The authors of the book "Rich Dad Poor Dad" are of the opinion that schools do not provide the children with the necessary knowledge of money, so they devote their future life to work for money, without having the ability to make money work for them.

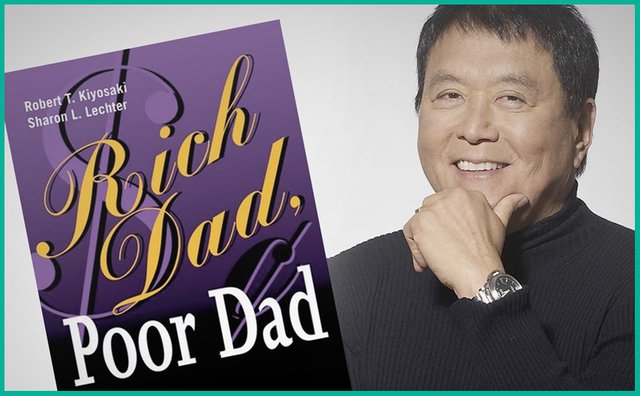

In the world, there are rules of money that are respected by rich people, and there are rules that are followed by the remaining 95% of people. And these 95% of people learn their rules at home and at school. That's why today you cannot just tell a child to learn more and look for a job. Children today must receive an education that the modern educational system cannot provide. The school cannot teach how to become rich, because just does not know how. Poor Dad will never teach his child what the rich man will teach. In order to remedy the situation, Robert Kiyosaki and Sharon Lechter wrote their unique book, which is capable of turning thinking - to make people become financially literate.

About Robert Kiyosaki

In addition, Robert Kiyosaki has developed unique table games: "Cash Flow 101", which teaches financial literacy, and "Cash Flow 202", intended for those who have mastered the first part. Today these games can also be found specifically for PCs.

Currently, the entrepreneur is actively involved in real estate and the development of small companies. However, his true passion is the training of people, which is why he conducts numerous trainings, seminars and master classes in different countries of the world.

About Sharon Lechter

Sharon Lechter is a businesswoman, a professional accountant-auditor, an international class lecturer, an investor, a consultant in the publishing of books and games, a co-founder and one of the leaders of CASHFLOW® Technologies, Inc.. In addition to this, Sharon Lechter is a teacher, co-author of Robert Kiyosaki and mother of three children.

The book consists of an introduction, ten chapters, an epilogue, a section advertising the educational products of Robert Kiyosaki, and a separate block about the authors.

Next, I will be happy to offer you a summary of the main ideas from the book "Rich Dad Poor Dad".

Introduction

Parents instruct their children so that they study diligently and receive higher education. But, wanting their children happiness, and also believing that their instructions have great power in real life, they do not think that these instructions do not work in many cases. The school has long given no knowledge that is necessary for a person in the modern world to become successful and independent. Parents are also often unable to prepare their children for adulthood. themselves do not know the principles on which financial well-being is based.

Rich dad, poor dad

Despite the fact that Robert Kiyosaki is a successful and successful person, he was born in a poor family, but he had two dads at once. The first was his own father, who was an educated and respected man who worked all his life and achieved great success in the service, but who failed to achieve financial independence. And the second was the father of Kiyosaki's best friend - the owner of his own empire, a financially educated, savvy and very wise man. The reason for the financial insolvency and prosperity of these two people was the image of their thinking.

If you want to become rich, do not work for money

The first lesson for Robert was that poor people or people belonging to the middle class do so: if they do not have enough of their wages, they start demanding an increase or are dismissed in order to find a more paid job. Others remain working where they worked, fearing to lose what they have.

It is greed and fear that drive millions of people into a trap called "rat race" - an endless job for money. But the secret is that you need to have the thinking of a rich man, otherwise money will always be in short supply, no matter what kind of work a person does. Rich people do not work for money - their potential is free from greed and fear, and this is much more important than high wages, because he allows them to find other ways of earning money.

Why is financial education important?

Financial literacy should be inculcated from a small age, so that people come to an understanding of the proper use of money. To increase your financial intelligence factor, you can resort to the following methods:

- To study accounting for understanding the intricacies of any business

- Learn to invest, developing your creative business potential

- To study the market in order to understand the features of supply and demand

- To study the law in order to always act according to it

Increasing financial intelligence helps to get rid of fears and increase financial literacy, which, in turn, allows a person to control the situation and take advantage of even the most difficult economic conditions. In addition, financial intelligence is the basis for action in the future, and helps to understand the risks.

Learn the flow of financial flows and acquire assets

The main rule of prosperity is this: if you want to become rich, you must acquire assets - what brings you money. Most people cannot get rich. confuse assets with liabilities. The asset can be a business that functions independently of you, royalties for intellectual property, real estate, securities.

Interestingly, with the increase in incomes of poor people, expenditures increase, and all these expenses go to liabilities - clothes, cars, furniture and so on. Rich people always try to cut costs and liabilities, and their income line is the assets they provide themselves with first thing, not wages - this is the basis of their financial independence.

Start working for yourself

People of the middle class always almost always work for the employer, banks or the state. If you are trying to escape from the "rat race", you need to start working for yourself.

At the very beginning of the work on yourself you need to choose the area (or areas) that is really interesting for you. Also, you need to learn to share your profession and your business, if you have not decided to leave work for hire. Do everything to increase your financial literacy and learn how to optimize tax payments.

Who and how to pay taxes

Rich people are smart people who have the power and perfectly know ways to get out of any situations with minimal losses. They pay less and less taxes, and the poor and middle class, for whom, in fact, the tax system was introduced, pay an increasing number of taxes.

You simply have to connect your financial intelligence and, being within the law, to reduce tax payments, i.e. begin to act as rich people do. If you do not have enough knowledge, you should resort to the help of specialists - tax advisers and lawyers.

Experience is more important than stability

One of the tips of the rich dad is that a person needs to change his place of work as often as possible, expand his horizons and specialization. Even a creative person, for example, a writer or an artist, must master adjacent professions and acquire skills that will allow him to successfully engage in advertising and selling his work.

In addition to your core profession, which you are interested in and which you are ready to devote to life, you must master the skills of managing all sorts of processes and systems that take place in your life. You also need to master the skill of managing cash flows, people, yourself and your time.

Conclusion

I have considered only the very minimum of that useful thing that can be learned from the book of Robert Kiyosaki and Sharon Lechter "Rich Dad Poor Dad". And I strongly recommend that you study this book from cover to cover. There is no doubt that if you apply the principles outlined in this work in practice, you will become much more financially competent and get the opportunity to break out of the "rat race".