The term “crypto bull run” refers to a sustained increase in the prices of cryptocurrencies, often accompanied by a surge in trading volumes and market capitalization. This phenomenon is characterized by a significant upward trend in the value of various digital assets, leading to heightened investor interest and optimism within the cryptocurrency market. To comprehensively understand the dynamics and implications of a crypto bull run, it is essential to delve into its underlying causes, historical precedents, and potential impacts on the broader financial landscape.

What Triggers a Crypto Bull Run?

Several factors can trigger a crypto bull run, with each contributing to the overall market sentiment and investment behavior within the cryptocurrency space. Some of the key catalysts include:

Market Sentiment and Speculation

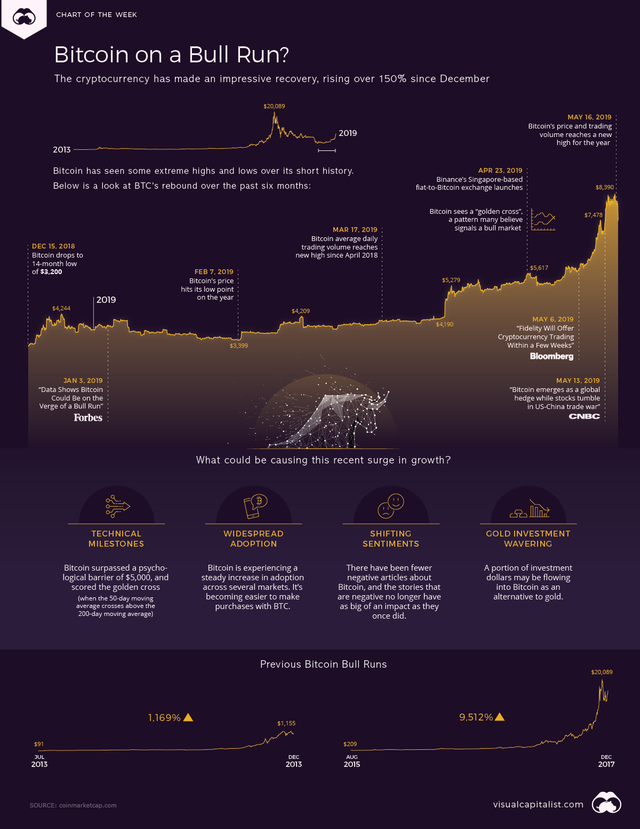

Market sentiment plays a crucial role in driving crypto bull runs. Positive news, regulatory developments, or endorsements from influential figures can create a sense of optimism among investors, leading to increased buying activity and upward price momentum.

Technological Advancements and Adoption

Advancements in blockchain technology and increased adoption of cryptocurrencies for various use cases can also fuel a bull run. Developments such as the integration of digital assets into mainstream financial systems or the launch of innovative blockchain projects often generate positive market sentiment, driving up prices.

Macro-Economic Factors

Macro-economic conditions, such as inflation fears, currency devaluation, or geopolitical instability, can drive investors towards alternative assets like cryptocurrencies as hedges against traditional market risks. These external factors can contribute to a surge in demand for digital assets, triggering a bull run.

Impacts of a Crypto Bull Run

A crypto bull run can have far-reaching impacts on various stakeholders and the broader financial ecosystem:

Investor Wealth Creation

During a bull run, early adopters and investors in cryptocurrencies stand to realize substantial gains as asset prices soar. This wealth creation effect often attracts new participants to the market, further fueling the upward momentum.

Increased Market Activity

Bull runs are typically accompanied by heightened trading volumes and liquidity within cryptocurrency exchanges. This increased activity reflects growing investor participation and interest in digital assets.

Regulatory Scrutiny

The heightened attention garnered by crypto bull runs often prompts regulatory authorities to scrutinize the industry more closely. Concerns related to investor protection, market manipulation, and systemic risks may lead to regulatory interventions aimed at ensuring market stability.

Mainstream Adoption Acceleration

A sustained bull run can accelerate mainstream adoption of cryptocurrencies as more individuals and institutions seek exposure to digital assets. This trend may lead to greater integration of blockchain technology into traditional financial systems.