This is Why I'm Bullish on Crypto Currency

Part 1 in a series of why I think it's time to invest in Crypto Currency.

The Crypto Economy solves major flaws in the Global Economy

The Crypto Economy will be worth trillions of dollars, and much sooner than we expect, because it provides a very important utility that has the potential to solve two major flaws of the Global Economy: (1) Transactions are expensive and slow and (2) to send money anywhere you need to go to a bank or transfer services. We will discuss the flaws, then highlight how Crypto currency provides the solution: transactions on the crypto network are fast, cheap, decentralized, and secure.

Transactions today can be expensive and can take hours to complete. For example, "wire fees," the fastest way to send money, range from $10 to $50. Banks charge fees for both sending and receiving wire transfers. Nerd Wallet. Essentially banks are the George Castanza of double dipping – they dip the way they want to dip, and we’ve got no choice in the matter. Nobody wants to invite the double dipper to the party.

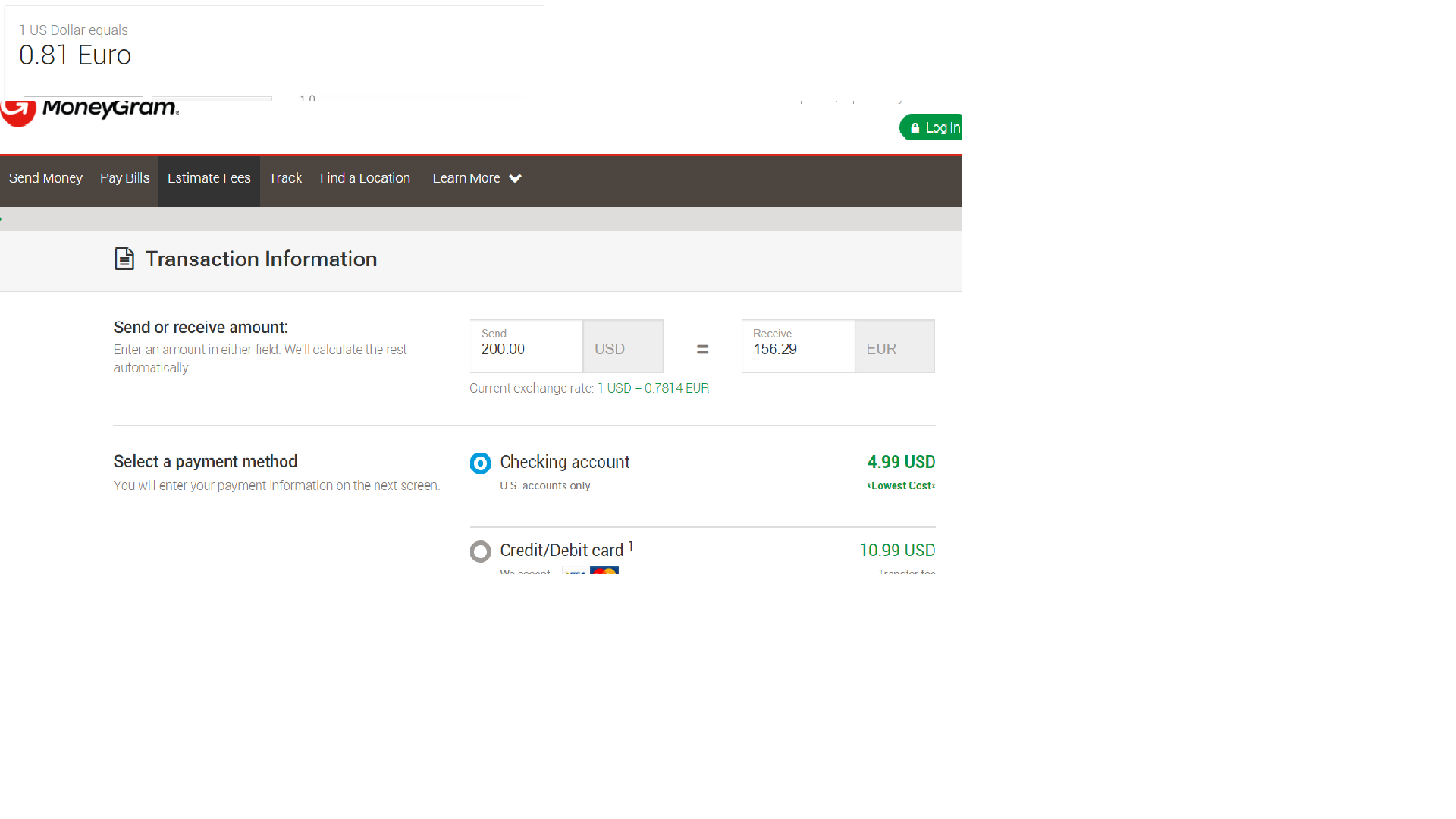

Sending money internationally is especially expensive. The average fee for an international money transfer? $43!. And if you need an exchange from your currency to a different one, you're probably paying either a percentage of the transfer, or at an exchange rate slightly below the market exchange rate. For instance, as an example I just entered a sample transaction for sending money to France. The cost was $6 to send, and the exchange rate was about 4 cents less per dollar than the going market rate. If I sent $200 cash, they would receive 155 euro.

All transactions, and especially international transactions, require the third party to transfer currency. As we saw above, the banks and payment services charge high fees for merely having the established channel of exchange. Every international transaction cannot exist on its own - there needs to be an intermediary. This flaw is massive and there has not been much of a solution. These flaws are more pronounced when a person wants to send small amounts overseas. Imagine that you needed to send $200 to a relative in a different country. You would have $200 to send, but they would receive a significantly less amount.

This flaw is even worse for international business deals. The business doers have to pay exchange rates, to get their profits back in the currency they desire. Exchange rates command a high fee, and are a percentage of the amount of money transferred, or the exchange rate is executed at a rate favorable to the bank. This percentage based fee is especially true for people transferring money to people in different countries. This service is often slow. When it's fast, it costs even more. So it is fair to say the global economy today suffers from high fees and slow transactions. Therefore, the fungibility of an individual nation's fiat currencies are not well suited for a truly global economy.

This flaw has been exploited for a long time by major institutions to the tunes of trillions of dollars, collecting fees on merely making transactions between international parties. Essentially, because the bank is required for the exchange, they can charge whatever they want to, just for performing a relatively basic service.

Of course, cash transactions are an exception to this rule, but rare is the direct cash transaction between party to party on an international scale (i.e. cash of the same currency).

When you have a third party in the deal, this is called "centralization" because you have to use some sort of central service – an intermediary - you can't exchange directly between two people. The crypto economy actually aims to solve these problems. What if we all used the same currency on a global scale? What if people could send money directly to each other without having to use an intermediary, a centralized bank, that will charge transaction fees? Removing the intermediary from the equation results in lower fees to transfer.

To illustrate this, Tom has a factory in China that produces fidget spinners. He produces 1 million fidget spinners per year. Tom is able to sell 500,000 of these spinners to one major Chinese retail chain of toy stores. The Chinese buyer pays Tom in yuan. However, Tom lives in America, and wants his payment in USD, because Tom wants to use his profits to buy a house in America. Tom has to use his bank's transfer service, and they charge him a 3% fee to exchange the yuan to USD. Tom's profits are immediately cut by 3%, and that 3% goes to the bank, the intermediary. The intermediary charges this fee although their actual cost is close to zero. They receive a hefty banking fee, because Tom has no other real option. Tom finally discovers that the bank's fee is a percentage of his total dollars, but the bank's actual cost for the transaction is actually very low – it's the price of electricity! Tom wishes there was a way to avoid this 3% charge. So, Tom has the remaining 500,000 fidget spinners to sell, but instead of listing on a marketplace like Alibaba or Amazon, which charge 17% transaction fees to process payments, he heard about this new bitcoin thing. So he sets up his own website with his public bitcoin wallet, and accepts bitcoin as payment. Tom even goes as far as to establish a smart contract, so when he gets paid bitcoin it starts an automated transaction –the computer prints a shipping label and processes the order to his factory. Tom even includes a small fee of bitcoin in the price to cover the "gas fee" of sending bitcoin. Because of bitcoin, Tom has been liberated from the high conversion fees of the third party bank, because he is receiving bitcoin directly to his bitcoin wallet. Tom no longer needs to convert to USD. Tom is also liberated from having to sell on a marketplace which charges 17% fees for processing the transaction. Also, customers are happy too - Tom reduced the price of his fidget spinners on his website, since he doesn't have to account for the increased overhead of third parties. Tom winds up being super competitive over the other fidget spinner sellers. Tom's business is booming, and Tom is even more pleased because he can put his down payment on the house with bitcoin, because the seller of the home also has a bitcoin wallet and is willing to accept it.

Crypto Currency solves the two flaws with one fell swoop. Crypto Currency allows you to send more money (because you're saving on fees) and also allows you to send directly to the recipient without having to wait for a bank to process the transaction. All you need is their wallet address to send money.

Because of the crypto economy, high transaction fees and long waiting periods are becoming a thing of the past. The block chain has international capabilities for near-zero cost transfers that are almost instant. Something that took days in the past now takes minutes or even seconds. In the future, transferring crypto will cost almost nothing to transfer, especially when compared to current transaction fees of fiat. Additionally, crypto is accessible to anyone with a smart phone or computer, so this will empower those with limited banking resources. Therefore, the crypto economy is allowing massive amounts of persons to become part of the global economy on an unprecedented scale.

This is beneficial for business as well – doing business with crypto currency will be much more affordable than traditional fiat currency, especially when we consider the high percentages that online payment services charge.

Now, I know some of you will say that transaction fees are still high with bitcoin and sometimes slow when the network is clogged. For now this may be true, but developers are working on solutions to this problem which will be solved in the near future, like Segwit and the lightning network.

Cryptos role in decentralizing money transfers, away from the hands of intermediaries, is absolutely genius. In the past, the third party middleman had to invest to establish the connections required for business. It is no secret that they are compensated handsomely for doing so. But the information age, and the age of the computer and internet, it is now possible to render third parties that contribute merely a connection as obsolete, by making the connections decentralized.

If you liked this post, please upvote and/or subscribe!

Congratulations @crytporush! You received a personal award!

Click here to view your Board

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @crytporush! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit