What is value? How do we measure it in the business world?

These are the kinds of questions I was pondering before I'd ever heard of Steem. When I finally heard of Steem, the proverbial light bulb exploded in my head - because we finally have an acknowledgment of value and a way of articulating it which isn't purely financial, embedded in a currency. Wow!! Well, wow for me, at least.

Changing approach to governance - looking far forward instead of recently backward

The business world has been hard at work the last decade trying to find ways to express how it contributes to sustainability (mostly to a cynical chorus of boos), but I've seen that there has been some genuine progress in the arena of Integrated Reporting, so I've decided to write a series of posts on the basis for this animal we call Integrated Reporting. It relates to a completely different approach to governance - one that is forward looking and strategy driven, rather than backwards looking and informed by indicators we can't influence because they're in the past.

As I mentioned in my first post about reaching the summit of Kilimanjaro, it gave me a real compass for strategy in life. That led me to become deeply critical about so-called company strategies - most of which on deeper examination turn out to be operational plans which are pretty vulnerable to external shocks, because often those companies haven't had the deep strategic discussion about where they're really going and why they're going there - factors which make a strategy robust. Aiming for the summit of Kili, you need a robust strategy because the consequences of missing the objective are pretty drastic.

When I first read about the Capitals-based way of expressing value for companies, the idea really resonated with me - it gives a way of articulating value which isn't limited to financial value, and through Integrated Reporting, communicating with stakeholders how an organisation is succeeding at implementing its strategy to create value. In a forward looking way. And not just how the company is creating financial value for its shareholders, I repeat.

No, Integrated Reporting is about telling the story of how all of an organisation's resources are creating value. Holistically. In support of achieving the organisation's strategy (which of course implies it has one). And it seems to me that there's a strong link between integrated reporting and the blockchain, given the peer to peer value exchange possible under the blockchain. The key here: the value doesn't have to be financial. But the perception of value has to be articulated somehow. And for an organisation which responsibly employs resources to deliver on its strategy, it needs governance at some level (a hand on the tiller, shall we say) to make sure the organisation keeps its eyes on the strategy and doesn't get stuck in the weeds of daily operations.

New governance framework - Capitals-based

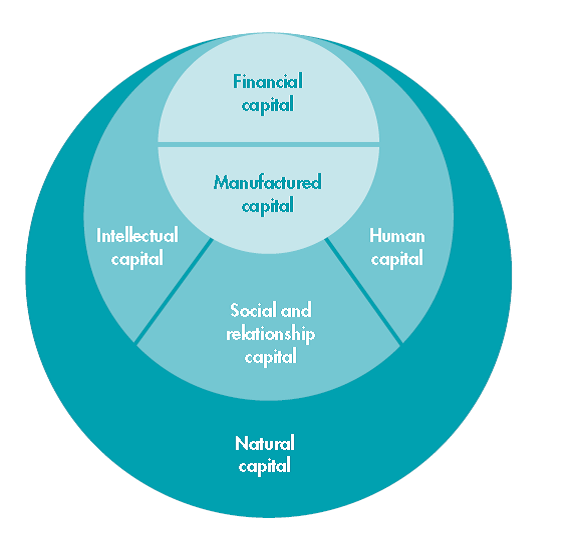

I'd like to explore with the Steemit community how Steemit could influence governance under the holistic thinking of the Capitals. So first, let me introduce one representation of the Six Capitals which makes particular sense to me:

One of the many visual representations of the inter-relationships between the Capitals (Source)

It's basically an extension of thinking on the so-called "triple bottom line" - social, economic and environmental. All our value nestles in and is derived from Natural Capital (let's face it, we're all stardust anyway). By drawing on Human Capital, Social and Relationship Capital and Intellectual Capital, we are able to create Manufactured Capital. Financial Capital enables trade between these stocks of capitals - and therein lies the rub. We see the value in Financial Capital but often struggle to articulate the value in the other Capitals...except in financial terms.

Look for a series of posts on the Capitals

I'll post some thoughts on each of the Capitals separately...but since the idea of Integrated Reporting is to look at value creation holistically, I'd like to avoid siloing the discussion.

Some organisations are adding a seventh capital, "Political Capital", but for the purposes of this discussion let's include that in "Social and Relationship Capital".

There's a pretty cool video created by Sasol to explain the Capitals - watch it here: Sustainable Development - Sasol six capitals video.

Integrated Reporting - what is it?

The International Integrated Reporting Council (IIRC) has done a great deal of valuable work in getting consensus on how to report on value creation, and how this links to companies' reporting. When sustainability first became a "thing" for companies, they would produce an annual report chock full of financial pages looking back at what had already happened and couldn't be changed (using lag indicators), then another pretty Sustainability Report, usually put together by the marketing department with the aim of convincing shareholders they weren't really awful (i.e. destroying ecosystems, messing with communities, treating labour badly, that sort of thing) in what amounted to an ineffectual defensive move (wethinks they doth protest too much), typically using cherry-picked environmental indicators such as carbon or water footprint...but again, these were generally lag indicators. Just like in the blockchain, you can't change the past.

Two key elements missing in those reports: the look forward at how the company is delivering on its journey to create value, and a consensus view on how to articulate that value. Enter Integrated Reporting, which looks forward, doesn't baffle with bafflegab, and deals with holistic value creation. Entire governance frameworks are being developed based on Integrated Reporting - I'm looking forward to the launch in South Africa 1 November of King IV™, hosted by the Institute of Directors of Southern Africa (IODSA). The King IV™ approach to corporate governance is rooted in the principles of Integrated Reporting and can be used by any kind of organisation: listed, private, non-profit...whoever wants to govern their organisation through a value-based approach to realising strategy can benefit from this governance framework. There are other governance frameworks out there, of course. This is one I'm reasonably familiar with, and as a member of the IODSA's Sustainable Development Forum, frankly, I'm keen to get this thinking into Southern Africa's corporate world.

How could Steem deepen the value discussions under Integrated Reporting?

I believe that Steem has profound potential to influence governance in support of sustainability, as we move towards a world where value is exchanged via the blockchain. Sure, Steem is a cryptocurrency and a currency is by nature financial. But Steem incorporates some of the other Capitals (particularly Social and Relationship Capital) in ways others do not yet appear to have envisioned.

Keen to engage with the Steemit community on what this can mean for corporate governance and sustainable value creation in the business world.

This instantly made me think about cryptocurrency in general. I think as more chains are built, power structures would turn into something rounder. Just like the above. I'm very intrigued by this and wish to know more about it. Thanks for the info!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I love the idea of blockchains. That is an interesting view on them that it would round the structures out! I believe they really could be a great equalizier in many aspects of life. It will inherently move us away from centralized, hierarchical type structures where most of the power lies at the top, to more distributed ones. This would give everyone more of a voice and more wealth/capital in all its forms

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

What an interesting idea - power structures becoming rounder. Thank you, Kevin, you've given me an entirely different angle (as it were) to view this discussion from. I wonder how many companies report on how "round" they are? Could be a powerful visual.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I've been writing this series from the perspective of a non-traditional board which has already adopted Integrated Management into its DNA. Introducing cryptocurrency and the blockchain into this mix could further revolutionise corporate governance. I've heard of some companies experimenting with going completely virtual on the blockchain, with mixed outcomes (one programmer rewrote a vital bit of code and diverted a lot of funds to himself - but does that ruin the story of virtual governance? I don't think so - clearly that was a failure of oversight over the Smart Contract authors). How do we envision a world where P2P transactions are in cryptocurrency, and how does the blockchain influence governance for the better?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I think I'll further elaborate this in a post. Been writing some abstractly similar in the past, just broad-stroke concepts. I don't think it stops just being at a corporate / firm level, but it extends to individuals having a web of cryptos instead of being just tied down to pretty much inert fiat currency, with causes and effects that are not so responsive / tied with other parameters in the many different moving parts of society. Hmm..

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Sorry but i think your comment and this post is quite the nonsense esp here at steemit when so many anarchy and anarchy-capitalist nonsense are floating around. IR is more for compliance rather than really wanting to do it for the sake of doing it. Companies doing it is more for promoting themselves as a "oh i am so transparent likk glass" and marketing shit. Most of their IR reports have many loopholes.

How to report cryto as that when it is highly decentralised.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very interesting post -- glad to see it got a lot of attention, sorry not to see a robust comment section. Hopefully on one of your follow up posts!

I too am struggling to find a meaningful way to lever Steem in a business world, specifically around the valuation of 'customer capital'.

I had not previously read about the six capitals or integrated reporting and while intrigued I am also confused by 'customers' being conspicuously absent from the diagram. Looking forward to reading more.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I think customers would come into the social and relationship capital. The difficult one for me is the Natural Capital. There are some great advances in valuing large woody debris in rivers for meeting water temperature standards, for example, in the Pacific Northwest. I can even see putting a value on the snow being stored in the mountains for water supply in our rivers and groundwater. But, wow, trying to put a value on the Arctic ice cap is something else.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

On valuing the Arctic ice cap, when building its strategy, the business should ask itself what impact their activities will have on Natural Capital. Often this questioning forms part of a much larger conversation with their stakeholders. They will find they have degrees of impact and ability to influence for better or worse e.g. protection of Natural Capital.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

"Should" is the operative word there, lol. There are externalities, short vs. long-term thinking and rewards, perverse discounting of the future to present values, perverse incentives of executives vs. other stakeholders, and lack of accountability structures that all get in the way. It's a tough business, assessing, valuing, and then protecting that natural capital. More power to everyone working on it!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

As we delve more into Integrated Reporting, we'll explore the importance of stakeholders, stakeholder mapping and materiality. Customers are a critical (but not the only) stakeholder. I appreciate your comment about the comments, as I was looking forward to a robust discussion...but since I'm looking forward to a long Steemit association, I'm happy with the first few steps on this journey. Also, with the launch of King IV coming up next week, I'm looking forward to a richness of perspectives from many sectors.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Indeed, companies do generally account for the value they create with their customers under Social and Relationship Capital. However, as I mentioned in the series of posts, it's important to look at value created holistically rather than in silos, so an Integrated Report typically doesn't have a table of contents showing "our Capitals". The journey of Integrated Reporting is a massive turnaround from looking at the past at the end of the year to the entire organisation looking forward continuously throughout the year, asking itself how it's creating sustainable value in support of achieving the strategy. Typically the journey takes a few years; most tell stories of confusion the first couple of years as the strategic vision filters through the organisation and the conversation shifts from one of inputs consumed (how many hours? How much money spent?) to one of outcomes being achieved (how do our customers feel about us? Have we achieved a state of harmony with the local community?).

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Excellent insights, thank you. Two things (designed to add value) 1. No mention of risk evaluation and valuation. 2. If a company were to add value to its environment, community etc., should it be eligible for tax deductions?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Great comment. In Integrated Reporting, risk is dealt with the way businesses generally should deal with it; the expectation is that the board will map risks and assess them in e.g. a matrix of potential impact on creating value under the strategy/likelihood of materialising. The operating levels of the company should be dealing with risk on an ongoing basis; the board should occupy itself only with those risks which show up as high impact/high likelihood of materialising (essentially, not get stuck in the weeds or interfere in operations). In other words, the board's responsibility is to identify, with the executive, those risks which are "material" to achieving the sustainable value identified in the strategy. Will post more about materiality soon.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

On your second point, from my perspective that's a public sector governance question. What strategy is the government trying to achieve? Is protecting Natural Capital a part of it (these days that's usually a rhetorical question)? How do they plan to help the society they are responsible for governing achieve sustainable value? What superb potential for the blockchain to support transparency in reporting progress.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This post has been linked to from another place on Steem.

Learn more about and upvote to support linkback bot v0.5. Flag this comment if you don't want the bot to continue posting linkbacks for your posts.

Built by @ontofractal

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit