixed APY of 526.5%, with rewards rebased every 60 minutes. This means investors can experience a portfolio growth simply and efficiently, without the need for constant monitoring or complex trading strategies.

Tokenomics and Mechanics Behind Buidl

The ecosystem of Buidl is driven by its native BEP-20 token, $BUIDL. Designed with an elastic supply, $BUIDL rewards its holders through a positive rebase formula. Let’s delve deeper into how the tokenomics of Buidl contribute to its success.

Initial and Maximum Supply

Buidl initially launched with a supply of 21,000 tokens, a figure drastically lower than Bitcoin’s initial supply. The total maximum supply is capped at 21,000,000 tokens, ensuring a controlled and scalable distribution over time. With no team tokens at inception, Buidl places all emphasis on community and investor fairness.

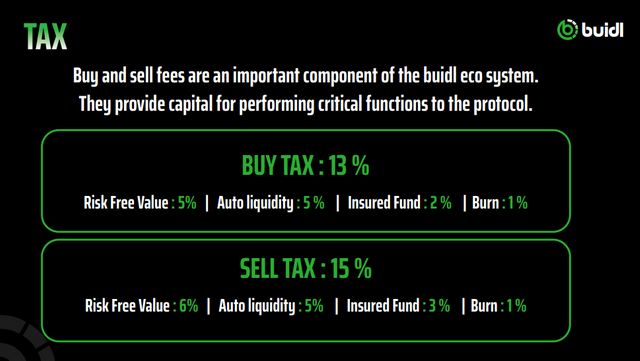

Taxes on Transactions

To sustain its ecosystem, Buidl implements a modest tax on transactions. When purchasing $BUIDL, a 13% tax is applied, which is distributed as follows:

- 5% to the Risk Free Value (RFV) fund to sustain rebase rewards.

- 5% to automatically add liquidity.

- 2% to the Buidl Insurance Fund (BIF).

- 1% is burned to control inflation.

Conversely, selling $BUIDL carries a 15% tax, allocated as follows:

- 6% to the RFV fund.

- 5% to automatically add liquidity.

- 3% to BIF.

- 1% is burned.

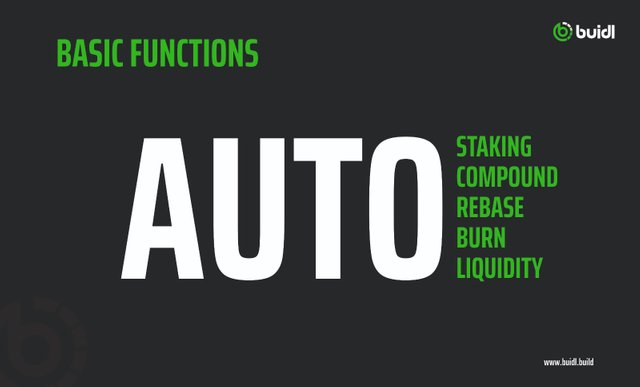

How It Works: Growing Your Portfolio Efficiently

One of the hallmarks of Buidl is its simplicity. The main mechanism through which users benefit is the effortless buy-hold-earn system. By merely holding $BUIDL in your wallet, positive rebase rewards are issued automatically every 60 minutes. In practical terms, this means your holdings increase by 0.021% each hour.

Auto-Compounding Rewards

The protocol also leverages auto-compounding to enhance returns. This process works by automatically reinvesting the earned interest, which in turn earns more interest, thus utilizing the power of compound growth in a fully automated manner.

Buidl’s innovative approach doesn’t stop with auto-compounding. The platform ensures investor protection and the long-term sustainability of rewards through several features:

- Risk Free Value (RFV): A significant portion of transaction fees both from buys and sells is redirected into the RFV fund to maintain the rebasing rewards over time.

- Automatic Liquidity Provider (LP) Contributions: A fixed percentage of transaction fees is automatically fed back into the liquidity pool, cementing Buidl’s market stability and liquidity.

- Buidl Insurance Fund (BIF): This fund acts as a safety net for investors, helping to curb potential market impacts and stabilize returns.

Potential Earnings: A Look at the Numbers

An initial investment of $1000 in $BUIDL can yield impressive results thanks to its 526.5% APY. By the end of one year, such an investment could potentially grow to $6265.01, assuming the RFV fund sustains the rebase reward throughout the year. This predictable return, calculated on a daily rebase interest, makes Buidl an appealing option even for cautious investors.

In the end, #BUIDL offers a unique and innovative approach to crypto investments through its fixed APY and hourly rebase rewards. With robust tokenomics, seamless auto-staking and compounding mechanisms, and a focus on sustainability and investor protection, Buidl stands out in the crowded DeFi space. By simply holding $BUIDL tokens in your wallet, you can watch your portfolio grow automatically, steadily, and securely. Whether you are a seasoned investor or a crypto novice, Buidl provides an accessible and highly rewarding financial growth opportunity.

Learn more and update:

Website : https://buidl.build

Twitter : https://x.com/buidlbsc

Telegram Group : https://t.me/buidlbsc

Telegram Channel : https://t.me/buidl_bsc

Whitepaper: https://buidl-token.gitbook.io/buidl-token

Writer Information:

Username: Toma Bedrac

Profile Link: https://bitcointalk.org/index.php?action=profile;u=3447738

Wallet Address: 0x279FC23B453Bb94A8b6B04890981AaB8C874B1F0